Vol. XXVI, No. 2, February 2026

FEC & LBE site selection: a combination of both art and science

Selecting the right site for a location-based entertainment business (LBE) is critical to its success. It doesn't matter whether it's a family entertainment center (FEC), social gaming venue, bowling center, children's entertainment or edutainment center, or another type of location-based leisure facility; a poor site lasts forever. A poor site will permanently handicap a project's revenues and profits, or worse, result in its failure. Sometimes moving a project as little as one-half mile can have a dramatic impact on its revenues and success. The old adage "location, location, location" is just as true for LBEs as it is for stores, restaurants, and other types of consumer businesses.

Considerations

There are many important considerations when selecting a site for an LBE. Some are:

- Accessibility

- Visibility

- Patterns of travel

- Traffic counts

- Traffic congestion

- Physical trade area barriers

- Psychological trade area barriers

- Relationship to the nodes of retail, restaurants, and entertainment

- Character of the surrounding properties/tenants

- Site orientation

- Competition

- Demographic and socioeconomic/lifestyle characteristics of the primary and secondary trade areas

- Zoning

- Size and shape

- Topography

- Storm water management

- Availability of adequate utilities

- Environmental factors

All these characteristics have an impact on whether a land parcel or retail store space is acceptable for the type of entertainment project being considered, including how large the trade area will be for the project, the market penetration rate, attendance, per capita sales, and, as a result, how much revenue and profit the project will produce. Gathering information and data is important, but just as important is understanding how to interpret it in relation to the project's mix, size, target market, revenues, and profitability.

Defining the trade areas

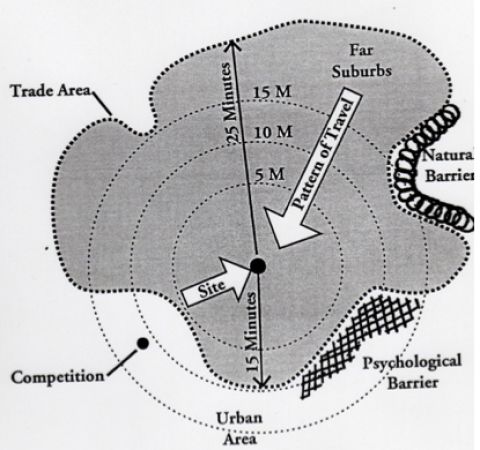

One frequent mistake in market analysis is defining trade areas by distance rings or concentric circles, such as 5 miles and 10 miles. Consumer behavior isn't based on "rule-of-thumb" mileage distances. Instead, consumers decide which location-based businesses they will visit based on the exact location, the quality of competition, drive times, their normal travel patterns, traffic congestion, ease of parking, physical and psychological barriers, and many other factors. For example, rivers, even those with bridges, create the perception of greater distance, act as a psychological barrier, and divide markets. And if there are no convenient bridges, rivers are physical barriers. A site in the normal direction of travel to work and shopping will be perceived as much closer, more convenient, and more top of mind than one that is not.

True trade areas tend to be amoeba-shaped and often extend much farther in one direction than the other. In some markets, the primary trade area might extend 10 minutes in one direction and 25 minutes in another. In densely developed areas, a 10-minute drive might cover only 2 miles, whereas in less densely developed areas with few traffic lights and good road access, 10 minutes might cover 8 miles or more. Our company has studied trade areas for many existing FECs and LBEs. For some, the market area only extended 10 minutes. In comparison, we have seen similar entertainment centers in other markets with a market reach of 1.5 hours in one direction and only 15 minutes in another. Defining trade areas is both a science and an art that requires years of experience and know-how. All factors have to be evaluated and weighed by someone experienced in site selection and market feasibility. If the trade areas are not accurately defined, all subsequent analyses and decisions will be flawed.

Market penetration

It is important to consider market penetration when examining a trade area. The greater the drivetime that consumers live from a project, the lower the market penetration - the percentage of residents the project will capture, and the frequency of their visits. So, it is important to understand where the target customers' residences (and sometimes workplaces and hotels) are located within the trade area. Are they close to the site or further away? If the bulk of residents are located near the perimeter of the primary trade area rather than near the project's location, overall market penetration and attendance from the primary trade area will be lower.

