Vol. XXV, No. 11, October 2025

- Editor's corner

- Young adults' time at entertainment and art venues is on the decline

- The rise of experience-driven businesses for new millennial families

- Who chooses alcohol as their "go-to drink" when dining out?

- Is Dave & Buster's "the canary in the coal mine" for older model LBEs?

- The emerging "living room family" trend

- Creating repeat attendance

- Offering elevated, more expensive menu items

Is Dave & Buster's "the canary in the coal mine" for older model LBEs?

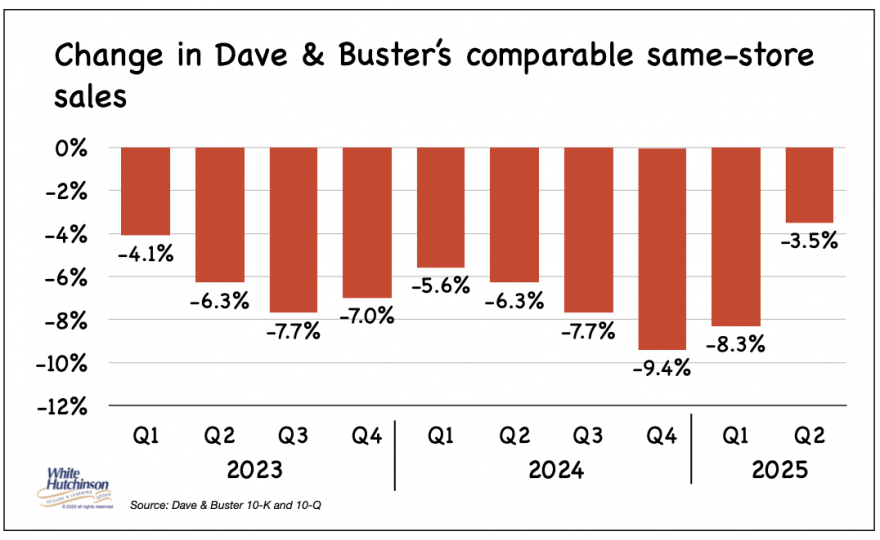

Dave & Buster's reported that their 2025 2nd quarter (Q2) comparable same-store sales declined by 3.5% compared to Q2 one year ago. Their comparable same-store sales have declined continually for the past 10 consecutive quarters since Q1 2023.

Compared to prepandemic Q2 2019, D&B's Q2 2025 comparable same-store sales have declined by 6.7%. However, financial results don't tell the whole truth during periods of high inflation. The U.S. Bureau of Labor Statistics reports that inflation between June 2019 (midpoint Q2 2019) and June 2025 (midpoint D&B's Q2 2025) was 25.9% (restaurant inflation was higher at 34.6%, which accounts for slightly over one-third of D&B's revenues). So just to stay even, D&B's comparable same-store sales should at a minimum be 25.9% higher compared to Q2 2019, not lower. If we factor in the impact of 25.9% inflation, same-store sales are now over one-third lower, down 35.6%, compared to 2019.

The picture isn't any rosier for D&B's revenues and net income. Yes, revenues have grown from $334.6 M in Q2 2019 to $557.4 M in Q2 2025. But that's due to an increase in the number of stores from 125 to 217. However, average store revenue has declined from $2.756 M to $ 2.592 M. That doesn't factor in that per-store revenues should have increased at least 25.9% to $3,461M to keep up with inflation.

Income per store shows a more serious decline, from $259K per store in Q2 2019 to $65.6K in Q2 2025.

Dave & Buster's management attributes their continuing same-store sales decline to a series of missteps and "significant and ill-advised changes" made by previous leadership that created systematic problems across nearly every aspect of their business operations:

- Marketing: Eliminated 90% of TV advertising, created overlapping/conflicting promotions that confused customers, and failed to communicate value effectively.

- Operations: Overwhelmed staff with too many simultaneous changes, reduced training, poor communication with store teams, and inadequate execution planning.

- Menu/Pricing: Eliminated popular entrées, over-promoted low-ticket shareables, and created confusing pricing architecture.

- Games: Failed to invest in new games for over two years, resulting in outdated and unengaging entertainment options.

- Capital: Poorly executed store remodels without proper testing, overspending on unsuccessful prototypes.

