Vol. XV, No. 3, April 2015

- Editor's corner

- The scoop on social media usage and users

- The future of laser tag - prosperity or Digital Darwinism?

- Is your business on the search engine maps?

- Engaging Millennials in the workforce

- More on declining vacations and trips

- Part 1: Where many feasibility studies go wrong

- The most common reasons startups fail

- Families with kids eating out less

Part 1: Where many feasibility studies go wrong

This is the first of a multi-part series of articles on feasibility studies.

The feasibility study is the first step of development and critical to the long-term successful of any family entertainment center (FEC) or other type of location-based entertainment center (LBE). It lays the foundation for everything that follows. This includes not only the mix and size of the center, but the budget needed to develop it and the revenues, EBIDTA and profits it will produce.

Over the years we have been called in to help many struggling FECs and LBES. In many cases we were able to review their initial feasibility studies. We've consistently found one major flaw get many of these centers in trouble - the cost estimate in the feasibility study under estimated what it would cost to develop the type of center that the study envisioned would be needed to produce the projected attendance and revenues.

Here's the normal scenario. Based on the feasibility study as part of the business plan, the LBE developer raises capital from investors and secures a loan to pay for the center's development based upon the feasibility's cost estimate. Then, construction plans are prepared and a general contractor(s) prepares a bid proposal. Sometimes at this stage of development it is discovered that the budget was inadequate based on the true cost of construction. So what happens? Something has to be eliminated to bring down the costs. Usually it's a combination of decreasing the size or number of attractions, reducing the building size and/or downgrading the finishes. If those options can't solve the problem, then the LBE developer has to go back to either the investors and/or the lender to secure more financing. In that situation, the investors will have the developer over a barrel and if they are willing to increase their investment, they will usually demand a much larger percentage of ownership. If the developer goes to the lender for more funds, the lender will usually demand more collateral and/or guarantees. Neither is a pretty situation to be in. Over the years, we've seen several centers get in this situation and couldn't raise the additional funding, so the projects went bankrupt before they were even finished.

Other times it isn't until construction is underway that the cost overrun is realized. At that point in time, there or only two options if additional funding can't be arranged. Eliminate an attraction and/or dumb down the finishes. In both situations, the project is eliminating what is most valuable to the customers. Furthermore, since the projections were based on a certain mix and quality of project, the revenue projections will not be achieved.

So how can these possibilities be avoided? The answer is very simple. The feasibility study needs to have a realistic cost estimate. So why is it that many feasibility studies underestimate the cost? The reason is they use some dollar figures per square foot, some average rule-of-thumb costs, to estimate construction costs. The problem with that is that every project is unique. A raw land site at one location might need minimal infrastructure improvements. At another location, the infrastructure improvements might be sizable. Basic construction costs vary in different regions. Some areas require union contractors and subcontractors. Other areas don't. The least expensive way to construct the building shell will vary in different parts of the country. So will energy codes and zoning requirements. All these factors and many more affect the cost of construction. And when it comes to renovating an existing building or space, there will be wide variation based on the age and condition of the space. If it is a closed supermarket, additional air conditioning will be required. In other retail spaces, that may not be the situation. There are just so many factors that come into play. Using some square foot renovation cost estimate is a sure path to ruin for remodels and new construction.

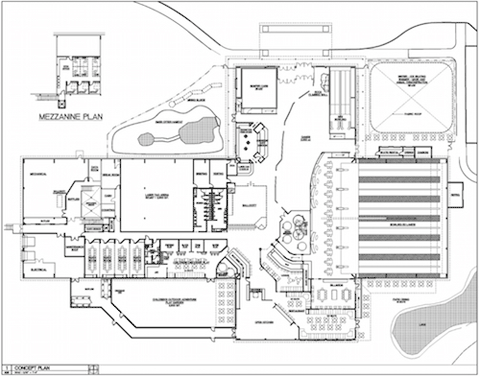

So how does our company avoid getting our clients in these situations with our feasibility studies? We do the needed due diligence to properly determine construction costs. And there is only one way to do that. You have to get a local contractor involved to estimate construction costs. And to do that, we prepare concept floor and site plans and needed details and specifications about the required improvements and finishes. Only with that information can a general contractor prepare a reasonably accurate construction cost estimate. Still, we add a contingency. And if it is renovation, a sizable contingency has to be added for all the surprises that will happen.

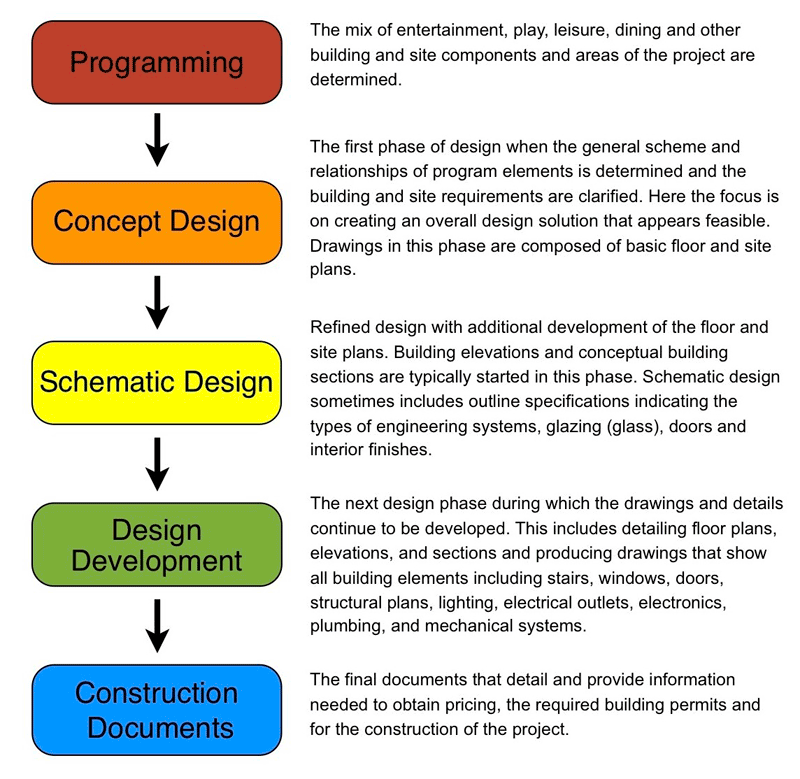

To do this means we have to have our architects and interior designers do the first phase of design, concept design, plus some parts of schematic design. This design work takes a lot of man-hours, so it costs money, making our feasibility studies more expensive than many other consultants who just provide their clients generic square foot construction estimates rather than detailed, realistic construction cost estimates. In fact, it means our feasibility studies cost around double what many other companies charge.

Yes, we lose a lot of business from potential clients who just want a market and economic feasibility study at the lowest cost. But our company's philosophy is to serve the best interest of our clients. That means doing a thorough job and giving them realistic numbers so they won't get in trouble down the line. Once you know how to do it right, you can't go back to taking shortcuts.

As they say, “You only get what you pay for.”

In upcoming issues we plan to continue our coverage of where many feasibility studies go wrong.

Vol. XV, No. 3, April 2015

- Editor's corner

- The scoop on social media usage and users

- The future of laser tag - prosperity or Digital Darwinism?

- Is your business on the search engine maps?

- Engaging Millennials in the workforce

- More on declining vacations and trips

- Part 1: Where many feasibility studies go wrong

- The most common reasons startups fail

- Families with kids eating out less