Vol. VIII, No. 4, July-August 2008

- Editor's corner

- The new leisure economy

- CAN-SPAM updates from the FTC

- Annual restaurant visits

- Cyber Sport arrives

- Free online listing at maps.google.com

- What's happened to bowling?

- Picky eaters have different genes

- Words of wisdom from Walt Disney Parks & Resorts

- Lego Discovery Center opens

- New clients

- Update on Kazakhstan projects

The new leisure economy

Trends we identified only a few months ago concerning shifts in away-from-home entertainment spending have accelerated faster than anyone dreamed possible, fueled by soaring gas prices. Read on to discover how will this impact the leisure industry -- and which income-level of consumers will be hardest hit.

Only a few months ago we identified trends that impact both restaurant and away-from-home entertainment spending in the United States in our two-part article, The shifting nature of leisure time and expenditures. One of those trends is a consumer shift in entertainment spending toward electronic entertainment purchases and away from out-of-home entertainment. Another trend is that discretionary spending, including food away-from-home and out-of-home entertainment, is being eaten away by the increasing costs of energy, health care and education. This is especially true for households with the lowest 70 percent of incomes.

Only a few months ago we identified trends that impact both restaurant and away-from-home entertainment spending in the United States in our two-part article, The shifting nature of leisure time and expenditures. One of those trends is a consumer shift in entertainment spending toward electronic entertainment purchases and away from out-of-home entertainment. Another trend is that discretionary spending, including food away-from-home and out-of-home entertainment, is being eaten away by the increasing costs of energy, health care and education. This is especially true for households with the lowest 70 percent of incomes.

When we wrote that two-part article, we didn't anticipate how quickly increases to energy and food costs would accelerate. Now, with oil prices bouncing around above $140 a barrel, gasoline prices north of $4 per gallon and more than 20 percent of Americans paying $100+ to fill their gas tanks, it looks like Americans are in for price increases unimaginable just a few months ago. With droughts in Australia and floods in America, a global situation where food demand begins to exceed supply has suddenly gone from bad to worse. And the high cost of energy evident at the gas pumps is just starting to work its way into electric, natural gas and heating oil costs.

There is a general consensus that in the next year or so, we will see electric, natural gas and heating oil costs increase by 50 percent. And food costs are projected to increase at an annual rate of 7 to 9 percent for at least the next three years. Those costs have already increased this year at an annual rate of 6.3 percent, and that's before the impact of floods, drought and spike in gasoline and diesel fuel costs has worked its way into the cost of production, supply and distribution chain.

So what impact is this likely to have on the restaurant and away-from-home entertainment industries? In some respects, for certain consumer market segments, things are going to get rather bloody. We prepared the following analysis to try to better understand the impact of these sudden and continuing price increase may have.

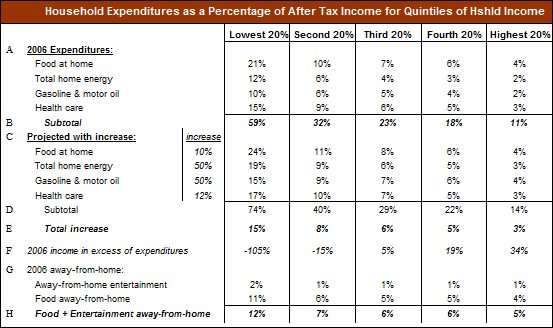

We looked at 2006 household expenditures (the most recent data available) as a percentage of after-tax income, for the five different quintiles of household income. Then we projected price increases for food, energy and health care to see the potential impact on restaurant and out-of-home entertainment spending in 2009.

Section "A" shows 2006 expenditures for the five quintiles of household income as the percent that spending in each category was of total after-tax income. Row "B" shows that households in the third quintile of income spent 23 percent of after-tax income for food at-home, energy (gasoline, electricity and home natural gas and heating oil) in 2006.

Section "C" shows the percentage of after-tax income each quintile will have to spend in 2009 based upon projected cost increases to 2006 expenditures over the three years: food at-home costs increases of 10 percent, total home energy costs increases of 50 percent, gasoline cost increases of 50 percent (most of which has already occurred) and health care cost increases of 12 percent. So, in row "D," for the third quintile, those three cost categories in total would require 29 percent of their household's after-tax income, a 6 percent increase (row "E") over 2006.

Row "F" shows how much after-tax income exceeded all expenditures for each quintile of household income in 2006. For the third quintile, after-tax income exceeded all expenditures, with 5 percent left for things like savings.

Section "G" shows the percent of after-tax income households spent on away-from-home entertainment and food away-from-home in 2006.

We can see the potential implications for restaurant and away-from-home entertainment expenditures by comparing rows "E", "F" and "G." For the third quintile of income, the price increases will consume 6 percent of after tax income. This exceeds the 5 percent excess of that quintile's after-tax income over all expenditures in 2006 and is greater than that quintile's total 2006 spending on away-from-home entertainment and restaurants in 2006 (6 percent). In 2009, to offset the increased cost of food, energy and health care, the third quintile will most likely have to make some serious spending cuts in other areas, especially discretionary areas like restaurant and away-from-home entertainment expenditures.

The situation will be less severe for the fourth and fifth highest quintiles, where the projected price increases will consume a lesser percentage of their after-tax income. Because their after-tax income is far greater than all their expenditures, they have some cushion for dealing with the increased costs.

The first three quintiles -- the lower percent of households by income - will suffer some serious hardships and have to make serious cuts to their restaurant and away-from-home entertainment spending. The upper two quintiles will probably do some trimming to that spending. Or at the very least, they will be much more fastidious in their choices.

How might all this play out with away-from-home entertainment spending? High gas prices and an increasing concern for the environment will make consumers who can still afford away-from-home entertainment much more conscious of the distances they need to travel to visit entertainment venues. The demise of low-cost airfares will surely result in less business for resorts, cruise ships and major vacation-entertainment areas like Las Vegas and Orlando. A large portion of consumers' away-from-home entertainment spending will shift to "staycations" and destinations close to home. Waterpark resorts near metropolitan areas will probably prosper, as well as metropolitan-based theme parks and waterparks. Those family entertainment type venues that cater to the higher socioeconomic consumers will probably do fine. Those that cater to the lower socioeconomic groups are in for some rough, if not fatal times.

And all entertainment destinations will need to sharpen their acts to compete with electronics. Electronic games, Internet-based games, television and DVDs are a far better buy in terms of cost per hour of entertainment when compared to entertainment venues. Nevertheless, consumers will not want to be held 100 percent captive in their homes and will seek out destinations where they can socialize and have fun. Entertainment venues that are also dining destinations, what we call eatertainment, will have a strong competitive advantage for two reasons: less driving required when consumers go out to eat and play, and one-stop shopping saves time in a society increasingly experiencing time-poverty. More than ever before, consumers will ask, "Can you give me a compelling reason to come to your place?"

Vol. VIII, No. 4, July-August 2008

- Editor's corner

- The new leisure economy

- CAN-SPAM updates from the FTC

- Annual restaurant visits

- Cyber Sport arrives

- Free online listing at maps.google.com

- What's happened to bowling?

- Picky eaters have different genes

- Words of wisdom from Walt Disney Parks & Resorts

- Lego Discovery Center opens

- New clients

- Update on Kazakhstan projects