Vol. XXIII, No. 10, September 2023 (Special Edition)

Special Edition

The end of the post-pandemic LBE surge. What's the future?

When the world opened up after lockdowns and people felt comfortable venturing out into the public world, many community location-based entertainment venues (LBEs) saw a surge in attendance and revenues due to both pent-up demand and pandemic-boosted spending power from the significant increase in savings that consumers accumulated from spending less during the heart of the pandemic and from government assistance programs. Some of the surge came from middle- and lower-income consumers who visited LBEs in late 2021 and 2022 who might not have visited in pre-pandemic 2019, or who visited more often due to their improved financial situation, predominately from their accumulated savings.

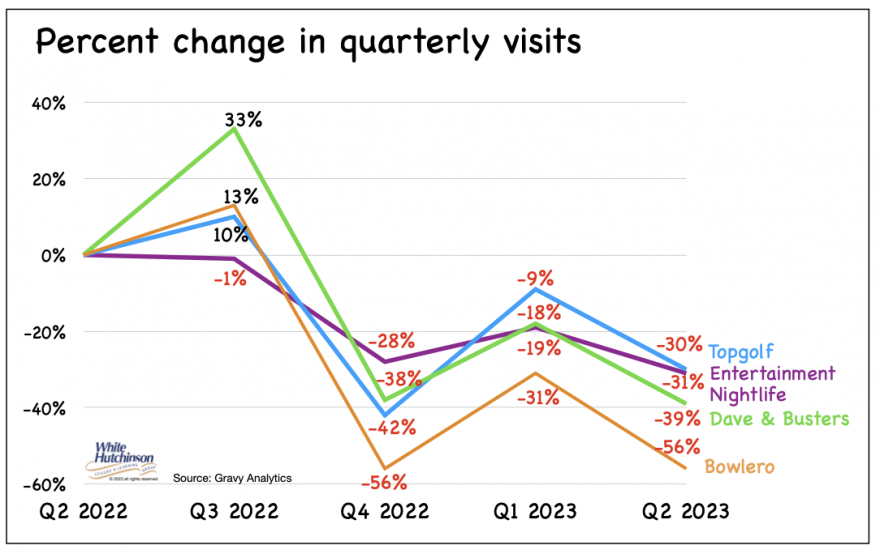

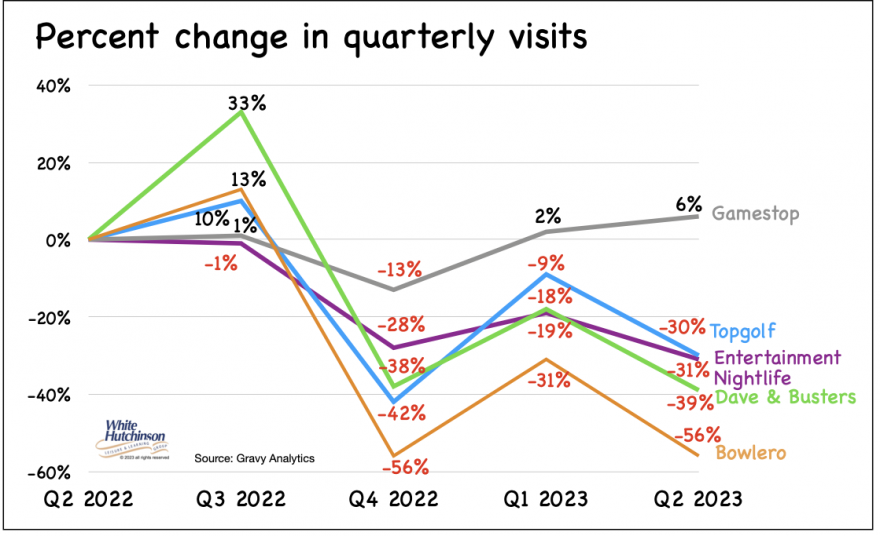

Gravy Analytics uses pseudonymous mobile phone location data to track people's movements in the physical world to understand market trends, consumer behaviors, and foot traffic patterns. For any out-of-home consumer destination, they can track visitation/attendance trends.

