In my previous blog I analyzed the revenues required for Dave & Buster’s and CEC Entertainment to reach cash breakeven after they reopened. My analysis found that D&B needs to achieve 70% of previous revenues and CEC needs 97% to reach cash breakeven. Most small chain and independent family entertainment centers (FECs) and location-based entertainment (LBE) have higher proportional debt payments than D&B, so their attendance and revenues will need to reach even higher than 70%, probably more similar to CEC, to be able to pay their bills.

All the polls are consistently showing that the percentage of people ready to return to FECs and other type LBEs is too low for the businesses to reach cash breakeven in the first month or so after reopening, meaning they wouldn’t be able to pay all their ongoing expenses and debt payments. Also, the 50% restricted capacities for social distancing and reduction in crowd size make it highly improbable to reach breakeven. So, the question is, how soon will enough people return to LBEs so they will reach cash breakeven and then profitability?

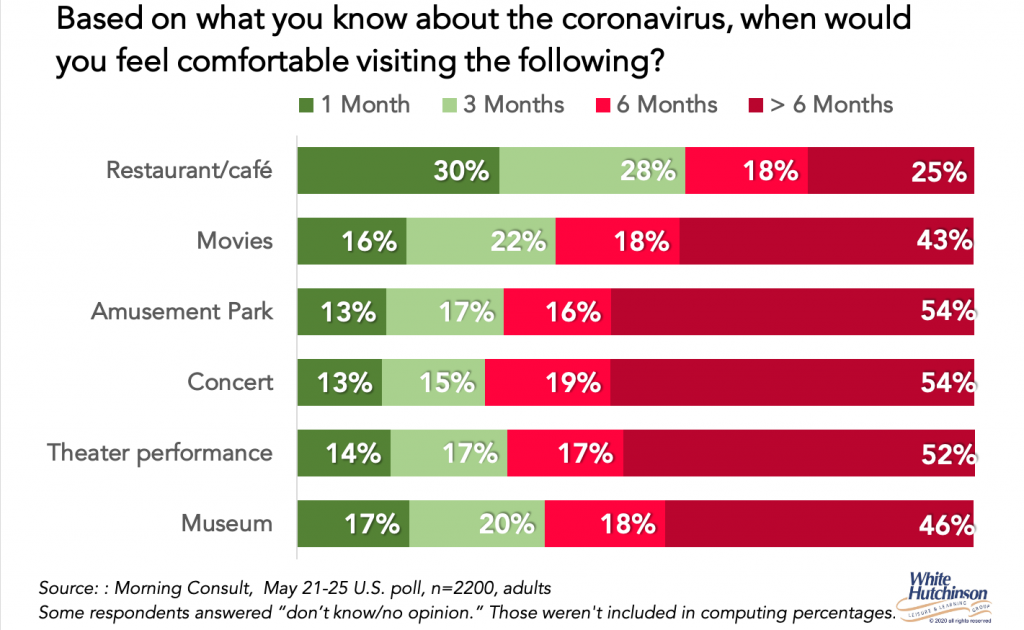

A recent Morning Consult poll found that around one-half of adults say they won’t feel comfortable returning to different type LBEs, museums and cultural venues, for six months or more. It’s less, just one quarter of people for restaurants.

