Vol. XXIV, No. 1, January-February 2024

Two of the largest LBE brands struggle to have food and social appeal

Dave & Buster's, with 160 locations in North America and Puerto Rico, and Chuck E. Cheese's, with its almost 600 U.S. locations, are working to enhance their menus to better appeal to today's consumers, as food and beverage have evolved in the location-based entertainment (LBE) industry to become as important a draw, if not more so, than the entertainment.

Dave & Buster's

Over the last decade, Dave & Buster's share of food and beverage revenues have steadily declined. There was a time when D&B generated more F&B revenue than entertainment revenue, with 57% of guests ordering food and drink. In the third quarter of 2023, it was only 35% of revenue, with only 39% of guests ordering F&B.

At a recent conference, D&B's CEO, Chris Morris, pointed out that D&B isn't perceived as a dining destination. He noted consumers are dining out in droves, but they're doing so elsewhere either before or after a visit to Dave & Buster's. D&B wants to convert more guests to diners.

The company is now testing an update to its menu with an anticipated systemwide rollout in April. The new menu includes the removal of complexities in the kitchen to improve speed and quality and to drive more revenue at peak times.

From there, it will infuse the menu with innovation around appetizers, bowls, desserts, and sides, which "better meet the need states of our entertainment guests," Morris said.

Chuck E. Cheese's

Chuck E. Cheese has launched a Grown-Up Menu meant for adults. The menu is designed for the palates of adults who enjoy spicy and bold flavors.

Their new Grown-Up menu includes four pizza flavors, spicy meatballs, wings, and desserts meant for adults. Specific items that launched are a Signature Meatball Pizza, Homestyle BBQ Chicken Pizza, Spicy Hawaiian Pizza, Spicy BBQ Piggy Pizza, bone-in and boneless Wings that come in five flavors (buffalo BBQ sauce, Louisiana Hot Honey sauce, spicy Korean BBQ sauce, Lemon Pepper rub or Chili Lime rub), and Spicy Meatballs.

The brand teamed up with Virtual Dinning Concepts and celebrity T.V. chef Buddy Valastro, a.k.a. the "Cake Boss." to feature Buddy's famous cakes by the slice, including three different delicious flavors: Confetti, Vanilla Rainbow, and Chocolate Fudge.

CEC Entertainment CEO and President David McKillips said in the press release that the new menu items are part of the company's strategy to offer new flavors and experiences to the millions of parents that visit each year rather than just the chain's youngest diners.

In addition to its improved in-house menu, CEC launched LankyBox Kitchen, a virtual restaurant concept for delivery only developed in partnership with Virtual Dining Concepts (VDC), the parent of MrBeast Burger and other delivery-only brands

LankyBox Kitchen is a tie-in with LankyBox, a kid-friendly YouTube channel with over 21 million subscribers. The menu is aimed at young eaters, with personal pizzas, mac and cheese, and fries. Packaging will feature LankyBox characters and a Q.R. code that links to exclusive videos. More than 460 Chuck E. Cheese's locations now offer the brand for delivery only via lankyboxkitchen.comand third-party delivery apps.

Chuck E Cheese's launched its delivery-only offshoot, Pasqually's Pizza, early in the pandemic. It's now in 400 locations.

Commentary

Dave & Buster's and Chuck E. Cheese's each have unique challenges to address with their food and beverage improvements.

Dave & Buster's

Dave & Buster's comparable store sales are up 8.1% for both their third quarter and for the year-to-date ending October 29, 2023, compared to the same periods in 2019. Financial results don't tell the whole truth during periods of high inflation. Due to inflation, a dollar of sales in Q3 2023 is not worth as much as in Q3 2019. The U.S. Bureau of Labor Statistics reports that inflation between December 2019 (midpoint in the 4th quarter) and December 2022 was 15.5%. That exceeds the 8.1% increase in the same store sales D&B reported. In reality their same-store sales when adjusted for inflation have actually declined by a little over 6% compared to pre-pandemic 2019.

D&B continues to try to improve its revenues from F&B while still offering a separate destination restaurant space. This has become an outdated LBE formula. Today, adults are looking for a communal and social entertainment experience that features food, often including shareables and beverages, simultaneously with participatory social games. Just look at the success of Top Golf and its imitators and all the other new social gaming eatertainment concepts. The combination of communal food and drinking with an approachable social game has taken on top appeal at eatertainment concepts, partially due to the IRL social isolation the pandemic brought on. If you want consumers to eat and drink at an LBE, it needs to be simultaneously combined with another social activity, such as social games. D&B does well with the combination at their sports bar, where people can share watching sports while enjoying F&B. Still, they do not offer such a high-fidelity social experience in their game room, where most games are for solo players or even if for several players, but the environment is not designed for the simultaneous enjoyment of F&B. With so much restaurant competition, it is challenging, probably next to impossible, for an LBE, let alone an eatertainment concept, to be thought of as a dining destination.

It may well be that Dave & Buster's basic LBE formula is becoming outdated, and just tweaking this or that part of it will not solve its root cause problem.

It appears that D&B is aware of its outdated formula and lack of social entertainment options. Last year, they launched their "Store of the Future" in Friendswood, Texas. Based on its success, they are rolling the new format out at select Dave & Buster's locations in the U.S. this year. On February 9 th, they opened one in Dallas, Texas.

In addition to an evolved food menu with a focus on sharable options to increase social experiences, the new format includes "Interactive Social Bays" - both "Social Darts Bays" and "Social Shuffleboard Bays" that offer private, reservable spaces in suites for two to six players where guests can engage on social games while enjoying food and beverage (social gaming).