Their data tracking of attendance at Dave & Busters, Bowlero, and Topgolf, key players for location-based entertainment (LBE) and for overall entertainment-nightlife, found that the ways consumers seek entertainment experiences have shifted. Their data shows that the third quarter of 2022 was the last phase of the surge for those entertainment venues. All four categories saw an increase in Q3 of 2022, only to see a decline in foot traffic since. Bowlero saw the most substantial drop in year-over-year foot traffic, ending Q2 2023 with a 56% decline since Q2 2022. Dave & Buster's experienced a 39% decline, Topgolf saw a 30% decline, and entertainment-nightlife experienced a 31% decline.

Gravy also tracked foot traffic at GameStop, an entertainment-focused retailer where consumers purchase games to play at home. GameStop's foot traffic has increased year-over-year by 6%. Here's the graph with GameStop included.

Gravy also found significant year-over-year visits to Apple Stores and Best Buy in Q1 2023, 13% and 24%, respectively, both retailers of at-home digital options.

The Gravy Analytics team attributes the decline in LBE attendance to a shift in consumer behavior toward at-home entertainment. "The dramatic difference in foot traffic between entertainment chains like Dave & Buster's and a retail chain like GameStop suggests that price could be a defining factor. GameStop is an entertainment-focused retailer where consumers purchase games to play at home as often as they'd like. On the other hand, Dave & Buster's, Topgolf, and Bowlero require consumers to play games in person at the venue and pay for each game they play. Consumers may prefer to buy video games and other equipment from GameStop [and Best Buy] because it provides entertainment they can enjoy multiple times for a single price. They offer entertainment that provides lasting value. In comparison, visiting places like Dave & Buster's, Topgolf, and Bowlero to play games in person can be more expensive because they have to pay each time they play, and most consumers typically buy food or drinks on top of the game costs."

Gravy CMO Jolene Wiggins said, "Consumers appear to be prioritizing entertainment that offers lasting value, like video games and electronics that they can enjoy repeatedly. This choice seems to stem from a desire to make the most of their spending, especially when compared to costlier, one-time experiences offered by entertainment chains."

Gravy believes 2023 is the year of electronic in-home entertainment. Inflation, reduced savings, and the end of government pandemic assistance continue to impact consumer entertainment choices. Although many consumers spend more time outside the home post-pandemic, they're still looking for budget-conscious ways to find entertainment through video games and electronics. In 2023, consumers are spending thoughtfully and purchasing entertainment that can provide the most bang for the buck.

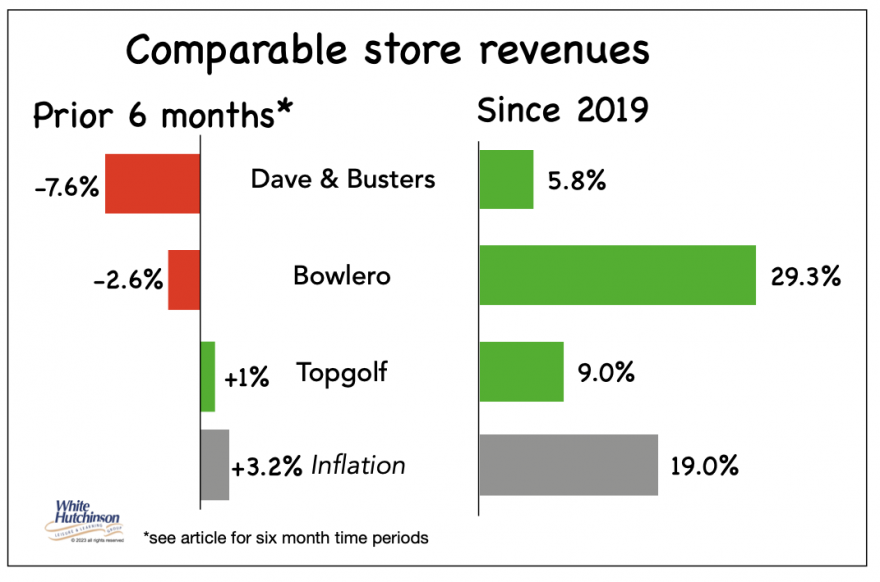

Dave & Buster's financial results support Gravy's findings. Dave & Buster's year-over-year comparable store sales (including Main Event stores) were down 6.3% in Q2 ending July 30, 2023 compared to Q2 2022. Comparable store entertainment revenues for the 26 weeks ending July 30, 2023 were down 7.6% compared to the 26 weeks ending July 31, 2022; food was down 3.1%, and beverages increased by 1.8%. Dave & Buster's reported that comparable store revenues declined "due primarily to a reduction in walk-in transaction counts."