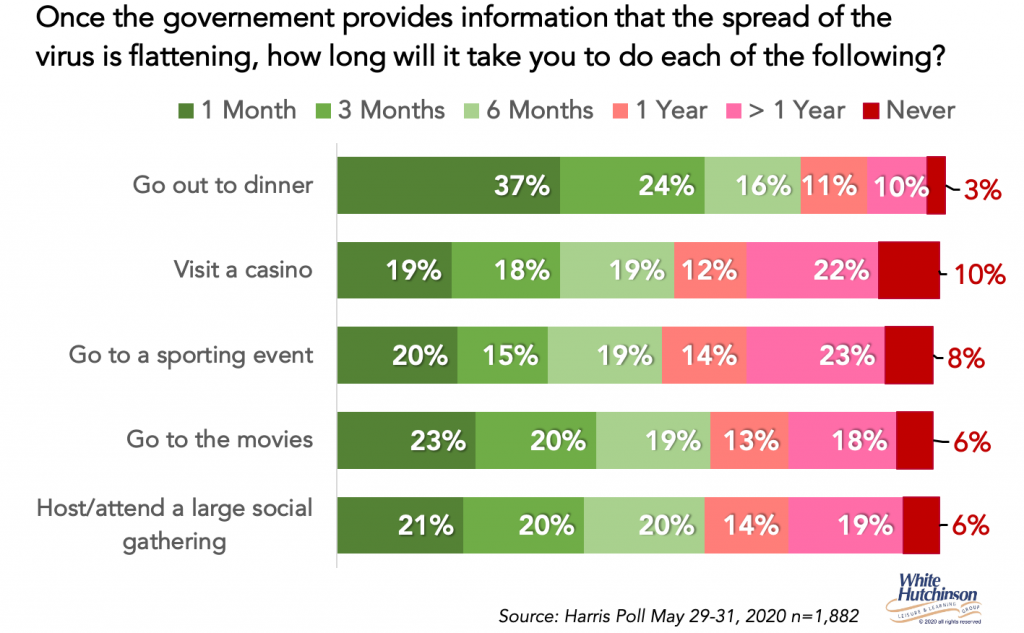

The most recent Harris poll shows that a substantial portion of people will wait more than a year to return to activities, with a small percentage saying, “never again.”

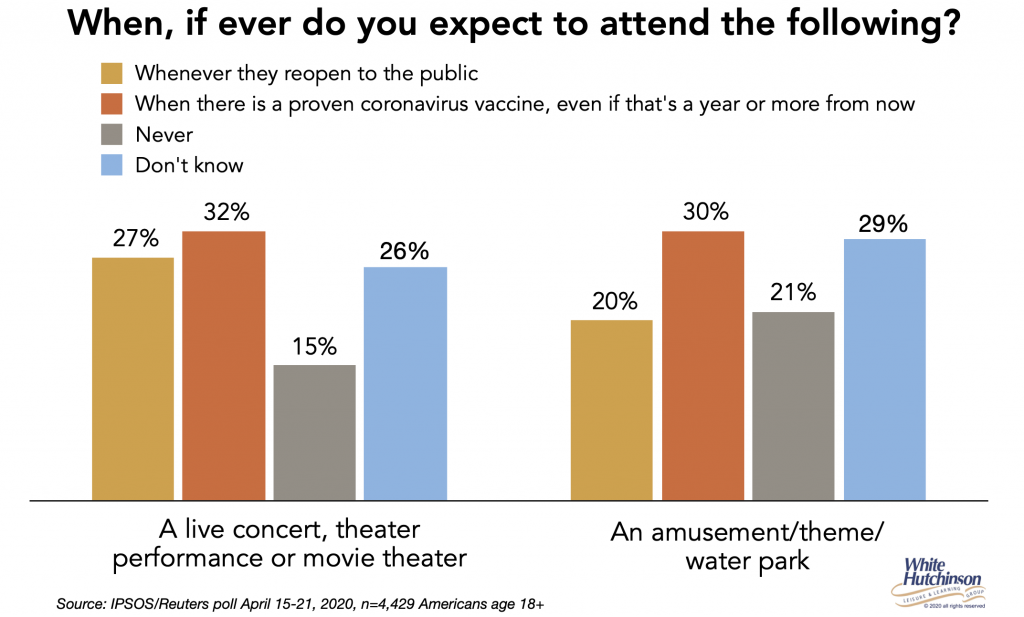

An Ipsos/Reuters poll found that almost one-third who go to arts and entertainment venues, including amusement/theme parks, answered they are willing to wait for a vaccine, even if it takes more than a year. If you exclude those that answered, “don’t know,” the share who will wait for a vaccine is more like four in 10.

Another poll by Engagious found that about one-third aren’t willing to return to LBEs until there is a vaccine or a medical protocol for Covid-19.

