Vol. XXV, No. 6, June 2025

- Editor's corner

- A significant long-term shift in location-based venue spending imperils static attraction LBEs

- More flavor! Bold choices with big impacts

- Drive Shack's entertainment revenues decline

- The entrepreneurial trap of human biases

- Dirty Soda makes a splash at the National Restaurant Association Show

- Let's talk THC

A significant long-term shift in location-based venue spending imperils static attraction LBEs

In our December 2024 issue, we identified the trend where spending on admissions and time attending live performing arts - concerts and theater - and live sports events in the local community* were up significantly post-pandemic compared to money and time spent at parks, museums, and movies, including location-based entertainment (LBEs) and family entertainment centers (FEC), which were flat. We've dug into pre-pandemic data from 2014 to see if these are long-term trends that the pandemic accelerated.

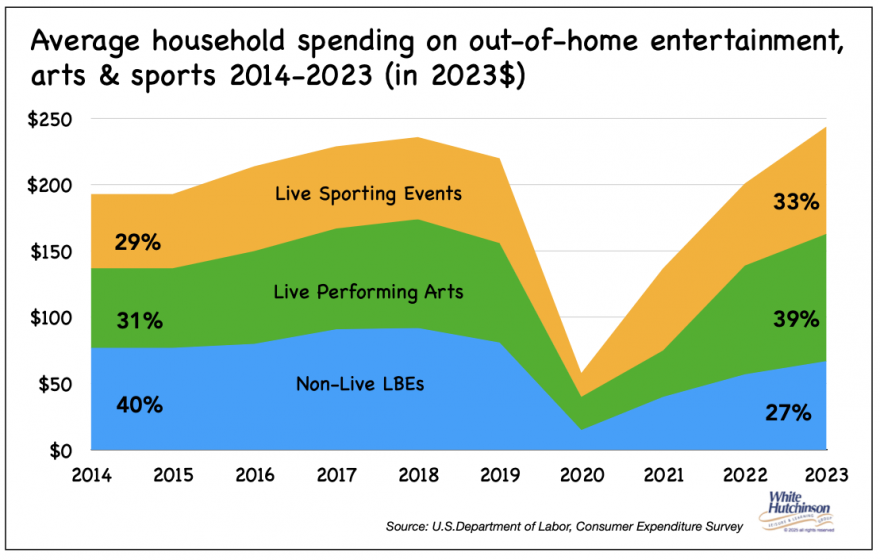

The good news is that inflation-adjusted average household spending on admissions to live performing arts, live sports, parks, museums, and movies has been increasing since 2014, not just since the pandemic. It grew from $193 per household annually to $244 in 2023 (inflation-adjusted).

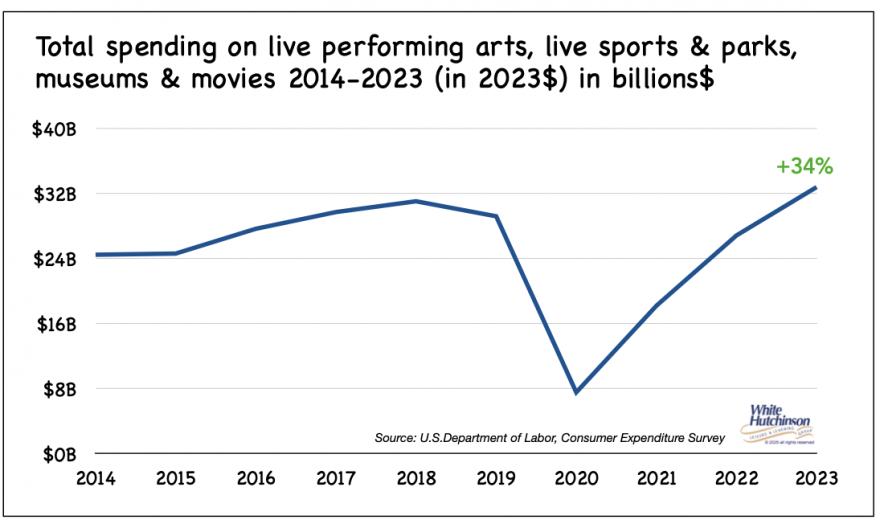

Total inflation-adjusted spending on admissions to live performing arts, live sports, parks, museums, and movies grew from $24.5 billion in 2014 to $29.2 billion in 2019 to $32.8 billion in 2023 (inflation-adjusted), a 34% increase.