Compared to 2019, sales are only up 5.8%, far less than the 19% inflation since then. Dave & Buster's comparable store sales remain below pre-pandemic levels as of July 30 this year if you consider inflation.

Topgolf's results since 2019 were very similar to Dave & Buster's. Comparable store revenues only increased by 1% from the quarter ending June 30, 2022 to the quarter ending June 30, 2023, and by 9% from the quarter ending June 2019 to the quarter ending June 2023.

It's a similar story with Bowlero for the past year, but different since 2019. For their fiscal year that ended July 2, 2023, comparable store revenue declined 2.6% versus the prior year. However, compared to the Q4 of 2019, comparable store sales were up 29.3%, an actual increase when you factor in inflation. Some of that increase is due to Bowlero purchasing single-owner bowling centers and then implementing their improved management, including their proprietary tech-enabled management systems, lane-side ordering kiosks, and price increases.

For all three LBEs, attendance at comparable stores can decline by a greater percentage than revenues if the people still attending are spending more money than in the prior period. This would explain the differences between Gravy Analytics' percentage decline in attendance and the LBEs' revenue percentage declines.

Financial results for all three LBEs seem to validate Gravy Analytics' report on declining visits to LBEs. It appears that the post-pandemic surge in LBE visits may have ended. The habit of enjoying electronic entertainment that consumers were introduced to and learned to enjoy at home during the pandemic may have become a long-term habit and will continue to influence entertainment choices well into the future.

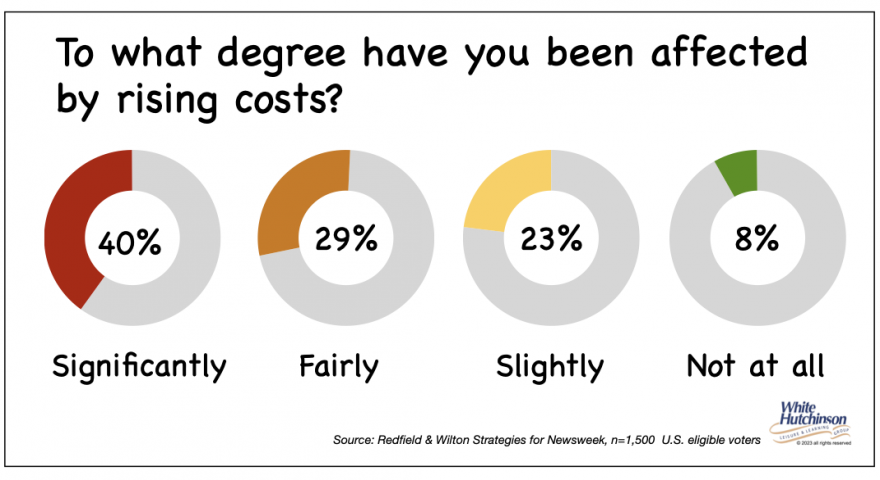

Several recent polls also substantiate a reduction in consumer spending, including for entertainment. A July 6 poll of 1,500 eligible voters by Wilton Strategies for Newsweek found that 92% of Americans said they've been affected by rising costs, over two-thirds (69%) "significantly" or "fairly."

According to the Newsweek poll, 45% said they spend less on entertainment and leisure activities. For a prime age group of LBE customers aged 25 to 44, one-quarter said their financial situation has worsened in the past year.

A June 2023 CNBC - Morning Consult survey of 4,400 adults found that 58% reported they've cut back on entertainment outside of the home, including concerts.

A CivicScience survey in August 2023 found that 44.2% of consumers have cut back their entertainment spending due to rising prices.