A major reason why many people are hesitant to visit LBEs and restaurants is their fear of catching Covid-19, especially since other people won’t act responsibly in public places. A PGAV Destinations survey found that the top two things that were making people nervous about visiting attractions was “too crowded to maintain social distancing” (67%) and “other guests not social distancing” (57%). A Vital Vio poll found that 58% of U.S. adults are suspicious about their friends’ and family’s hygiene habits. Datassential’s research found that nearly three-quarters of people (72%) don’t trust others to act responsibility, including in bars and restaurants.

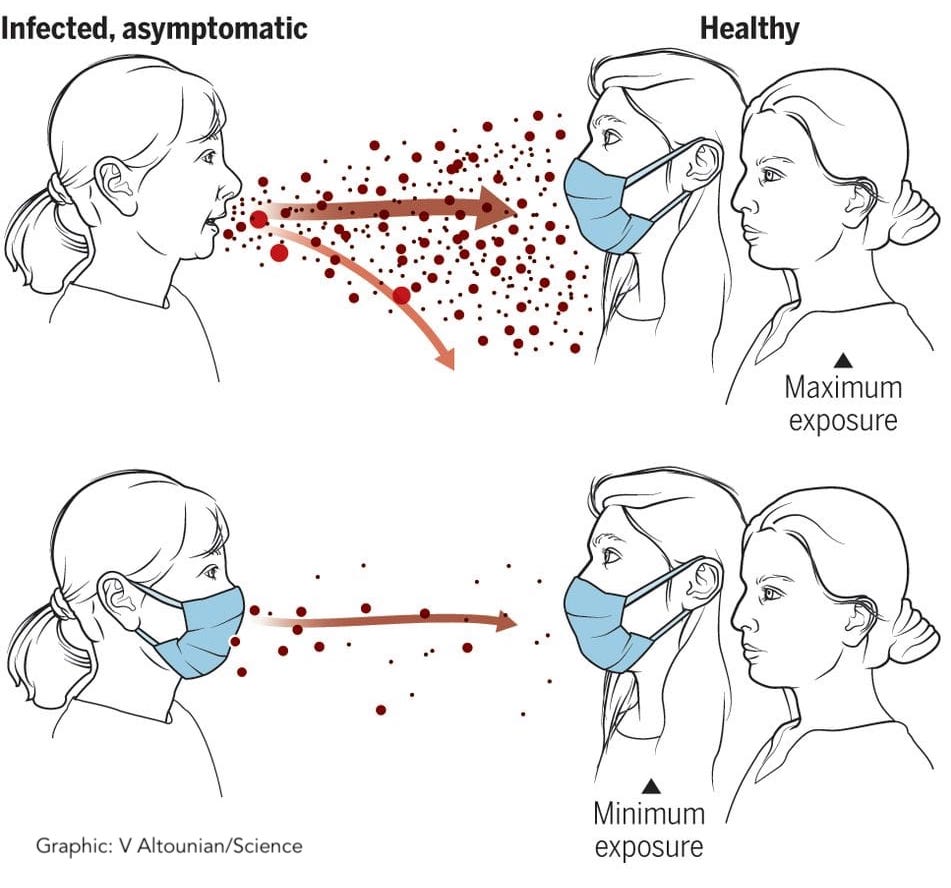

Scientists are telling us they believe the major means of Covid-19 transmission is from airborne respiratory droplets and micro-droplets transmitted by the breathing, talking, sneezing and loud conversations from coronavirus “silent spreaders,” the asymptomatic carriers of the virus, either pre-symptomatic in the first few days of catching the virus or asymptomatic for the entire duration of their infection.

The U.S. Centers for Disease Control and Prevention estimate there’s a 20%-to-50% chance that those infected with the coronavirus do not show symptoms. Both social distancing and mask wearing (by the asymptomatic carrier) greatly reduce the chance of transmitting Covid-19.

