In my last blog I discussed pandemic forces that will lead to the decimation of a significant portion of the LBE industry, including many family entertainment centers (FECs). I used the example of several FEC chains, including Chuck E. Cheese’s, Dave & Buster’s and Main Event, to illustrate the current economic challenges they are facing. Both Dave & Buster’s and Main Event have raised considerable cash through debt or sales of equity and now have on hand nearly $2.0 million per store to be able to stay financially afloat through the pandemic. This includes covering all the additional costs they’ve had as well as probably operating with negative cash flows due to reduced attendance. Chuck E. Cheese’s owner, CEC Entertainment, Inc., filed Chapter XI bankruptcy to allow them to continue to operate, allowing them to stop landlords from evicting them from stores due to unpaid rent, to reject (cancel) leases at underperforming locations, to renegotiate many leases and to either restructure their excessive debt or be sold.

Of course, all three companies are attributing their problems to the pandemic. There can be no question it is a major contributor. However, all three companies’ business models were already on a slow path of obsolescence prior to the pandemic. The pandemic is now accelerating many of the trends that were already underway pre-Covid for peoples’ out-of-home (OOH) leisure behaviors. If the three chains make it to the other side of the pandemic, they won’t be successful if they don’t reinvent their business models to both fix the underlying issues they were experiencing pre-Covid and also to be attractive to the consumer who will shape a forever-changed competitive OOH leisure and entertainment landscape that will emerge on the other side. This is not only true for these three chains, but also for any FEC that makes it to the post-pandemic era.

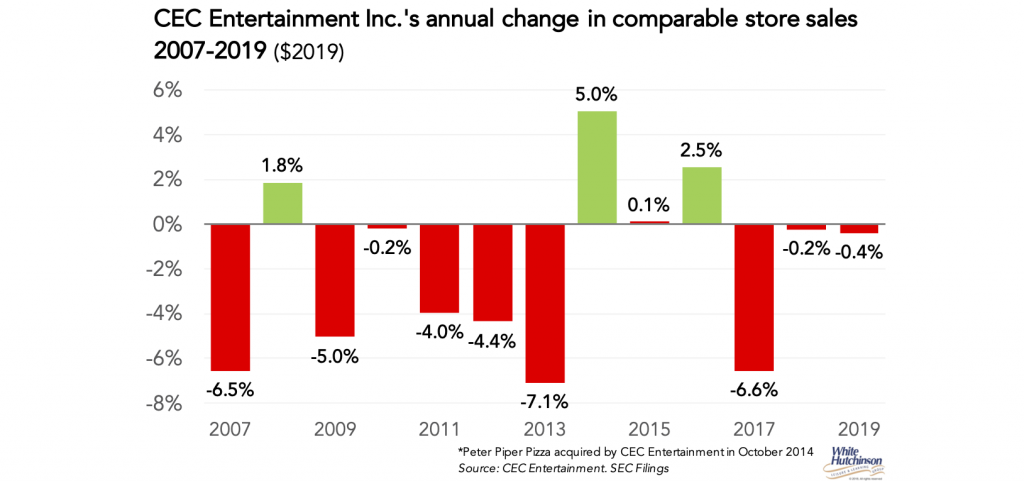

In a statement, David McKilips, chief executive officer of CEC Entertainment (CEC), said that entering bankruptcy was necessary to allow the beleaguered pizza eatertainment chain to recover from the financial impact of the pandemic. However, CEC had far more underlying problems and was operating on thin financial ice before the coronavirus hit. In addition to an excessive debt burden of almost $1.0 billion ($1,700K per owned unit), CEC was seeing declining comparable store sales.