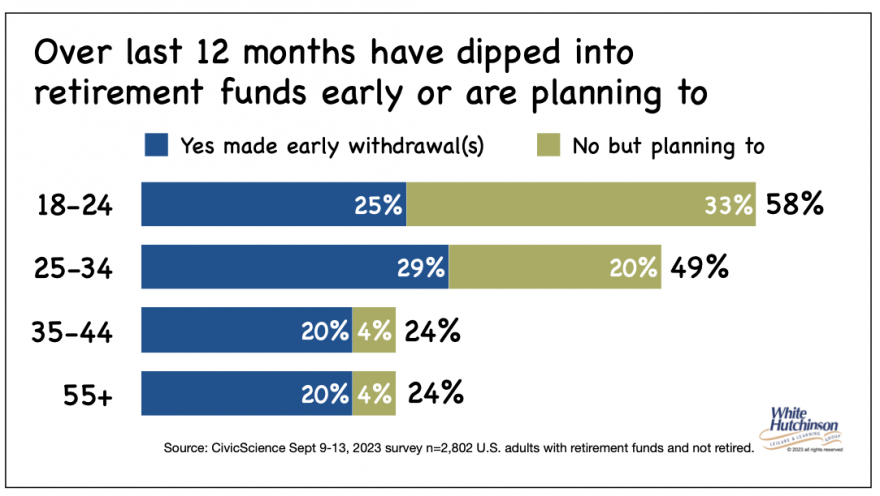

A Morning Consult survey this month indicates that many people have tapped out their savings. One-fifth of non-retired U.S. adults with retirement funds (22%) report making one or more early withdrawals despite the 10% tax penalty for early withdrawal and needing to pay income tax on any retirement fund earnings (unless it's a Roth IRA). Another 11% who haven't accessed their retirement accounts plan to in the future. That's a total of one-third of non-retired Americans who have accessed their retirement accounts early or plan to.

Millennials make up the largest share of those who have already withdrawn, and Gen Z is most likely to do so in the future.

Morning Consult Economic Intelligence reports that younger generations, Gen Z and Millennials, have primarily been behind the surge in out-of-home entertainment spending.

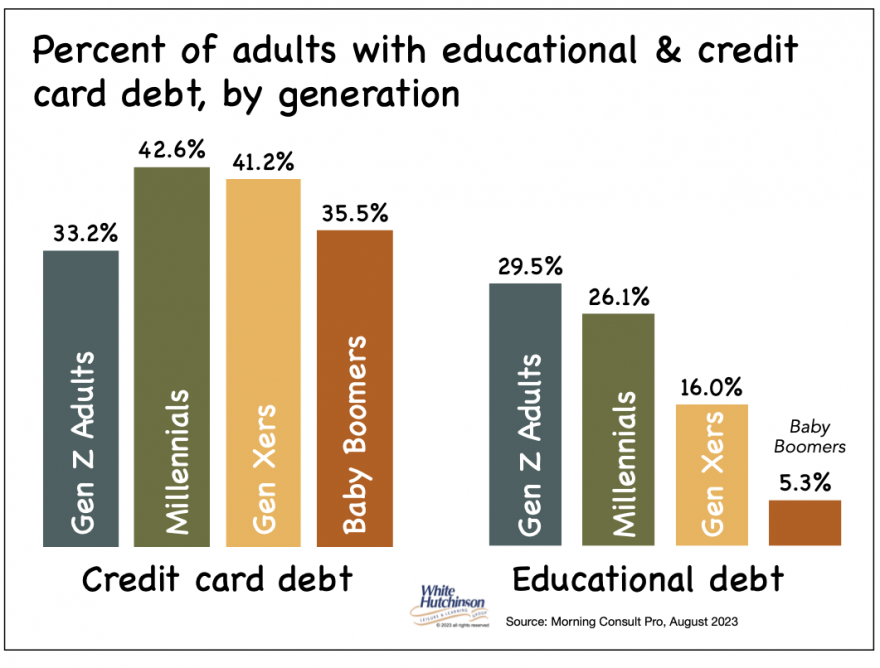

Morning Consult sees speed bumps going forward to that spending from tighter credit conditions with rising credit card balances due to higher interest rates and the resumption of student debt payments. One-third of Gen Z and 42% of Millennials carry credit card debt. A significant percentage of both generations have education debt.