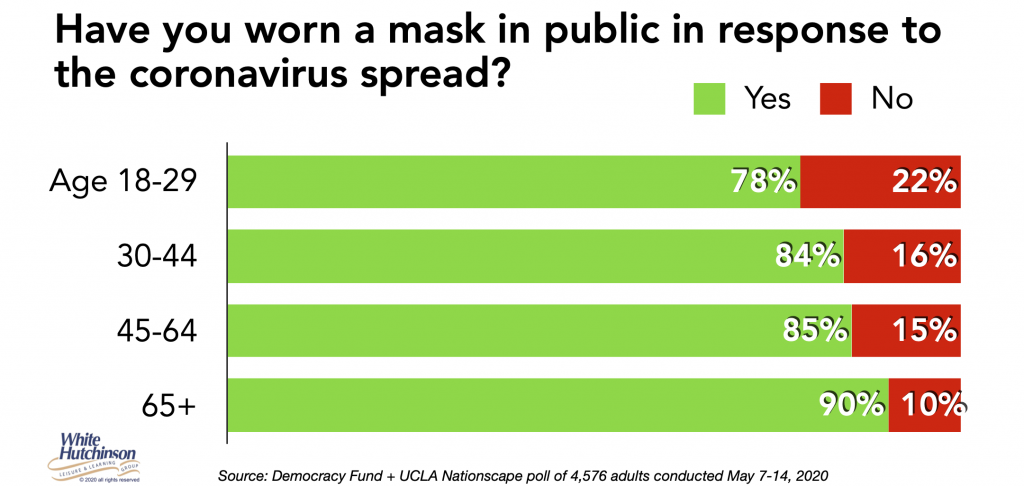

Polls are showing that peoples’ fears of other people not acting responsibly in public places is well founded. A May 7-14 poll found that one-sixth of Americans report not wearing masks in public.

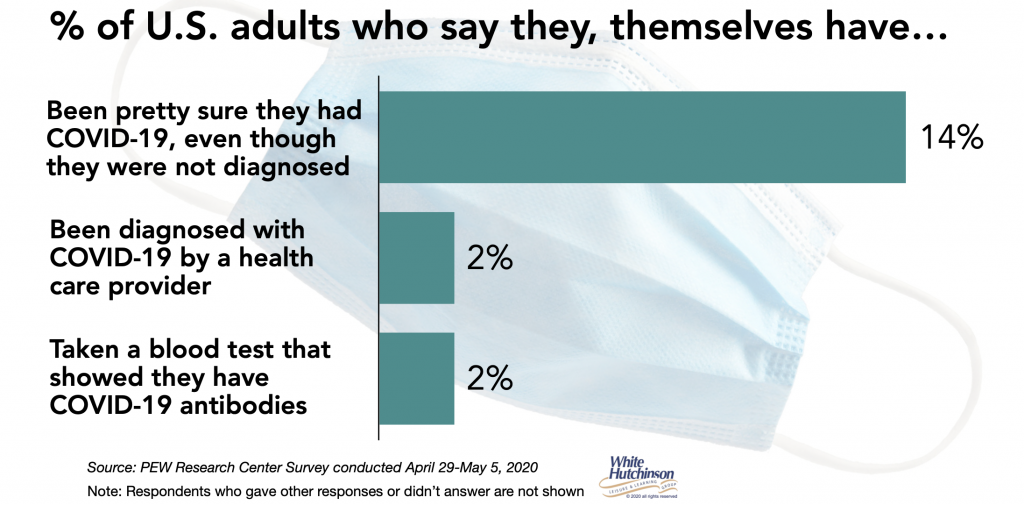

The irresponsible behavior by a minority of Americans may be due to two factors. First, people might not understand that the main reason to wear a mask is to protect others, not themselves. Second, surveys show that nearly one-fifth of Americans believe they have definitely or probably already had Covid-19, so they believe they are not carriers, are immune and therefore don’t need to wear a mask or social distance. Yet only a small single-digit percentage of them were actually tested for the virus.

Then, of course, we also have some people refusing to wear masks as a political statement (more about why people are flouting social distancing and masks).