Dave & Buster's new Social Darts Bay for social gaming

D&B has also redesigned its bar area with a 40-foot screen with surround sound and dozens of additional oversized HDTVs. They designed the area to offer the ultimate social experience of watching the big game while drinking and eating.

Dave & Buster's Store of the Future bar area

Chuck E. Cheese's

Chuck E. Cheese's has an entirely different problem. According to Technomic, its U.S. units only averaged $660,000 in annual revenue in 2021 after emerging from its Chapter 11 bankruptcy in January 2021.

CEC is a children's entertainment center. But to get the children, the parents need to bring them and stay. So, CEC hopes that the grown-up menu will help convince adults to bring their children and more often.

This fails to address how the family decision-making dynamic of where families with children choose to visit for leisure and entertainment has changed.

Today, Millennial parents constitute the vast majority of families with younger children. Millennials' concept of family time is entirely different than that of their Gen X parents. Gen X parents often let their children rule, especially when it comes to the choices for family leisure time together. Gen X parents would tolerate a stay at a Chuck E. Cheese's. Millennial parents, conversely, don't want to relinquish control or give up their own personal pursuits in favor of their childrens'. There's now a new family dynamic of "we're in this thing together."

Millennial parents also have a different concept of "me time." Although the vast majority say they spend most of their free time with the kids, most still want to pursue their own passions at the same time. This means that "family time" has a new meaning.

60% of Millennial parents say that when they think about things to do with their children, it's no longer about only kid-specific activities. They want new, interesting experiences that fulfill them personally while bringing their kids along for the ride. 40% of dads even say they have no problem bringing their kids to bars.

What Chuck E. Cheese's is attempting to do is have their centers perceived as a family dining destination by offering more adult-appealing food in addition to kid-friendly food. This may help them, but it is very difficult to change the brand image from being a children's entertainment center to a family dining destination. Additionally, they now have increased competition from other children's entertainment centers and other types of entertainment concepts that appeal to adults. Many of the more contemporary bowling concepts are just one example. The entertainment appeals to the adults as well as the children. They offer a family social entertainment experience, typically simultaneously combined with food and beverage, versus an experience only designed for children that doesn't provide a social experience involving the entire family.

CEC also has other significant challenges. One is KGOY (kids growing old younger), or what is also known as children's age compression. Children's age compression, children becoming more sophisticated for their age in what appeals to them, has shrunk the age range that children's entertainment centers appeal to. In the early days of Chuck E. Cheese's, it appealed to children up to around age 12. Today, it would be rare to find a 9-year-old wanting to go there.

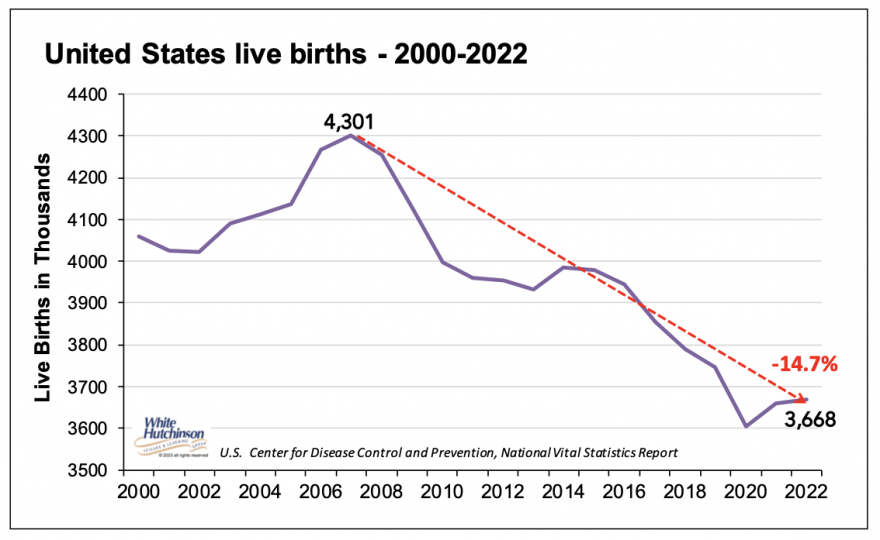

CEC's other significant challenge, besides KGOY shrinking their potential market of children, is the steadily declining birthrate; the number of younger children is declining. The pandemic has accelerated a baby bust, a long-term decline in births that started in 2008. There were 633,000 fewer births in 2022 than in the peak year of 2007.

If the birthrate hadn't begun to decline in 2008, we would have 10.2 million more children in 2022 than we did. The number of births is projected to continue to decline into the future.

In addition to its menu changes, CEC is doing other upgrades to its locations, including adding trampolines for children up to 42 inches in height.

They are also working with Magical Elves, the production company behind the Top Chef TV show, to develop a game show inspired by Chuck E. Cheese's. Adults dubbed "big kids" will compete on "supersized" arcade games like air hockey, alley roller, pinball, and the human claw. The duo who wins the most tickets (like at actual Chuck E. Cheese's joints) will trade in the tickets for prizes on a massive version of the iconic Chuck E. Cheese's prize wall.

Bottom line

Two trends already underway were accelerated by the isolation during the earlier days of the pandemic - a preference for spending on experiences over material purchases and the desire for IRL social experiences. They have changed the formula for success in the location-based entertainment industry. More of the entertainment needs to facilitate a social experience that also includes quality, even craveable and/or foodie food and beverage. Dave & Buster's is working to address this change. Chuck E. Cheese's, even with what might be more adult-appealing food, still lacks offering an entire family social entertainment experience.

Subscribe to monthly Leisure eNewsletter