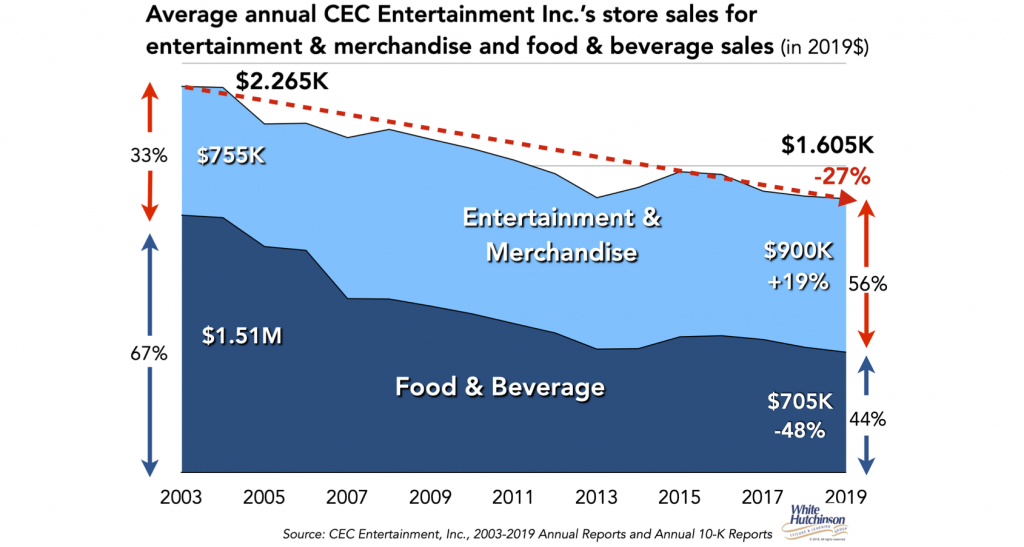

CEC’s declining comparable store sales were due to a number of factors including their passé brand image, which they tried to fix by remaking the Chuck E. Cheese’s character into a rock star and phasing out animatronic stage shows. They also tried to upscale their food and renovate to have open kitchens to meet contemporary food and beverage expectations, so the parent veto factor wouldn’t come into play for a visit decision. However, over the years, food and beverage sales per store not only declined by half, from $1.51 million in 2003 to $705 thousand in 2019 (inflation-adjusted), but also from two-thirds (67%) of all store revenue to only 44% in 2019. And the recent years included the added mix of the Peter Piper Pizza restaurants, which are intended to be more of a restaurant destination than an entertainment one.

But adding to all that, the chain is also a victim of KGOY (kids growing old younger) with a declining age range of children interested in visiting. On top of that, there has been a declining birth rate since 2007, further shrinking their potential target market size.

Furthermore, the concept of family time is completely different today for the majority of parents of younger children, mostly Millennials, than it was for their Gen X parents. Gen X parents often let their children rule, especially when it came to the choices for family out-of-home leisure and entertainment. Many Millennial parents on the other hand don’t want to relinquish control or give up their own personal pursuits in favor of their child’s. Millennial parents have a different concept of “family time.” Most want to pursue their own passions at the same time they go out with their children. There’s now a new family dynamic of “we’re in this thing together.” When they’re thinking about things to do with their children, it‘s no longer about kid-specific activities. They want to have new, interesting experiences that fulfill them personally while bringing their kids along for the ride. A children’s entertainment center that is focused on children’s solo entertainment experiences is no longer a good fit.

During the good economic times in 2019, CEC lost $28.9 million on $912.9 million in revenue. So, their model was basically broken before Covid-19. Excessive debt and the pandemic were not the only reasons for their financial troubles. Their target market was changing, both in expectations and in size.