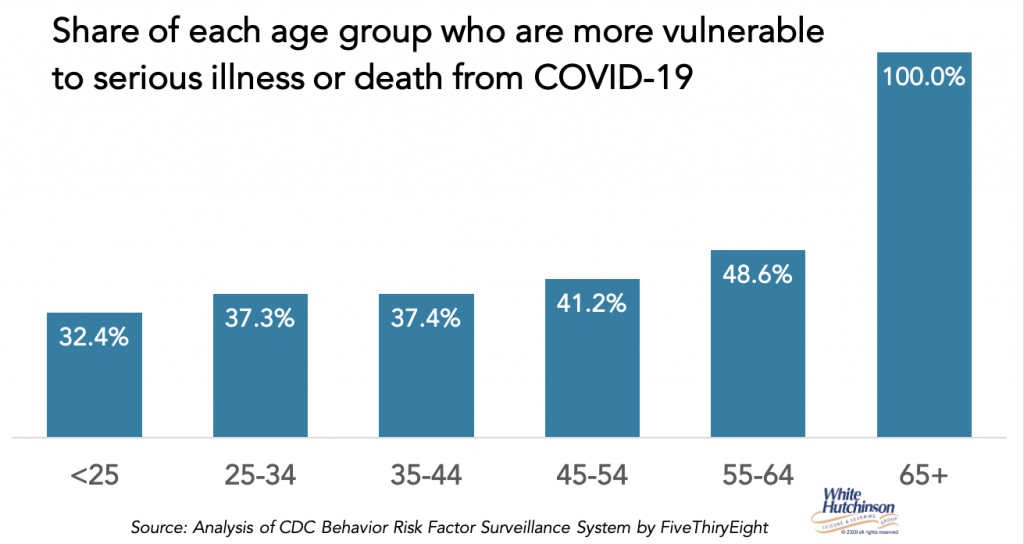

People’s fears of public places make a lot of sense when we look at the share of the population who are at high risk of becoming seriously ill or dying from Covid-19. The CDC says that anyone over age 65 or with underlying medical conditions including chronic lung disease, moderate or severe asthma, serious heart conditions, immunocompromised, severely obese, chronic kidney disease undergoing dialysis or liver disease are at high risk. Surprisingly, the at-risk population is very large. In addition to everyone over age 65, nearly 40% of all Americans under 65 have a condition that makes catching coronavirus very dangerous for them. For the prime target market for many FECs and LBEs, the 25-44 age group, over one-third are at risk (37%).