These execution errors may be minor factors in Dave & Buster's significantly declining same-store sales. We believe there's a more fundamental root cause - the D&B business model, which is based on having a large game room as the anchor attraction that predominantly offers a solo experience, not a communal social one, is out-of-date and obsolete.

D&B is losing customers to an evolving competitive landscape with many more options that favor smaller, more specialized eatertainment experiences that target young adults, those aged 21-45, the same D&B core customer base that accounts for 65% of its customers. These new concepts include adult-focused social gaming venues with trend-forward, foodie-worthy, globally-inspired food and curated beverages that better serve young adult preferences. While D&B's management can improve execution, they're essentially trying to optimize a fundamentally flawed business model for today's out-of-home entertainment market.

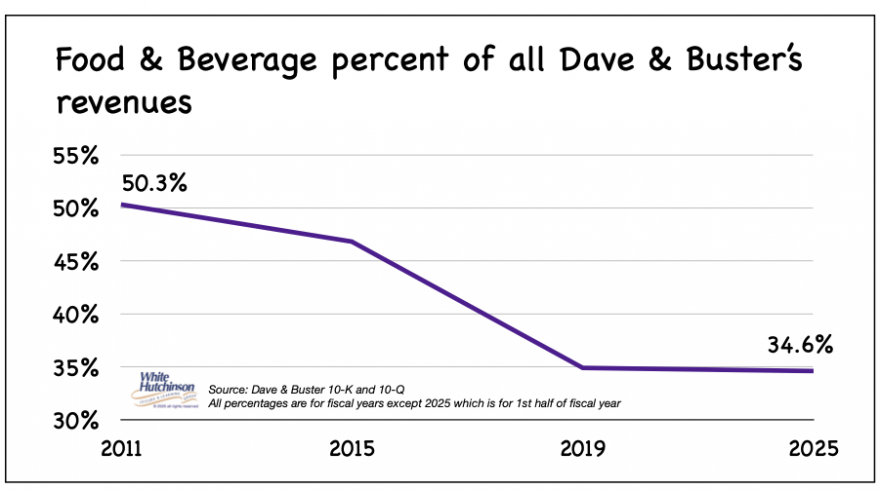

D&B's food and beverage sales show the most significant weakness. In Q2 2025, it was down to 34.6% from 50.3% of revenues in 2011. This suggests they are significantly behind the curve in appealing to young adults' food preferences. In early 2024, D&B's CEO, Chris Morris, said, "Over the last decade, the food and beverage mix has steadily declined. It's decelerated more than any other part of the business. There was a time when Dave & Buster's generated more food and beverage revenue than entertainment [2011]." He said that D&B isn't perceived as a dining destination. He noted consumers are dining out in droves, but they're doing so elsewhere, either before or after a visit to Dave & Buster's.

D&B continues to try to improve its revenues from F&B while still offering a separate destination restaurant space. This has become an outdated LBE formula. People no longer perceive a separate dining room space within an entertainment center as a dining destination. The only way it can work under some circumstances is for the restaurant to have a separate brand identity and be individually marketed like a standalone restaurant or to be thought of as primarily a restaurant with some entertainment.

Today, adults are looking for a communal and social entertainment experience that features food, often including shareables and beverages, enjoyed simultaneously with participatory social games, not as two separate experiences.

Dave & Buster's "Store of the Future" remodel in Friendswood, Texas, confirms this root cause. It saw an initial 30% increase compared to 2019 by incorporating "Interactive Social Bays" with private, reservable spaces for social gaming while enjoying food and beverage. This success validates that their traditional model is the problem.

Dave & Buster's decline could very well be "a canary in the coal mine" warning for many older model location-based entertainment and family entertainment centers (FECs).

This issue's article, "Creating repeat appeal", discusses other factors that are contributing to Dave & Buster's decline. Additionally, this issue's article "Changes in young adults' time spent at entertainment and art venues" discusses how young adults are spending less time away from home at entertainment and art venues, making competition for their leisure time even greater among the growing number of options.

Subscribe to monthly Leisure eNewsletter

Vol. XXV, No. 11, October 2025

- Editor's corner

- Young adults' time at entertainment and art venues is on the decline

- The rise of experience-driven businesses for new millennial families

- Who chooses alcohol as their "go-to drink" when dining out?

- Is Dave & Buster's "the canary in the coal mine" for older model LBEs?

- The emerging "living room family" trend

- Creating repeat attendance

- Offering elevated, more expensive menu items