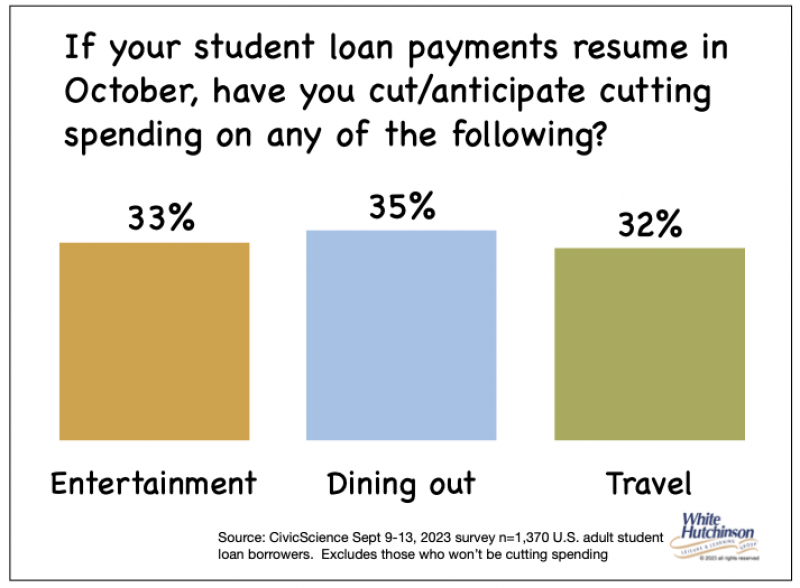

Morning Consult found that one-third of Americans report they have or will cut entertainment spending if student loan payments resume.

In addition to the financial strain of increasing monthly debt servicing, many young consumers locked into other significant financial commitments in the past few years to purchase homes and vehicles when they had more generous budgets due to pandemic savings and the student loan repayment pause.

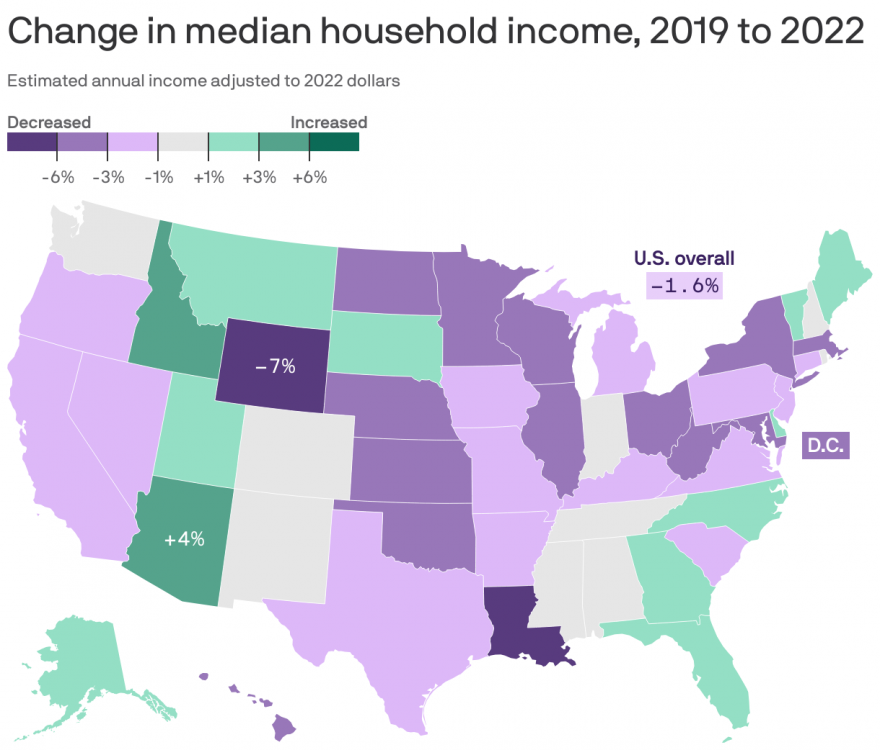

An additional factor contributing to the decline in discretionary spending at LBEs is a decline in median household income. Between 2019 and 2022, it declined by 1.6%.

For an interactive map with individual state data, visit Axios

Since 2022, median household income adjusted for inflation declined by an additional 0.8%. The share of households making $100,000 rose from 34% to 37%.