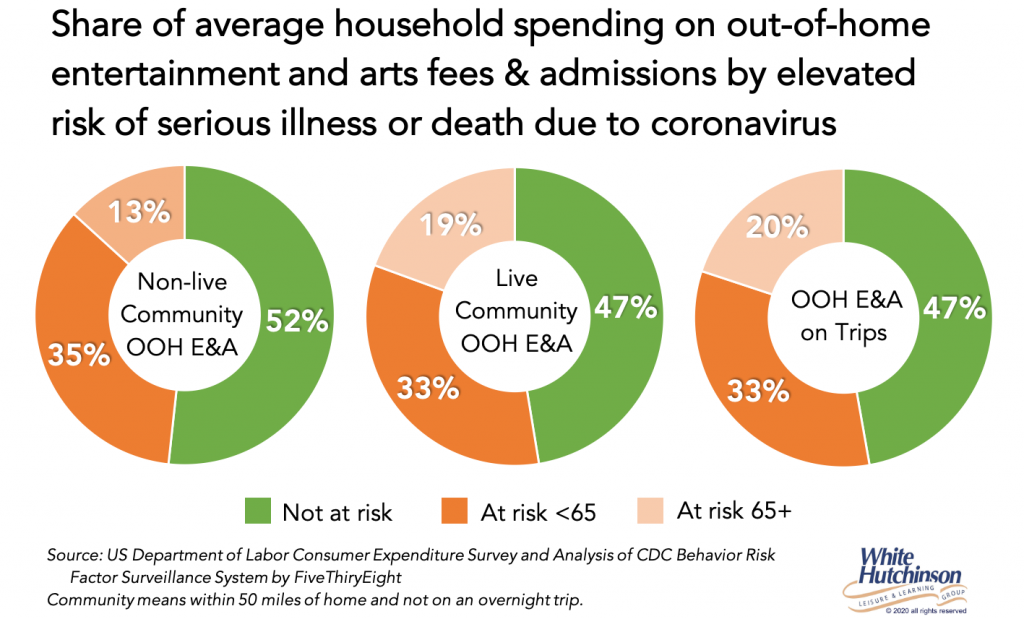

I analyzed what percent of out-of-home fees and admissions for entertainment and arts the at-risk population represents using 2018 household consumer expenditure data and based on the age of the head of the household.**

The non-live community out-of-home entertainment and arts in the first pie graph includes FECs,, eatertainment centers, regional amusement parks, arcades and other LBEs that don’t predominately offer live entertainment and are attended within 50 miles of a person’s home when they are not on an overnight trip. Over one-third of all that spending for fees and admissions (35%) is from households with a householder under age 65 which are at high risk. The percentages for spending at live entertainment venues and for entertainment and arts on trips by people under age 65 who are at high risk is just slightly less, exactly one-third

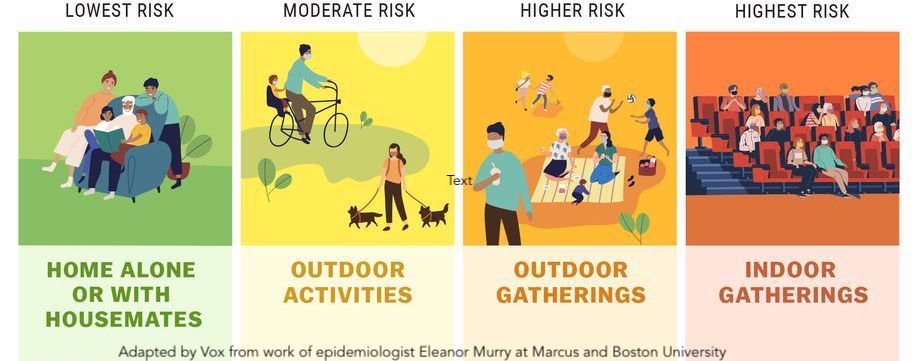

So, while the coronavirus is still in circulation, most of the high risk population will avoid public places, especially ones indoors and with large crowds, such as most FECs and LBEs, as gatherings of groups indoors is considered as the highest risk.

Even if half the entire high-risk population, including those over 65, decided to visit LBEs at pre-Covid frequencies, we would only be at three-quarters of previous attendance and revenues and probably below the cash breakeven revenues for most LBEs. And this assumes the not at-risk population is also attending at their pre-Covid rates.

As the U.S. reopens and some people are heading back to work at offices and factories, many companies are urging workers to be cautious in their off hours and avoid activities that put them at risk of catching coronavirus. Many companies are concerned that safeguards they’ve put in place at work to limit the spread of the virus could be undone if workers take risks when they are off work. This is likely to have a chilling effect on workers out-of-home behaviors, including visiting LBEs.

Surveys are showing that the coronavirus has created a permanent heightened fear of catching a disease in public places, not just from Covid-19, but even when the pandemic is over. Datassential found that 10% of adults said it’ll never be as safe as before to dine in a restaurant.

We basically have four different archetypes of people when it comes to once again attending different type LBEs:

- Ready to return immediately after they open. Generally, this is around 20% to 25% of adults.

- Hesitant and will require improved news about the spread of coronavirus and assurances about the safety of visiting particular venues. Generally, this is about one-third of adults.

- Cautious and fearful – This group will wait until there is a vaccine or proven medical protocol to mitigate and remedy the effects of the virus – generally around one-third of adults, with a high proportion of those at high risk.

- Never return – permanently fearful of their health and safety in public places – a single digit percentage

The percentages in the first two categories vary based on the type of LBE and the risk they present.