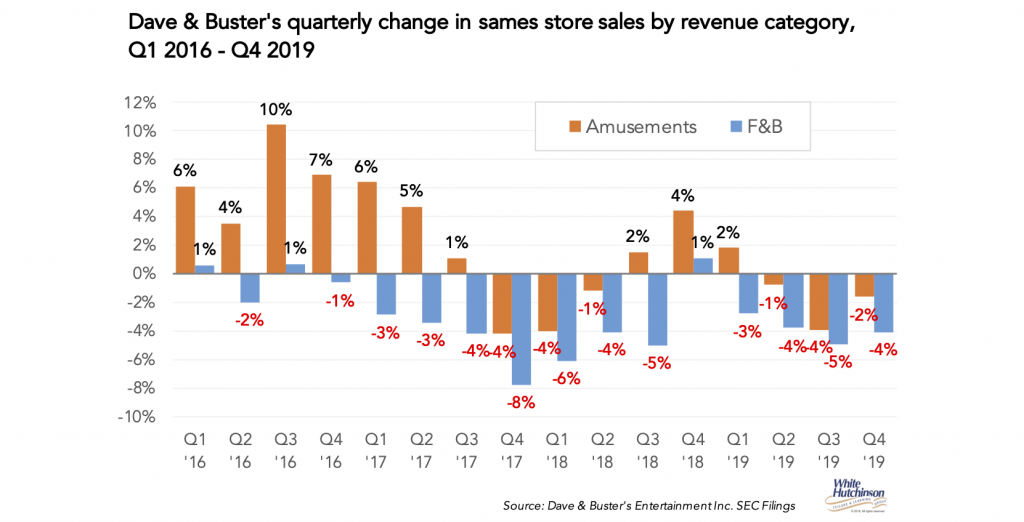

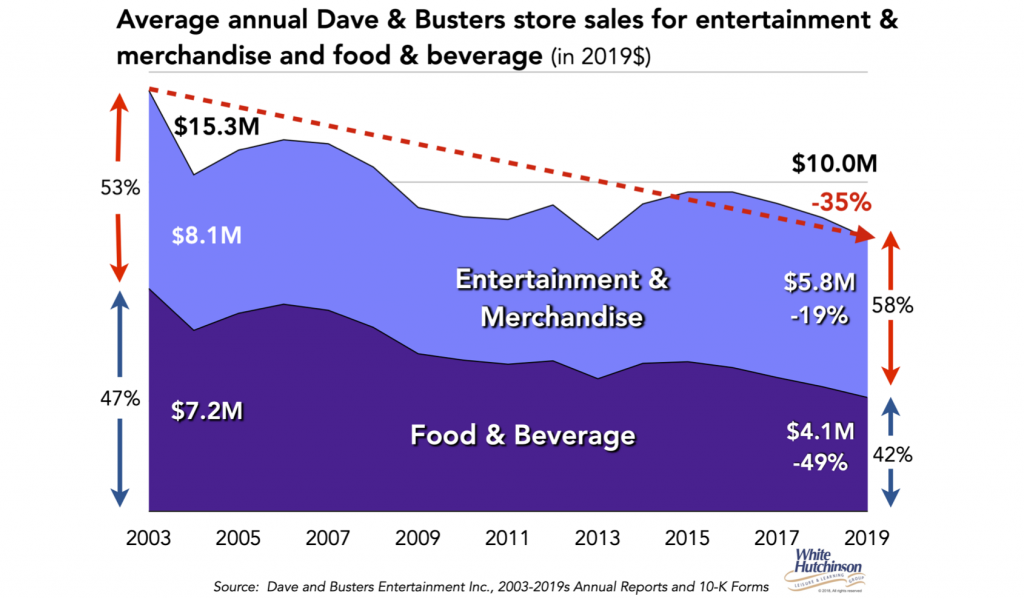

Prior to Covid-19, Dave & Buster’s was also being impacted by a disruptive shifting culture of out-of-home leisure and entertainment. Adjusted for inflation, D&B’s comparable store sales were down 3.4% in 2018 and down 3.6% in 2019 (fiscal year ending Feb 2, 2020). In the fourth quarter ending Feb 2, 2020, before any impact from the coronavirus, same store sales declined by 6% (due primarily to a 7.8% decline in walk-in traffic sales). Total 2019 comparable store sales declined by 4.9%.

And the same as CEC, their food & beverage share of all revenues has been in a decline as well, from 47% in 2003 to 42% in 2019.

D&B’s decline in average store revenues is not only a result of a decline in same store sales in recent years, but also a gradual reduction in the average size of their stores.

D&B reported that in the third quarter of their 2019 fiscal year, 45% of their stores open more than one year have seen declining sales due to either new competition or cannibalization by their own expansion.

Main Event was also seeing challenges, with declining same store sales, estimated at minus 3% in 2019 (inflation-adjusted).

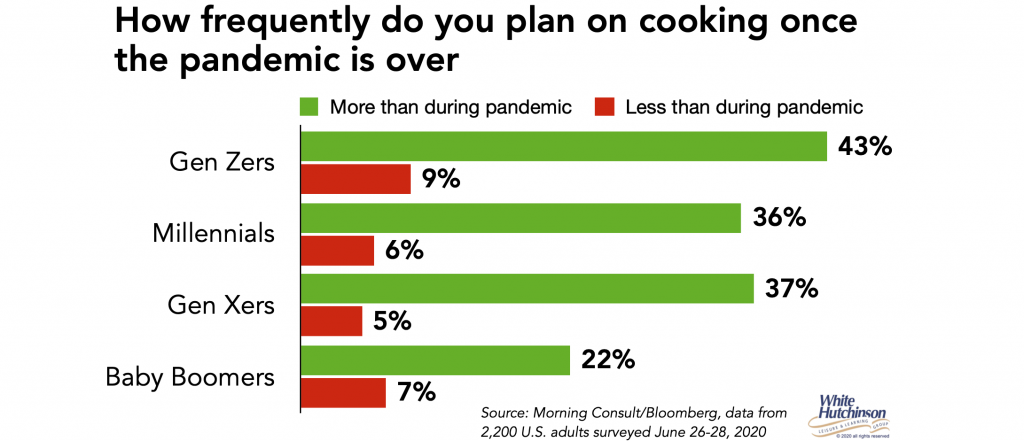

During lockdown and subsequent self-isolating at home for many people, we’re seeing an acceleration of a trend that was already underway – both time and money spent on at-home digital entertainment and socialization displacing OOH options. During the pandemic people have been introduced to improved and new virtual and digital social and entertainment options and are taking up new or returning to old hobbies. People are also cooking from scratch more and enjoying it, with many planning to continue post-pandemic.

