Vol. XVI, No. 8, October 2016

- Editor's Corner - the disruption issue

- The growth of eLeisure

- Only 10 days left to register

- The growing upper middle class

- The shift of out-of-home entertainment to trips & vacations

- The shrinking children's market

- If you only optimize yesterday's business model, you're inviting disruption and obsolescence

The growing upper middle class

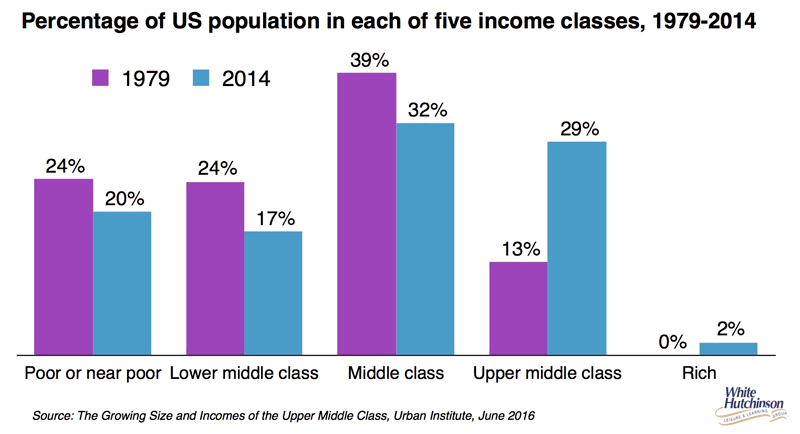

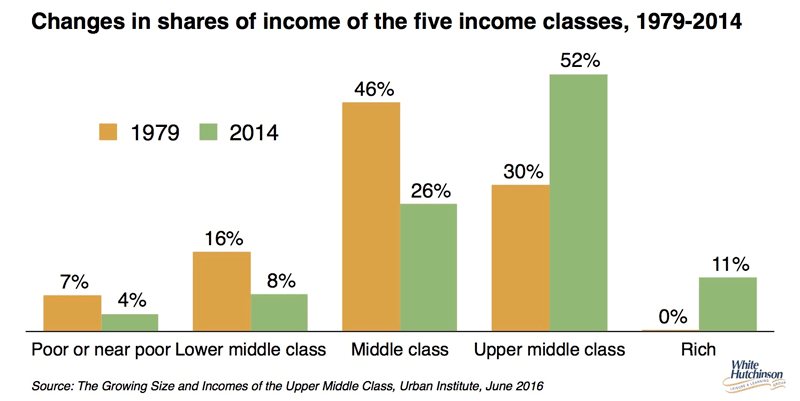

We continue to read about the shrinking and struggling middle class. But what is never discussed is that while the middle class is shrinking, the upper middle class is growing. Back in 1979, the middle class was 39% of the population and earned 46% of incomes whereas the upper middle class was only 13% of the population and earned 30% of incomes. In 2014, that had flip-flopped. The middle class had shrunk to 32% of the population and only 26% of incomes whereas the upper-middle class had more than doubled to 29% of the population and more than half of all incomes (52%). Today the population of the upper middle income class is almost as large as the middle class, and of course has far more discretionary income to spend.

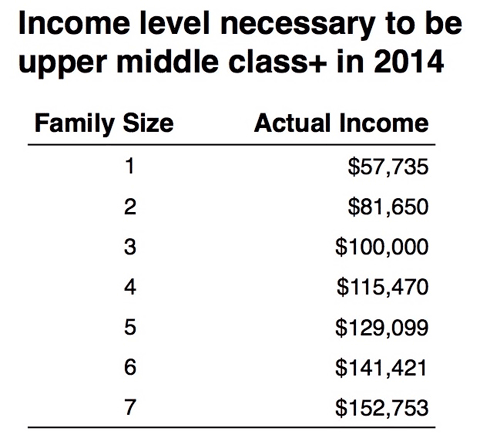

These are the incomes that were required to be a member of the upper middle class in 2014 for different size families. What might surprise you is that a single person with an income of $58,000 is a member of the upper middle class. For a couple, the entry level is $82,000.

The upper middle class is now the target market for community leisure venues (CLVs) that include entertainment. As our article in this issue on the new CLV business model points out, it is the higher socioeconomic households, basically ones with a Bachelor's or higher college degree, that now account for almost two-thirds of all participants at community non-live entertainment (64%).

