Vol. XXV, No. 11, October 2025

- Editor's corner

- Young adults' time at entertainment and art venues is on the decline

- The rise of experience-driven businesses for new millennial families

- Who chooses alcohol as their "go-to drink" when dining out?

- Is Dave & Buster's "the canary in the coal mine" for older model LBEs?

- The emerging "living room family" trend

- Creating repeat attendance

- Offering elevated, more expensive menu items

Young adults' time at entertainment and art venues is on the decline

The American Time Use Survey (ATUS) tracks how much time the average American spends at entertainment and art destinations. In 2024, ATUS interviewed approximately 7,700 individuals. The ATUS definition of arts and entertainment is extensive. It includes performing arts, museums, movies, gambling establishments, festivals, shows, fairs, amusement parks, LBEs, historic sites, poetry readings, auto shows, carnivals, circuses, parades, sightseeing, and book signings. It essentially encompasses most out-of-home entertainment and art options available to people, excluding sports and social events.

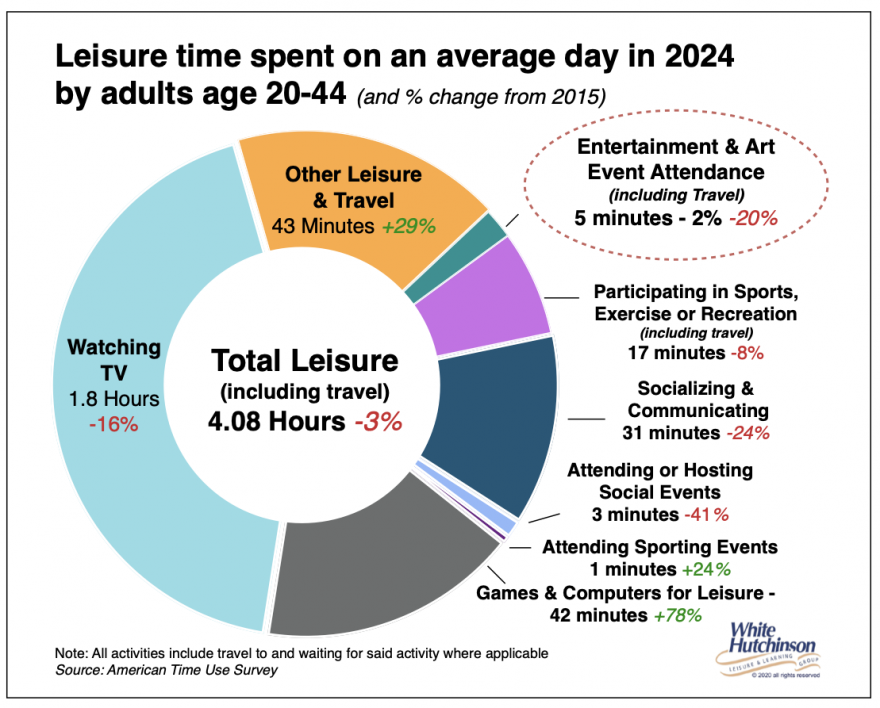

Young adults are a prime target market for most location-based entertainment venues. Here's how the 20-44 age group* now spends their leisure time and how it has changed from 10 years ago in 2015.

Young adults' total available leisure time has hardly changed since 2015, just 8 minutes less per day, but how they spend it has changed. They spend 42 minutes, 78% more a day, using games and digital devices for leisure, and +24% more time attending sporting events. They're spending less time at social events (-41%), socializing (-24%), watching TV (-16%), participating in sports, exercise, or recreation (-8%), and attending entertainment and art venues (-20%).