These new routines and habits are likely to be sticky and permanently replace some of the visits previously made to OOH social and entertainment experiences. Research on habit formation has found that it takes a minimum of 21 days to form a new habit and a little over two months (66 days) for a new behavior to become automatic. We’re now nearly 120 days into the closure of most LBEs and FECs, with people limited to using their at home digital options. Many people are unlikely to return to their pre-pandemic OOH habits, or at most to a lesser degree. Many FEC experiences that were attractive in the past will be less relevant and compelling compared to the at-home ones we have gotten comfortable with and are enjoying on a regular basis. The at-home options are far more convenient, less costly, and now definitely safer.

Dave & Buster’s CEO Brian Jenkins told stock analysts last month, “I think we are going to see less competitive headwinds here on the other side [of the pandemic],” implying it will result in improved sales for D&B. Less competition post-pandemic is not going to assure success for D&B, CEC or Main Event. The size of total OOH entertainment market potential will also be reduced. It’s not the number, or the fewer competitors that determine an LBE’s/FEC’s attendance and sales, it’s whether they offer people an attractive option that meets their preferences, one better than the competition, one more compelling than just staying home with the digital options. Just because one type FEC people used to go to closes permanently, such as a laser tag center, doesn’t mean they will switch a different-type one, such as bowling.

D&B’s, CEC’s and Main Event’s business models were already showing obsolescence pre-Covid, losing market share to new and better business models. All three chains, as well as all other LBEs/FECs that survive, will be trying to attract a post-pandemic changed customer. The COVID-19 pandemic will have a profound effect on consumers’ attitudes, perceptions of value and their purchasing decisions for many years into the future. Covid-19 is resulting in an acceleration and expansion of the preferences and considerations that consumers bring to their decision-making for their OOH experiences.

Old pre-Covid FEC business models are all facing a true existential threat. Their existing business models will all suffer accelerated Darwinism if they don’t adapt and innovate for the new future with customers who are now fundamentally different than the ones we knew before.

Here’s some of the changes LBEs and FECs will need to adopt to succeed:

Importance of social experiences – It’s not surprising that FECs, such as CEC’s and D&B’s business models, that are heavily dependent on game rooms were seeing declining same store attendance and revenues. Game rooms tend to be solo or shared experiences, not social experiences. The isolation that Covid-19 has brought from stay-at-home orders, self-quarantining and working from home has made in-person, face-to-face social experiences more important than ever, with all indications its increased value will continue post-pandemic. A recent June 29 – July 2 survey by Globalwebindex found that a large percentage of people say they plan to spend more time socializing as a family post-pandemic. And the socialization needs to be with things the whole family can do together, not parents watching their children doing something. It’s the same for friends gathering at some OOH destination. They want social activities.

Targeted niche market – Mass-market FECs such as Main Event are a lowest common denominator formula that tries to work for everyone, so is not perfectly suited for anyone. The expanded variety of different, more focused FEC concepts that grew over the past decade or so led people away from the average, the generic. Concepts focused on both a niche market and a focused experience were already gaining market share. With people looking for more premium OOH leisure experiences that are good fit for them, generalized, large, multi-attraction FECs will continue to fall out of favor.

Declining birth rate – The pandemic has accelerated the decline in births. It is now projected that there will be 300,000 to 500,000 fewer births in 2021 than if the coronavirus hadn’t happened (more information). The future children’s entertainment market, as well as the family-with-children market, will significantly shrink.

Premium concepts – The out-of-home entertainment offering has to either be such high quality that people will choose to spend their disposable money (which is declining for many people) and leisure time on it (what I call a High Fidelity offering), or convenient/inexpensive enough that they won’t worry about how much it costs. At-home digital entertainment generally fulfills the latter. Trying to be in the middle, the mediocre experience that doesn’t fit either criteria, is where too many LBEs find themselves. The recession will probably hollow out the middle class even more. The pre-Covid trend of the higher socio-economic becoming a growing share of all OOH entertainment time and spending is only being accelerated. That market segment generally won’t settle for anything less than quality and premium. It’s not so much an issue of price with them, but rather whether is it a great experience and good value for the price.

