Vol. XXV, No. 6, June 2025

- Editor's corner

- A significant long-term shift in location-based venue spending imperils static attraction LBEs

- More flavor! Bold choices with big impacts

- Drive Shack's entertainment revenues decline

- The entrepreneurial trap of human biases

- Dirty Soda makes a splash at the National Restaurant Association Show

- Let's talk THC

Drive Shack's entertainment revenues decline

Drive Shack Inc., a public company (DSHK), is a leading owner and operator of golf-related leisure and entertainment businesses in the United States. They are the largest operators of traditional golf courses and country clubs in the U.S., managing 42 traditional golf properties (their Traditional Golf segment). Their Entertainment Golf segment operates four Drive Shack locations featuring tech-enabled golf hitting bays, similar to the Topgolf concept, and ten Puttery indoor minigolf venues ranging in size from 15,000 to 20,000 SF.

Puttery

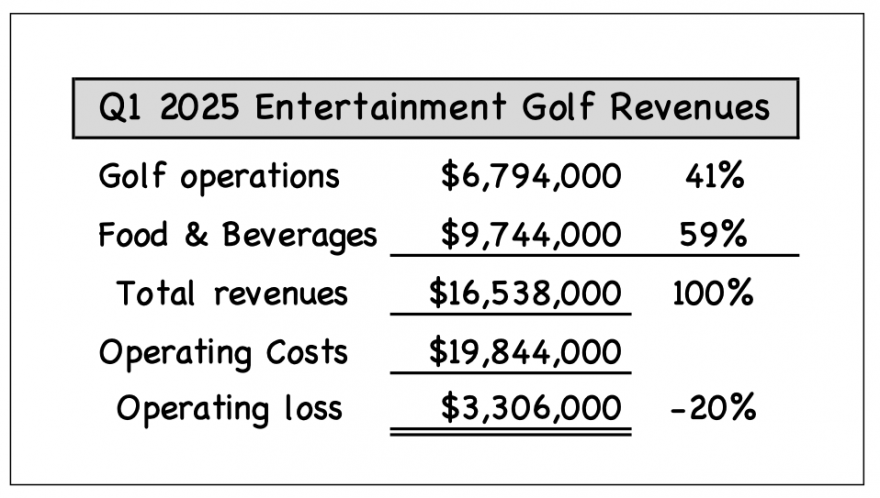

In this year's first quarter (Q1 2025), their Entertainment Golf revenues declined by $4.5 million compared to Q1 2024. The decline in Entertainment Golf revenues was mainly driven by a 40% decline in revenues at the Drive Shack Raleigh and West Palm Beach locations due to recent competition from Topgolf and PopStroke, respectively, near those locations. Excluding these two locations, same-store Entertainment Golf operations revenues declined by 18%, attributable to what Drive Shack says is soft consumer demand and lower corporate event spending. The Entertainment Golf loss was 20% of revenues.

Their Q1 2025 Entertainment Golf operating loss of $3,306,000 is more than double their Q1 2024 $1,594,000 operating loss. EBIDTA for Entertainment Golf declined from $4,441,000 in Q1 2024 to $911,000 in Q1 2025. Their Q1 2025 F&B COGS was 24.7%, up from 21.8% in Q1 2024.

Commentary

Drive Shack describes both Drive Shack and Puttery as competitive social entertainment, what many in the location-based entertainment industry mistakenly call 'competitive socializing.' As we've previously written, socializing and competition don't go together. If the game is competitive, it destroys the socialization; people are focused on the play and score, not socializing with others in the group. The correct name for the new LBE formula is 'social gaming,' as enjoying quality food and beverages while playing the game is essential to creating the highly interactive social experience that is the appeal of social gaming venues. (find a full explanation of social gaming here.)

Drive Shack qualifies as social gaming. Puttery does not. Puttery has the right player rhythm, with one player briefly playing while the other players watch and socialize, but it lacks simultaneous drink and food. Puttery lacks the high appeal of the social experience social gaming offers with simultaneous food and beverages, especially shareable food.

Yes, some of Puttery's declining sales may be due to soft consumer demand, as the company says. However, we believe the root cause is a lack of repeatability - been there, done that - because the putting course doesn't change and the venue lacks the high social appeal that social gaming venues do. The problem with indoor putting venues like Puttery and Puttshack is they've tried to take the appeal of outdoor miniature golf, infuse it with technology, and bring it indoors, where much of mini golf's appeal is due to being outdoors,.

Drive Shack and Puttery's revenue declines are also attributable to the general location-based entertainment venues' (LBEs) decline in repeat appeal due to experience novelty-seeking consumers and the endless choice consumers have for out-of-home leisure and entertainment experiences. Research has found that the adults age 18-54 are more likely to build a diverse portfolio of unique and new experiences over visiting old ones. Along with Drive Shack's decline, Topgolf experienced an 8% attendance decline in Q1 2025, with same-venue sales declining by 12%.

Even if there is some soft consumer demand, consumers may seek new LBE and other experiences when they decide to go out, as they want to get the most bang for their buck and leisure time. New experiences can be more appealing than old ones.

Subscribe to monthly Leisure eNewsletter

Vol. XXV, No. 6, June 2025

- Editor's corner

- A significant long-term shift in location-based venue spending imperils static attraction LBEs

- More flavor! Bold choices with big impacts

- Drive Shack's entertainment revenues decline

- The entrepreneurial trap of human biases

- Dirty Soda makes a splash at the National Restaurant Association Show

- Let's talk THC