However, there has been a significant shift between those three categories of out-of-home spending. Total spending at community-based parks, museums, and movies grew from $9.7 billion in 2014 to $10.7 billion in 2019 and declined by $1.7 billion to $9.0 billion in 2023 (inflation-adjusted). The decline is solely due to a 47%, $3.6 billion decrease in movie admissions since 2019, with admission spending at parks and museums increasing 12% in 2023 by $0.5 billion since 2019.

Meanwhile, admission to live events increased significantly more:

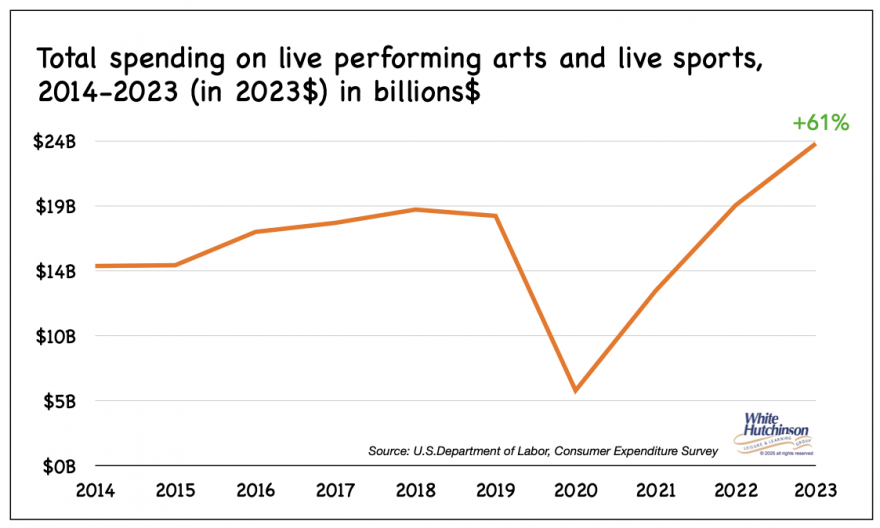

- Spending for performing arts grew from $7.6 billion in 2014 to $9.9 billion in 2019 to $12.9 billion in 2023 (inflation-adjusted), a $5.3 billion, 69% increase since 2014.

- Spending for admission to sports events grew from $7.2 billion in 2014 to $8.5 billion in 2019 to $10.9 billion in 2023, a $3.7 billion, 53% increase since 2014.

Total live performing arts and sports events admission grew from $14.7 billion in 2014 to $18.4 billion in 2019 to $23.8 billion in 2023 (inflation-adjusted), a $9.1 billion, 61% increase since 2014.

The data clearly shows that community-based live events are winning out over static attractions and gaining a more significant market share of spending on venue admissions.

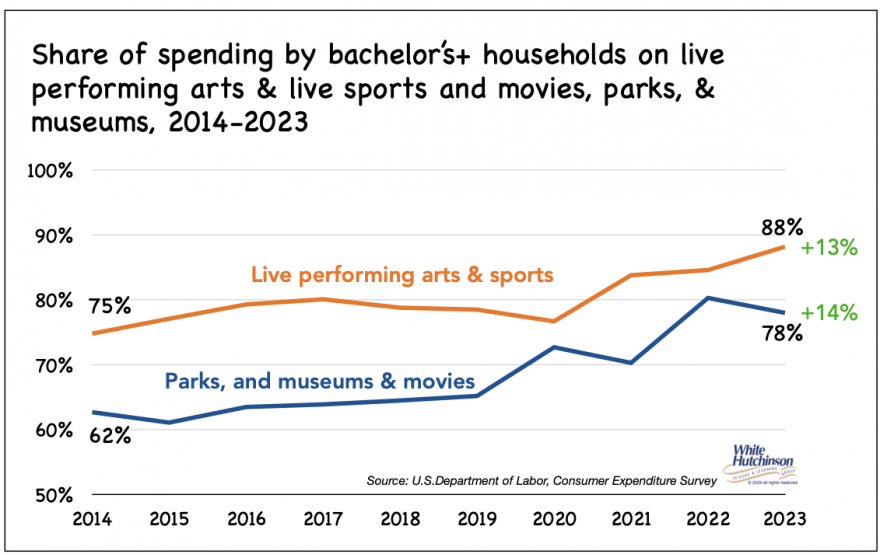

Our data analysis revealed another long-term trend that started before the pandemic. Households with a bachelor's or higher college degree member represent a greater and greater share of both non-live and live spending on admissions.