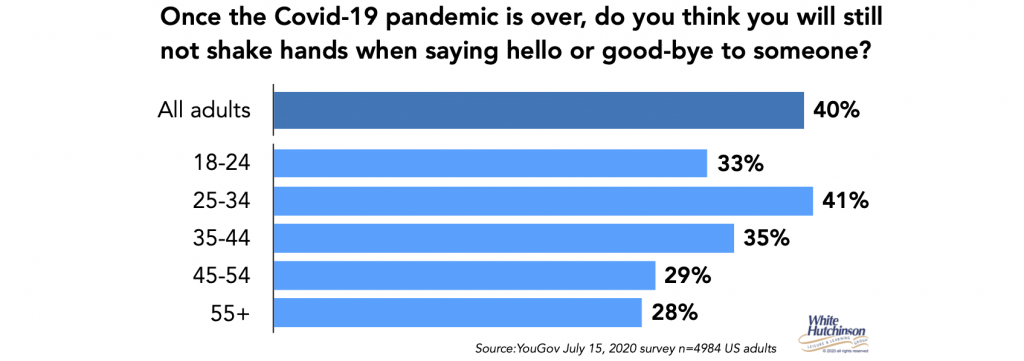

Safety-first mindset – A safety-first mindset doesn’t just involve avoiding coronavirus transmission. It deals with avoiding all diseases and food safety. A lot of the fears and behaviors people developed during the pandemic will continue post-Covid. For example, a July 15th poll of 4,984 adults found that one-third (32%) said that once the Covid-19 pandemic is over, they still will not shake hands when they say hello or good-bye to someone. The percentage answering they won’t only varied by two percentage points by income. The 25-34 age groups showed the highest percentage saying they won’t at 41%.

This means that many people will continue to expect high levels of cleaning and sanitation in centers. Both high-touch activities and social distancing could continue to be an issue with many people. LBE and FEC demand will probably be redistributed based on how safe from catching some disease a visit is perceived to be. Outdoor experiences will probably have an advantage.

Food & beverage – Pre-Covid, dining out had elevated to an experience that many younger adults considered more desirable than a pure entertainment offering. The most successful new school LBE business models were incorporating high quality, often foodie-worthy, food and drink as their anchor attraction with the entertainment almost being secondary. When consumers start dining out, the predictions are they will quickly move past an initial desire for comfort food back to adventure and discovery food and drink exploration. There is really nothing more social then eating and drinking together. I believe that CEC, D&B and Main Event were already being negatively impacted by the mediocre quality of their food.

One- & limited time events – Pre-Covid there was already a major shift in peoples’ OOH leisure experiences to variety seeking rather than repeat visits to the same OOH experience, such as at FECs. Non-attractions, one- and limited-time events such as live events, festivals and concerts, were winning a greater share of peoples’ OOH time and wallets. As a result, LBEs and FECs that were highly dependent on attractions were becoming commoditized and losing their repeat appeal (learn more). Post-Covid, we will see a return to and probably an expansion and increased appeal of non-attraction events.

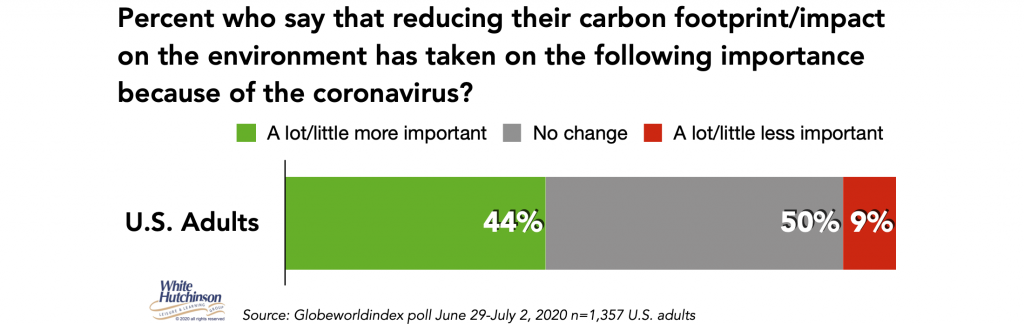

Health, wellness & sustainability – Another pre-pandemic characteristic that will not only stick, but be accelerated as well, will be the prioritization of health and well-being. This characteristic includes not only food selections, but also extends to the health of the planet. The importance of sustainability will be even further accelerated coming out of the pandemic, as almost half of adults report that reducing their impact on the environment has taken on more importance because of the coronavirus.