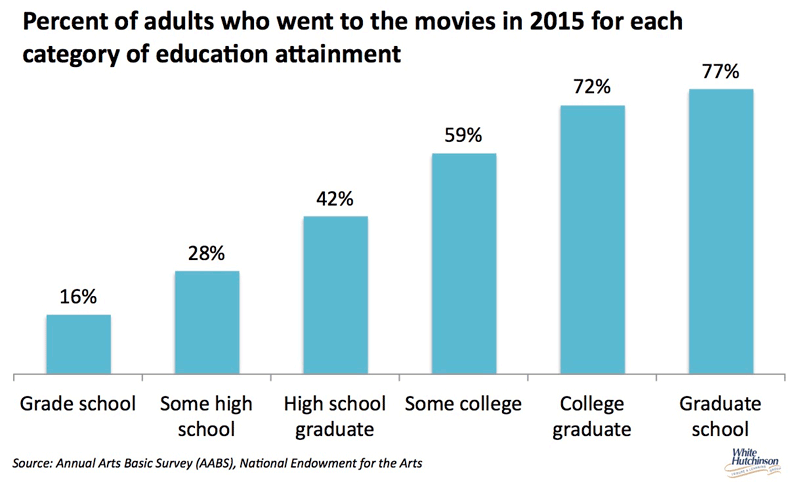

If you have any doubt that the middle class is no longer the desired target market, just check out these statistics on who goes out to movie theaters.

Even the most popular form of out-of-home entertainment, and a relatively affordable one, is dominated by the higher socioeconomic, not the middle class.

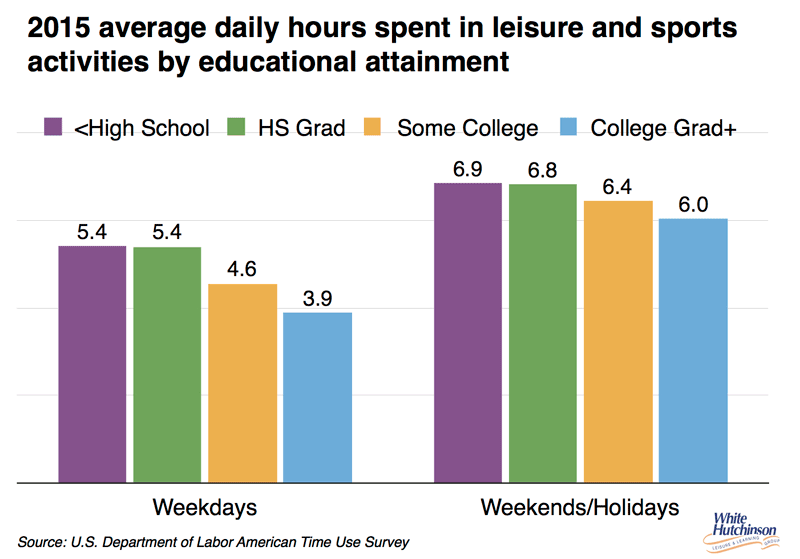

One important factor that influences the upper middle class' leisure choices is that they have less leisure time than the lower classes. This makes their leisure time even more valuable to them. They don't want to waste their limited leisure time on mediocre experiences. When they do go out, they want to spend their time on quality experiences, and they are more than able and willing to pay for that quality. They are very discriminating in how and where they will spend their leisure time.

This shift in income demographics means the CLVs can no longer be developed on the old business model that targeted middle class families. The upper middle class' expectations for design and ambiance, food and drink and hospitality are high. Those expectations are formed based on all the other out-of-home businesses they frequent, including specialty retail, restaurants (where the bar has raised dramatically in the last few years), hotels, resorts and places such as Disney World. If location-based leisure venues don't meet their values, standards and expectations, the upper middle class will just stay away.

Vol. XVI, No. 8, October 2016

- Editor's Corner - the disruption issue

- The growth of eLeisure

- Only 10 days left to register

- The growing upper middle class

- The shift of out-of-home entertainment to trips & vacations

- The shrinking children's market

- If you only optimize yesterday's business model, you're inviting disruption and obsolescence