Vol. X, No. 6, October 2010

- The foundation of location-based entertainment success is a four-legged stool

- Meet us in Orlando at IAAPA

- What's up with bowling?

- New Motion Evolution program for children

- Out-of-home entertainment spending on the increase for families with children

- White Hutchinson joins The Optimus Group

- Follow our tweets

- Top 20 most loved brands

Out-of-home entertainment spending on the increase for families with children

We all know that the Great Recession has had a negative impact on consumers’ spending. How much has spending declined for entertainment and restaurants? Is such spending permanently depressed? Are there any bright spots? To find out, we’ve dug into the recently released consumer expenditure data for 2009. There are some surprising findings.

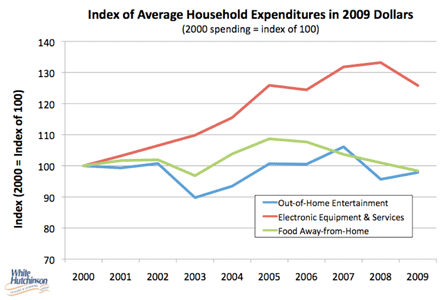

We first looked at average household spending for entertainment and away-from-home food from 2000 to 2009. For entertainment, we looked at both spending for electronic entertainment (televisions, computer games, game consoles, smart phones, iPods, etc.) and out-of-home entertainment, which includes things like theme parks, FECs, bowling centers, etc. We then converted the data to 2009 dollars to account for the effects of inflation. The graph below shows the data as an index, with 2000 spending for each category starting at an index of 100.

Average household spending on food-away-from home increased through 2006, but has been on the decrease ever since. Spending on electronics increased by about 1/3rd through 2008, then decreased in 2009 by 5.5% from 2008. Spending on out-of-home entertainment hit a peak in 2007, decreased during the 2008 recession year, but surprisingly increased in 2009. Since this is inflation adjusted household spending, that increase is surprising and good news for the LBE industry. It could well be that consumers shifted some of their spending away from the virtual world of electronics, which spending decreased in 2009, to the real world of out-of-home entertainment. Of course the bad news is that average household spending for both food-away-from-home and out-of-home entertainment is still lower than in 2000. The good news is that if we look at total inflation-adjusted spending by all households, there have been significant increases since 2000 due to population increase – 45% for food-away-from home and 40% for out-of-home entertainment. Electronics have seen a whopping 78% increase.

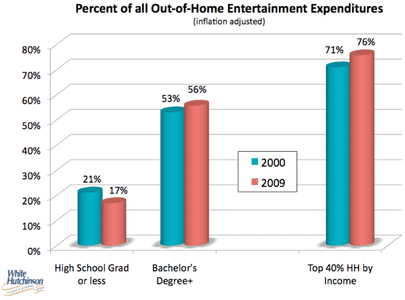

Of course this is a macro analysis. So we dug deeper into the data to examine trends within particular types of households. As we have discussed in our previous articles on the increasing socio-economic stratification of away-from-home spending, a larger percentage of all out-of-home entertainment spending continues to shift to higher socio-economic households. In 2000, households with adults with a high school degree or less education accounted for 21% of all out-of-home entertainment spending and those with a Bachelor’s or higher college degree accounted for 53%. In 2009, high school and less dropped to 17% and Bachelor’s+ increased to 56%. Looking at income, in 2000, households with the top 40% of incomes accounted for 71% of all out-of-home entertainment spending. In 2009, it increased to 76%. These are all long-term trends not attributable solely to the Great Recession.

When we examined spending by different types of households, we found something that surprised us. Everyone assumes that during the years of the Great Recession just about everyone cut back spending. Well, just about every type of household did. But married families with the oldest child between 6 and 17 years actually increase their out-of-home entertainment spending in 2009, by a whopping 7% over 2008. This means that previous mentioned increase in average spending by households is solely attributable to these married-couple families with children. And when we examined long term trends from 2000 to 2009, the only household types that have increased their out-of-home entertainment spending are married families with their oldest child younger than age 18 and married couple households that also have an extended family member such as grandmother, uncle, etc.

When we analyzed changes in spending on electronics between 2000 and 2009, married couples with the oldest child between 6 and 17 had the smallest increase, indicating that electronic expenditures are not taking away from their out-of-home entertainment spending to the degree of other household types. To put it another way, their entertainment spending is not migrating from the real world to the virtual world to the same degree as other types of households.

And one last note on all these nerdy statistics. Married families with the oldest child younger than 18 were the only type of households to increase their away-from-home food spending (inflation adjusted) since 2000. It was up 11% in 2009. They also showed no decrease in such spending during the recession.

It appears that married couple families with children are becoming an even more attractive target market for the out-of-home entertainment industry.

Additional reading:

- Why socio-economic/lifestyles matter

- The increasing social stratification of out-of-home entertainment & leisure

- The future of out-of-home entertainment

- The impact of the new ground consumer on location-based entertainment

Vol. X, No. 6, October 2010

- The foundation of location-based entertainment success is a four-legged stool

- Meet us in Orlando at IAAPA

- What's up with bowling?

- New Motion Evolution program for children

- Out-of-home entertainment spending on the increase for families with children

- White Hutchinson joins The Optimus Group

- Follow our tweets

- Top 20 most loved brands