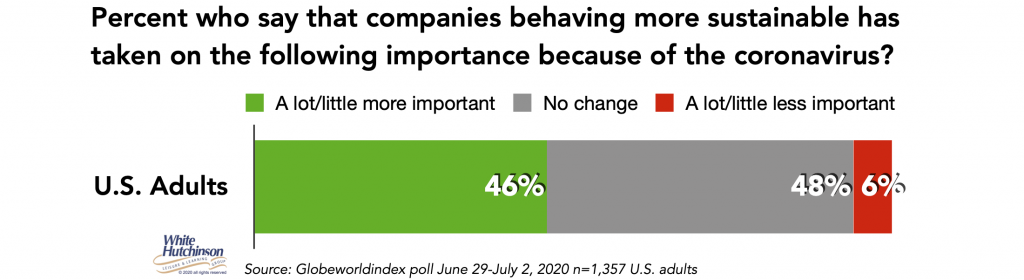

Almost half of people also report that companies’ environmental responsibility has also taken on more importance due the coronavirus.

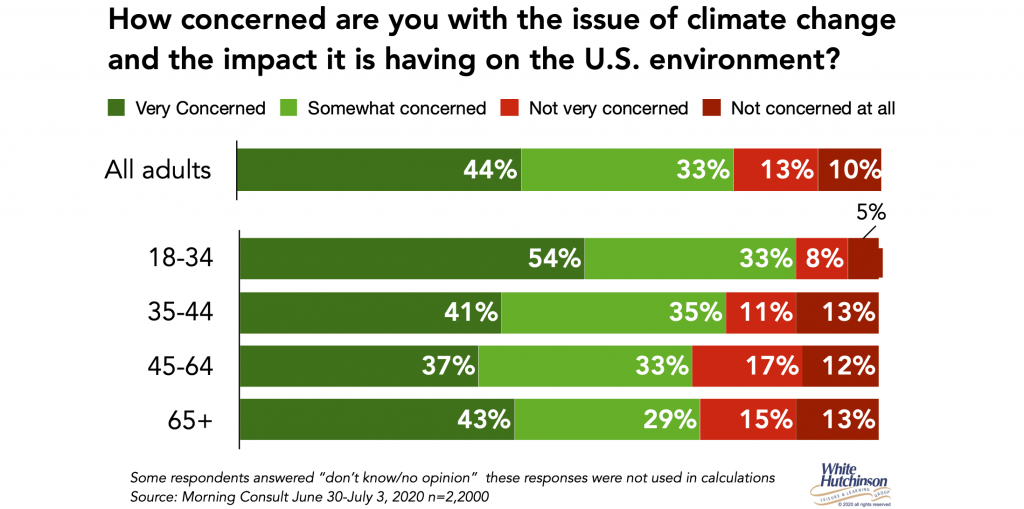

Over three-quarters of adults (77%) are now concerned about climate change and the impact it is having on the U.S. environment.

I continue to be a bit dumbfounded by how little the LBE, and especially the FEC segment, has embraced the importance of developing and operating sustainably. Back in 2018 the Ocean5 LBE project with its Table 47 restaurant our company designed and produced earned a LEED Silver Certification. It’s the world’s first eatertainment project and the first with laser tag to earn a LEED certification. Additionally, it is the first project with bowling to receive a Silver certification or higher. I haven’t seen any announcement of a FEC earning LEED since then.

Community and society – The growing importance of community and society, and how we live together, including equality for all, will not only stick, due to the national upheaval currently underway, including black lives matter, but will fundamentally change the American culture for embracing diversity and inclusion in all parts of our lives and expectations for how businesses operate.

The pandemic has raised the bar for how people compute value. Post-pandemic, people will be placing even greater importance on how businesses demonstrate that their offerings and practices align to personal values and ethics. Corporate social responsibility and sustainability will be even more important to peoples’ decisions for which LBEs and FECs they frequent.

The one great uncertainty for the future of LBEs and FECs is that the hope for a vaccine may not prove to be the panacea that ends the pandemic that everyone is hopeful for. The other side may not end up being what we think it will be. I will be blogging about that next week. Stay tuned.

Follow me on Twitter and Linkedin – I try to post news and information that is relevant to the LBE and FEC industries a few times each weekday.