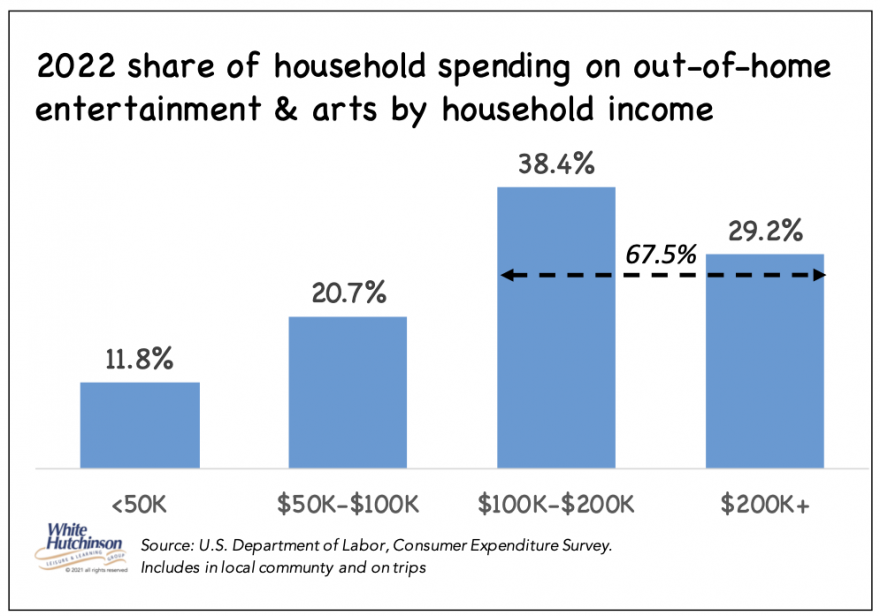

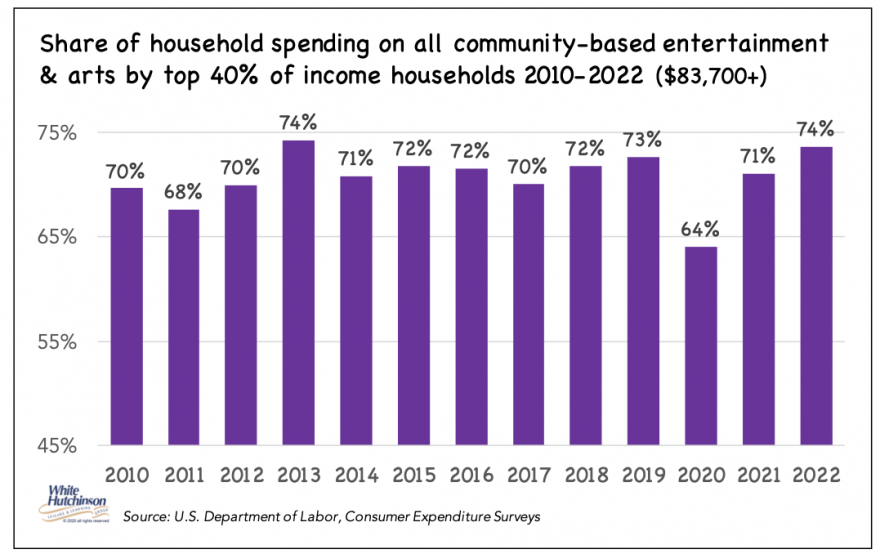

Studies have shown that inflation impacts middle-income ($50,000-$100,000) and lower-income households the most. They have cut back more on spending than higher-income households. ($100,000+). Households with $100,000+ incomes, one-third of all households (33%), accounted for more than two-thirds of all 2019 community entertainment and arts admission and fee revenues (67.5%).