For non-live, bachelor's+ households grew from 62.7% of spending on admissions in 2014 to 78% in 2023. Bachelor 's+ households spending rose from 74.8% to 88.2% for live events in 2023.

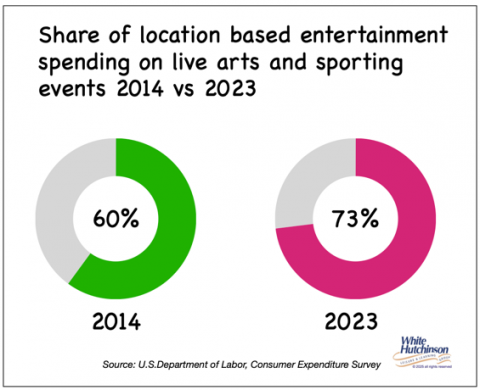

One more significant trend surfaced. Live events increased from 60% of all fee and admission spending at community live and non-live venues in 2014 to 73% in 2023. Live events have gained a greater market share of spending and are increasing becoming competition for non-live events.

Live performing arts and sports events are more appealing than static attractions because they offer a unique, unrepeatable experience that cannot be replicated elsewhere. The "you had to be there" feeling and the fear of missing out on memorable, shareable moments motivate people to prioritize attending these events over other forms of entertainment. The atmosphere at live events is infused with energy and excitement, creating emotionally resonant moments that static attractions cannot match.

A major draw of live events is the strong sense of community and social interaction that live events foster. Attendees are surrounded by others who share similar interests, which boosts self-confidence, sparks conversations, and helps build social networks beyond the digital realm. Sharing these experiences with like-minded individuals provides a sense of belonging and collective enjoyment, fulfilling a deep human need for real-time connection.

Additionally, seeing favorite musicians, performers, or sports teams in person enhances the appeal, as each event is different and offers something new every time. In contrast, static attractions provide the same experience on every visit, lacking the dynamic and communal elements that make live events memorable and emotionally valuable.

Static attraction LBEs, which include family entertainment centers (FECs), need to recognize they are competing more with all the live events options for consumers' leisure time and discretionary spending and far less with the other non-live LBEs and FECs in their market.

One of the big handicaps static attraction LBEs have is "been there, done that." They lack the uniqueness that live events have to satisfy people's novelty seeking. There are some things that attraction LBEs can do to become more competitive with live events. This includes programming different unique one- and limited-time events.

Food and beverages offer an excellent opportunity to add uniqueness. This can include limited-time (LTOs) food and drink offerings, wine, beer, or cocktail tastings curated with foods to cooking classes, food tastings, and themed dining events.

Other opportunities to add uniqueness and repeat appeal include live entertainment nights with local bands, DJs, comedians, or magicians, trivia or game show nights, bingo, contests centered around the attractions, paint & sip nights, singles mixer nights, crafting workshops, and holiday-themed parties.

Static attractions alone no longer cut the mustard in the out-of-home leisure market for location-based entertainment venues. Today, besides the attractions, there needs to be significant one- and limited-time programming with both food and beverages and other appealing micro-events. This is confirmed by IAAPA's report on North American attraction results during the first four months of 2025 - "Offering special events beginning in the winter months has produced positive results and a fresh term: "festivalization." Food and wine festivals, art festivals, and music festivals are providing a boost to early season attendance, while specialty food and beverage products have gained a reputation for driving additional spending."

All attractions, static and live, must recognize that the vast majority, nearly three-quarters of the target market, are higher socioeconomic bachelor's+ households. These households typically seek experiences that align with their values, lifestyle, and expectations for quality. They are attracted to entertainment options that offer exclusivity, sophistication, and meaningful engagement. Attractions that emphasize cultural, educational, or artistic value are particularly appealing. Higher socioeconomic households often seek experiences that are intellectually stimulating or offer opportunities for personal growth. The presentation, from marketing materials to venue design, should reflect sophistication and attention to detail.

* In the local community is within 50 miles of home and not on a trip

Subscribe to monthly Leisure eNewsletter

Vol. XXV, No. 6, June 2025

- Editor's corner

- A significant long-term shift in location-based venue spending imperils static attraction LBEs

- More flavor! Bold choices with big impacts

- Drive Shack's entertainment revenues decline

- The entrepreneurial trap of human biases

- Dirty Soda makes a splash at the National Restaurant Association Show

- Let's talk THC