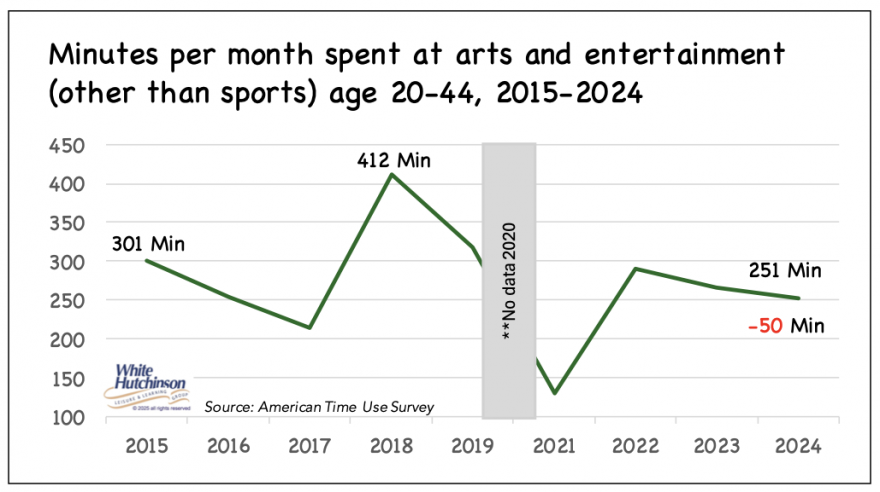

The amount of time young adults ages 20-44 spent away from home on entertainment and art venues (E&A) since 2015 is significantly lower. In 2024, the time spent was almost one hour less per month than 10 years ago (-50 minutes), down from six hours a month to slightly over five hours per month. It has dropped by almost 3 hours since reaching its peak participation in 2018.

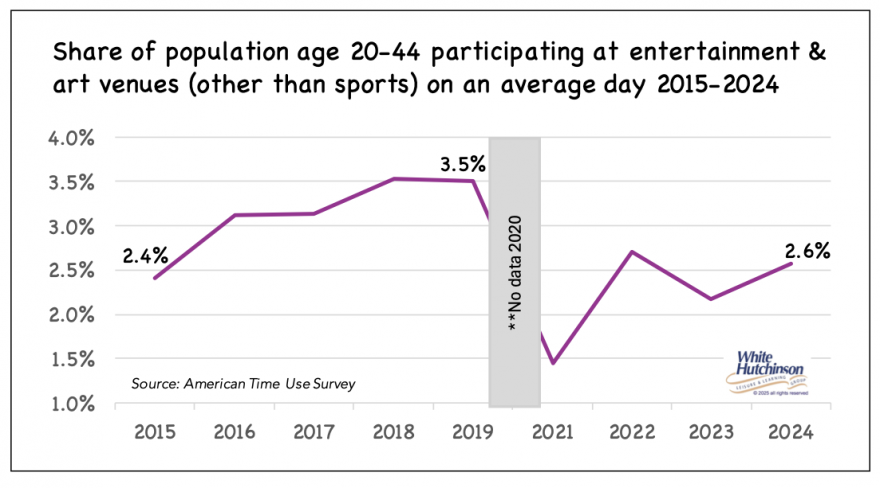

What's interesting is that young adults' average daily participation rate at E&A has increased from 2.4% on average in 2015 to 2.6% in 2024. However, there has been a significant decline from the peak participation of 3.5% in 2019, right before the pandemic.

There is now a lot of competition for young adults' out-of-home entertainment and art activities, and their time attending them is now significantly less. That makes the out-of-home entertainment and arts market even more competitive than it was just over five years ago. This means that to capture some of the younger adults' limited E&A time, entertainment venues need to be not only highly appealing, but far more repeatable than they were just five years ago. Mediocre no longer works.

In our previous enewsletters (here & here), we discussed the decline in the repeat appeal of location-based entertainment venues (LBEs) due to experience novelty seeking and the endless choice of out-of-home leisure and entertainment options. People are increasingly drawn to new experiences, prioritizing exploration and discovery over revisiting familiar destinations…'Been there, done' that has grown as an aversion to repeat visits. Young adults are more likely to build a diverse portfolio of unique and new experiences than visit old ones. Gen Z and Millennials are especially prone to novelty seeking.

The decrease in time spent at entertainment and arts events is part of the overall trend of people spending less time away from home than they did before the pandemic. On average, people spent just over almost one-hour less time per day away from home in 2024 than in both 2019 and 2015 (-54 minutes and -53 minutes respectively).

Some of the decrease in time spent attending entertainment and arts events is also attributed to an increase in time spent attending live sporting events.

We've seen a significant decrease in the amount of time young adults spend away from home and a shift in where they spend that time. These appear to be new long-term trends since the pandemic.

Also see this month's article on creating repeat appeal.

* The ATUS data is organized such that we had to use age 20 as the starting point rather than ages 18 or 21.

Subscribe to monthly Leisure eNewsletter

Vol. XXV, No. 11, October 2025

- Editor's corner

- Young adults' time at entertainment and art venues is on the decline

- The rise of experience-driven businesses for new millennial families

- Who chooses alcohol as their "go-to drink" when dining out?

- Is Dave & Buster's "the canary in the coal mine" for older model LBEs?

- The emerging "living room family" trend

- Creating repeat attendance

- Offering elevated, more expensive menu items