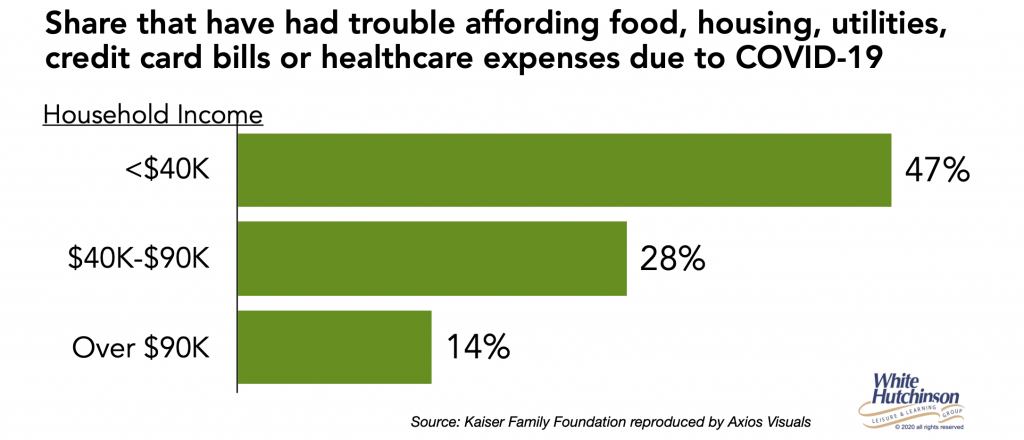

As if the coronavirus by itself isn’t disruptive enough, we’re going to get a double whammy from its economic impact. Another major influence on when people will return to different LBEs and how frequently they will visit is how severe the pandemic recession will become, how long it will last and how severe will its impact be on consumers’ discretionary out-of-home leisure and entertainment spending. The recession’s impact will probably last way past when there is a vaccine and/or the pandemic is over.

More than one in five U.S. workers are currently unemployed and still others have reduced pay or earnings. A Harris May 29-31 poll found that 11% of adults say they have lost their income entirely, 31% say they have lost their income partially and a total of 60% say they have been financially impacted in some way. 24% of adults say they have accumulated more debt than normal during the pandemic. An Engine Caravan May 29-31 survey found that one-third of adults are very concerned about their personal finances due to the coronavirus. The Congressional Budget Office says it will take ten years for the economy to fully recover from the coronavirus pandemic. Citi analyst Sam Teeger doesn’t see the FEC chain Main Event recovering to its pre-pandemic revenues until 2024.

The recession is sure to further erode the potential market size and demand for LBE experiences and will delay how long it will take those LBEs that survive to become profitable again.

There is both good news and bad news for how attendance and revenues at LBEs will likely unfold. The bad news is that a substantial number of LBEs will not reopen or will become insolvent and close after they do reopen. And for a considerable time, there won’t be any large public, one-time special events such as music concerts and food, beer and wine festivals that pre-Covid were taking market share from LBEs due to their conspicuous leisure appeal.

So, the good news is that the reduced competition will improve the operating environment for those LBEs that survive in the reduced market size environment. For those LBEs, once capacity restrictions are lifted and there is a vaccine, and if they can innovate their business model to increase their Fidelity (see my previous blog), they may eventually get back to 2019 levels of revenues. Unfortunately, considering the heightened fear of public places the pandemic has brought on that is sure to linger even after there is a vaccine, a recession that is sure to stretch out for years, and the virtual at-home entertainment and socialization habits and routines people developed during the lockdown and self-quarantine, their new normals, it will probably take many years for most of the surviving LBEs to fully recover.

Notes:

* S&P Global Market Intelligence says Dave & Buster’s has a 53.5% chance of defaulting on their debt. If they do they might file for Chapter XI. That doesn’t mean the chain will close. It more likely means the worse performing stores will be closed, stock owners will lose some or all of their equity and debt holders will take a haircut.

** In reality, the percent of households with a member at risk, thus affecting the behavior of all household members as they won’t want to bring the virus to the at-risk member, is higher than the at-risk percentages for individuals in the chart. For example, the head of household may be younger than age 65 and not at risk, but there could be a household member who is 65 or older.