Vol. XVII, No. 6, September-October 2017

- Editor's corner

- Doc Brundy's sodacade under construction

- The rise of gender-neutral marketing pronouns

- Dining out is now the main event

- Trade names announced for our South Puget Sound project

- The cannibals are coming

- Low-tech entertainment

- The all-new Davis Mega Farm Festival

- The lure of LTOs

- Don't believe go-kart misinformation. Know you source. Part 2

- Earache

- October is National Pizza Month

The cannibals are coming

During Dave & Buster's 2nd quarter investor conference call, CEO Steve King acknowledged that, “Dave & Buster's aggressive growth strategy (14 new stores in 2017) will result in some negative headwinds related to cannibalization.” Brian Jenkins, CFO, said in the call, “... during the second quarter, the impact of cannibalization and competition on our system was modestly above expectations.” What King and Jenkins were referring to is the growth of competitors, including Main Event Entertainment, that touts their Eat Bowl Play model and Topgolf. And although they didn't mention it, there are many other new community leisure venues (CLVs) opening that are targeting their same customers, including the more upscale eatertainment venues that include boutique bowling and other interactive group games such as Punch Bowl Social.

Cannibalization is becoming an increasing challenge in the CLV industry, especially to the traditional FEC model. More and more venues are opening, many of them disruptive models, while the potential market size is limited. Consumers are being bombarded with rapidly expanding choices for their limited discretionary leisure time. Exacerbating the problem is that:

- Malls throughout the country are chasing after entertainment anchors, often subsidizing them, to generate mall traffic to offset the decline from department stores and other retailers. This is often introducing more CLVs than a market can support.

- Many retailers are trying to increase their attractiveness and footfall by adding entertainment, often free entertainment.

- Restaurants are becoming the preferred going-out location over entertainment, especially for younger adults (see Dining out is the main event in this issue)

- Live events of all types are becoming more and more popular. Driving their popularity is that they are limited time offerings. These include beer, wine, food, arts, ethic, Renaissance and festivals of all types and live performances.

- Farmers are taking over the fall and Halloween season with the growing number of agritainment venues including haunts, pumpkin patches, corn mazes and u-picks.

- Chilling out, cocooning at home, is rising in popularity (see Cocooning is the new going out: the hygge trend's impact on CLVs)

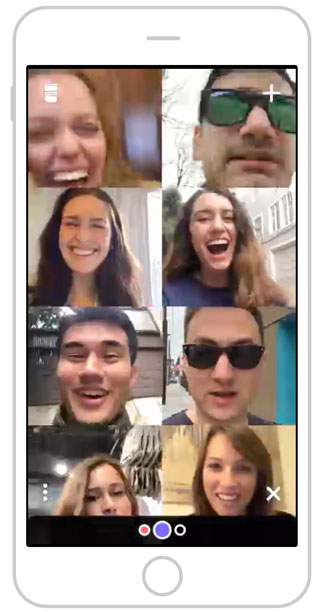

There is also another category of cannibal, a very hungry one, eating away at the market share of CLVs that neither Dave & Buster's nor hardly anyone in the CLV industry is talking about (except of course us). It's the digitalization of our friendships and social lives. More and more of peoples' time with their friends is being spent in digital spaces rather than out in the physical world. New apps to virtually hang out with friends are being introduced all the time. Some of the latest options are group video chat apps such as Houseparty that allow you to simultaneously hang out with a number of friends

There is also another phenomena that's reducing the market share of many CLVs'. And it isn't competitive leisure venues or digital experiences. It's obsolescence. The formulas for many CLVs, especially older FEC models, are becoming less and less relevant and attractive to modern consumers.

Implications for CLVs

With the cannibals eating away at the leisure time market pie, the bar to be successful in the CLV industry has risen greatly and will only continue to do so. To get people out of their homes, away from their digital options and to get them to visit your CLV instead of the competition and all their other away-from-home leisure options will require a very high quality, High Fidelity, compelling experience that is relevant to the modern consumer. To be competitive, it will need to include great food and drink in addition to socially interactive entertainment. Mediocrity and many old business models no longer work.

Vol. XVII, No. 6, September-October 2017

- Editor's corner

- Doc Brundy's sodacade under construction

- The rise of gender-neutral marketing pronouns

- Dining out is now the main event

- Trade names announced for our South Puget Sound project

- The cannibals are coming

- Low-tech entertainment

- The all-new Davis Mega Farm Festival

- The lure of LTOs

- Don't believe go-kart misinformation. Know you source. Part 2

- Earache

- October is National Pizza Month