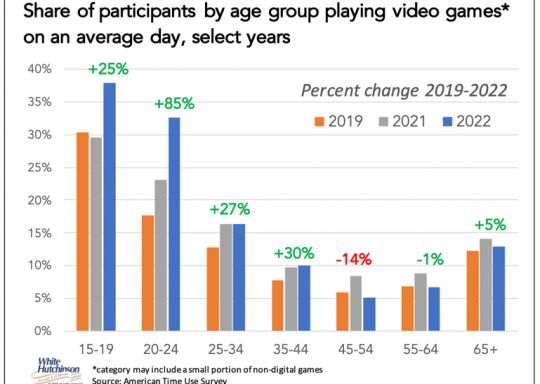

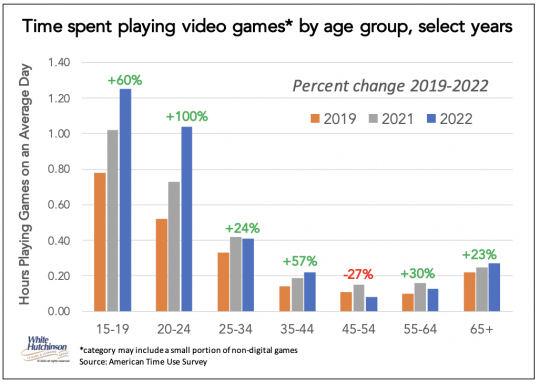

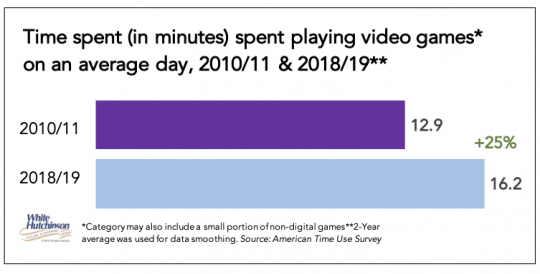

Data from the American Time Use Survey clearly shows that in 2022, nearly one-quarter more people aged 15+ played video games daily (+23%) and spent 42% more time playing them than in 2019. Ages 20 through 44, a primary LBE target age group, saw very significant increases both in participation and time playing.

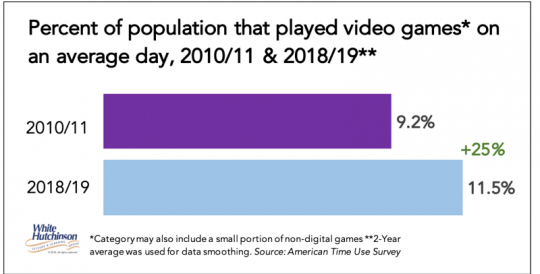

The increase since 2019 was an acceleration of playing video games that started well before the pandemic.

In the three years since the start of the pandemic, video game participation grew as much as it did over the previous ten years, and time spent playing nearly doubled over the past three years compared to the previous ten.

With more people experiencing a deterioration in their financial situation and their discretionary spending due to reduced savings, the impact of inflation, and rising monthly debt payments, the habits of all the digital at-home entertainment they learned to enjoy during the earlier days of the pandemic may continue long-term to influence entertainment time and spending, with a decreased share of their discretionary entertainment spending and time allocated to out-of-home LBEs.

Additionally, the pre-pandemic socioeconomic stratification trend of increasing LBE attendance and spending going to higher socioeconomic households should continue. In 2022, the top 40% of households by income ($83,700+) accounted for nearly three-quarters of all spending on community-based entertainment and arts admissions and fees (74%).

Takeaway

It appears that the surge in out-of-home visits to community LBEs has ended. Trends that started before the pandemic of increased participation and time spent playing video games and increasing socioeconomic stratification of participation in community LBEs appear to have accelerated over the past few years. Consumers face many financial headwinds affecting their discretionary entertainment spending, especially Millennials and Gen Z, a prime LBE target market. This does not bode well for LBEs. They have been losing market share for both leisure time and declining discretionary spending for entertainment. In addition, the number of LBEs continues to grow, especially the new category of "social gaming eatertainment" (mistakenly called "competitive socializing").

Going forward, LBEs need to embrace a post-pandemic competitive business model. Due to how inexpensive at-home digital entertainment has become, trying to compete on price is ineffective. Instead, LBEs need to compete on value. Many consumers will continue to visit LBEs, just fewer of them and not as often. The ones who will visit will predominately be the higher socioeconomic with upper-middle class and higher incomes and/or bachelor's and higher college degrees. Many will have adequate disposable incomes to attend, but only if it is a good value for the money. This requires raising the attendance experience to a high fidelity level.