Socioeconomic-lifestyle analysis

Using socioeconomic-lifestyle (SEL) cluster analysis of a market is a much more reliable and useful tool for guest segmentation analysis than demographics. Demographic data generally only aggregates households and families and does not provide as detailed an analysis to identify a very specific target market as SEL analysis does. SEL analysis also addresses resident behaviors and values, which are more useful predictors of consumer behavior than demographics alone.

Site cost

Another important consideration in site selection is cost, whether it's the purchase price or the rent. The conventional wisdom is that the lower the cost or rent, the more profitable the project will be. That wisdom is correct, but only if all other characteristics of different sites are identical, including the revenues they will produce. However, that is rarely the case. What matters is not the absolute cost, but the relationship between cost or rent and the volume of business.

Often, the more expensive site will yield the more profitable project, as the project will do more business and/or its development costs will be lower. Let's take a look at one example that illustrates these points. We'll use an example from our work with one client.

A client retained us to evaluate four potential sites for an entertainment project in a suburban area of a major Midwest metropolitan market. The sites ranged in price from $5 per square foot to $11 per square foot. We had determined that the project would require approximately 4 acres, so we were looking at sites ranging in cost from $871,000 to $1,917,000, or a difference of $1,045,000. That's a big difference. Three sites were within several miles of each other in one town, and the fourth, the lowest-priced, was about 6 miles away in another town.

The first thing we did was evaluate the potential market draw of the sites using a combination of drivetime modeling and household-income mapping to define probable trade areas, along with our knowledge of how trade areas are defined by consumer behavior. The lowest-priced site, the one farthest away from the other three, had a trade area about 25% lower in population than the three in the other town. Furthermore, its location indicated that it would have a low market penetration among most residents in its trade area. Translation: the cheapest site would end up being the most expensive in terms of its carrying cost as a percentage of revenue, i.e., it would have the lowest return on investment.

This household dot density map shows where residences are located in the drivetime market area.

The three sites in the other town were all well located, at least in terms of proximity to interstate interchanges and other retail. The lowest-priced of the three was eliminated because it was hidden from traffic on major roads. The problem with it was 'out of sight, out of mind', meaning it would have a low awareness factor. Its other problems were poor access and being surrounded by businesses with mediocre images.

That left two sites. The less expensive of the two was near major retailers, whereas the most expensive was very near the regional enclosed mall and across the street from a well-known convention center. Location-wise, the more expensive site would do the most business. The more expensive site also had one more thing going for it. It was in an office/retail development where all infrastructure improvements, including utilities and stormwater management, were completed. The other site would have required infrastructure improvements, which would have added to its ultimate cost. So, in the end, the most expensive site won out.

We then conducted a formal market study to evaluate the market in greater depth. This included a socioeconomic-lifestyle (SEL) analysis of the targeted customers for the project. Our more detailed market study data confirmed our preliminary evaluation, and the client optioned the site.

You may still be wondering. How can the site that costs over one million more dollars be the better site? The answer is multifold. First, the project's return on investment will be higher. It will cost the same to construct the building and purchase all the furniture, fixtures, and equipment as the other three sites. At the same time, there were site development savings as some of the infrastructure was already in place. In the end, the difference in land costs amounted to only 5% increase in overall project cost. However, in our market and attendance evaluations, that location will produce revenues at least 20% greater. If you work the numbers, you quickly see how the return on investment will be much greater at that site as the cash flow is far greater than at the less expensive sites, more than offsetting the increased land cost. Also, the probability of success is greater. It never makes sense to start a new business with any avoidable handicaps. That is exactly what a less-than-ideal site brings to a project.

When it comes to leasing a building or store space, the same is true. That is why retailers rent stores in major shopping centers at $30 or more per square foot, versus a strip shopping center that might cost only $18 per square foot. What is important is the relationship of rent to sales, not the absolute rent amount.

Selecting a feasible site for a location-based entertainment project requires extensive analysis, a combination of art and science. The site is forever, so proper due diligence at this early stage in a project's development can easily determine success or failure.

Subscribe to monthly Leisure eNewsletter