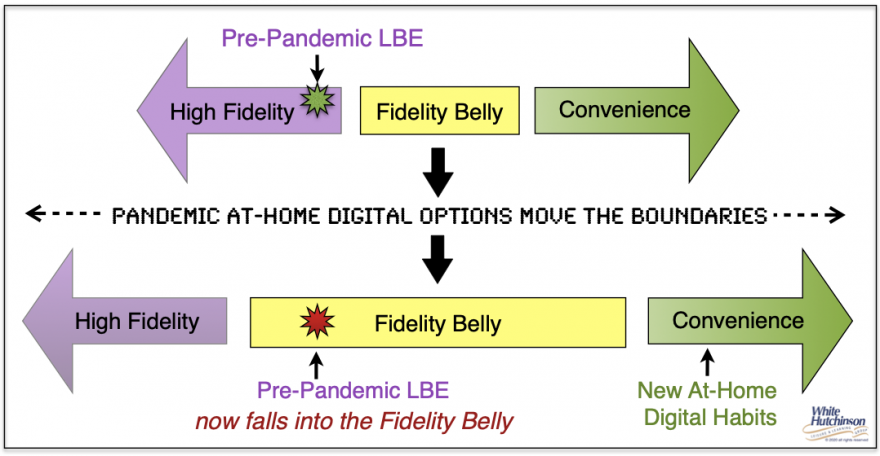

People make entertainment choices in terms of two key dimensions - the experience and its convenience. It's a trade-off between Fidelity, the quality of the experience, and Convenience - the ease of access in time, effort, and money. To win, you need to be at one extreme or the other of the Fidelity-Convenience continuum. Being in the middle means it falls into the Fidelity Belly and has no or little appeal. The more attractive just staying home with the increased Convenience of all the at-home digital entertainment and socialization options is, the higher the Fidelity of out-of-home LBE experiences need to become to compete and attract people.

During the pandemic, digital entertainment and at-home socialization dramatically improved in Convenience and appeal. The digital world has evolved to become more meaningful and connected, replacing in-person experiences.

What used to be a pre-pandemic High Fidelity experience for many LBEs is no longer considered High Fidelity due to all the improved at-home digital Convenience alternatives, and they will find themselves falling into the Fidelity Belly. To win, the quality of out-of-home LBE experiences will need to be much higher today and in the future. Today, it has become a battle of digital experiences on the couch vs. out-of-home LBEs.

With higher socioeconomic households accounting for the vast majority, roughly two-thirds of all LBE spending, the quality of the facility, its design, and aesthetics must cater to their tastes and preferences to be considered a High Fidelity experience by them. Many pre-pandemic LBEs have designs that cater more to the middle class and lack the upscale qualities higher socioeconomic households expect.

Many of the new social gaming eatertainment venues have done just that, raised the fidelity of the visit experience. They have enhanced the fidelity of the in-person socialization that people now crave since the early pandemic isolation by combining fun, non-competitive, low-skill level group gaming with simultaneously enjoyed destination-worthy, foodie-worthy, globally-inspired menus with sharable dishes and curated beverage and alcoholic selections in highly appealing venue with contemporary interior design and aesthetics.

One reason Dave & Buster's comparable store revenues have effectively declined since 2019 on an inflation-adjusted basis and Bowlero's have grown is that the bowling at Bowlero is a social experience. In contrast, many of Dave & Buster's games are not. With peoples' post-pandemic emphasis of looking for High Fidelity social, out-of-home social experiences, Dave & Buster's may be slipping into the Fidelity Belly. Topgolf's comparable stores' minimal 9% revenue growth since 2019, far less than inflation, is a bit of a mystery, as Topgolf does offer a social gaming experience.

The new social gaming eatertainment venues are not inexpensive. Rather, they are considered a good value based on the High Fidelity experience they offer. As such, they have high appeal to the higher socioeconomic who can most afford them and account for the vast majority of LBE attendance and spending. Even for the lower socioeconomic who have more limited discretionary income so they can't visit LBEs very often, they have high appeal, as they'd prefer to go once to a High Fidelity memorable LBE than twice to an unexceptional one, an experience not worthy of sharing on social media. The High Fidelity LBEs, especially the social gaming eatertainment venues, will be the big winners in the future.

Additional reading:

- The new paradigm for community location-based entertainment venues

- What is a great social gaming experience?

- The growing socioeconomic stratification of community OOH entertainment

Subscribe to monthly Leisure eNewsletter