Vol. XXII, No. 7, July 2022

- Editor's corner

- The baby boom that isn't

- Pleasure revenge arrives

- How video game socialization is competition to location-based entertainment

- The immutable laws of marketing: Violate at your peril!

- Disney again dipping its toe into the non-theme park LBE market

- Does indoor mini-golf and cocktails have legs?

- Pickleball grows in popularity and launches a new LBE chain

- Founder of Punch Bowl Social to launch a new concept

The baby boom that isn't

The CDC announced that there were 3,659,289 babies born in the U.S. in 2021. That's one percent more than the 3,613,647 babies born in 2020. That's the first time since 2014 that the number of babies born in the U.S. has increased. This suggests we have a baby boom underway.

The 2020 dip in births wasn't much of a surprise to demographers. The pandemic lockdowns of early 2020 were not particularly conducive to conceiving children. Surveys conducted in 2020 found that as many as one-third of American women changed their reproductive plans because of the pandemic, while half of American adults reported a decline in their sexual activity.

The one percent increase in births in 2021 stems partly from delaying planned pregnancies for a year or so during the later stages of the pandemic until the country saw improved infection and economic conditions, and governmental stimulus and unemployment aid which made would-be parents a little less apprehensive.

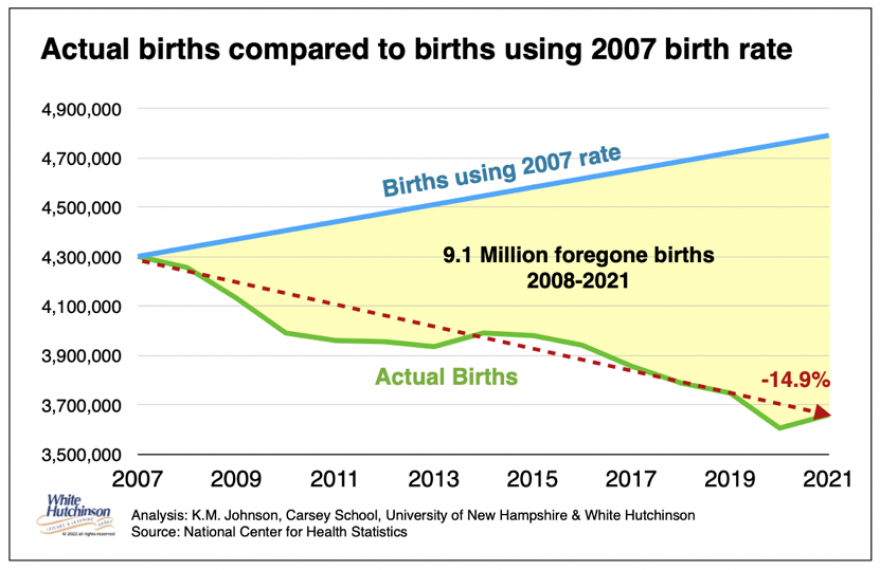

The 2021 bump in births isn't a baby boom as 2% fewer babies were born last year than in 2019 before the pandemic. Births have been on a decline since 2007. Last year there were 642,00 less births than in 2007, one-seventh fewer babies born than in 2007 when we had the historic greatest number of births,. If the increasing birthrate in 2007 had continued, we would have 9.1 million more children today than we do.

There are multiple reasons for the long-term trend of declining births. Social scientists don't expect the direction to change anytime soon.

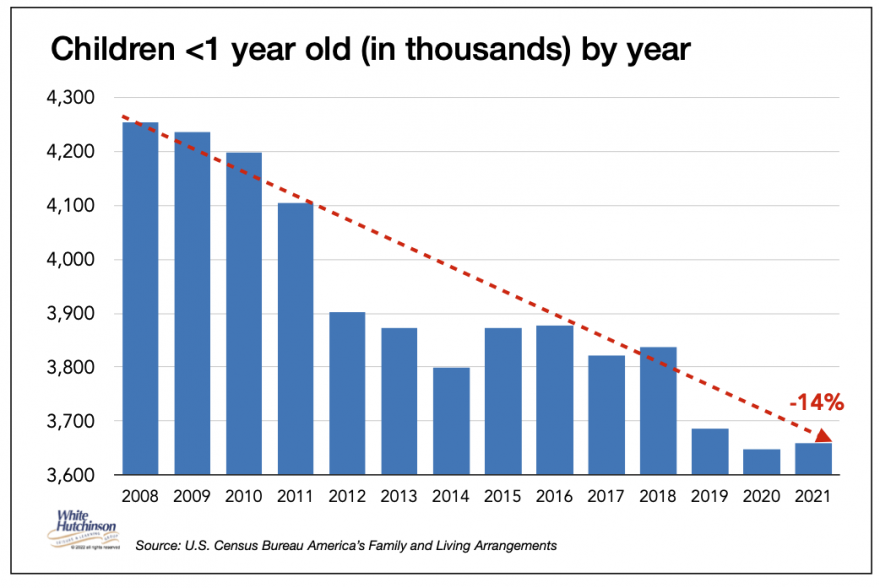

Each year the number of children one year old is declining. Each year's reduced number of children works its way up in age with every year, reducing the number of older children. It's now causing an ongoing reduction in each age between one and fourteen.

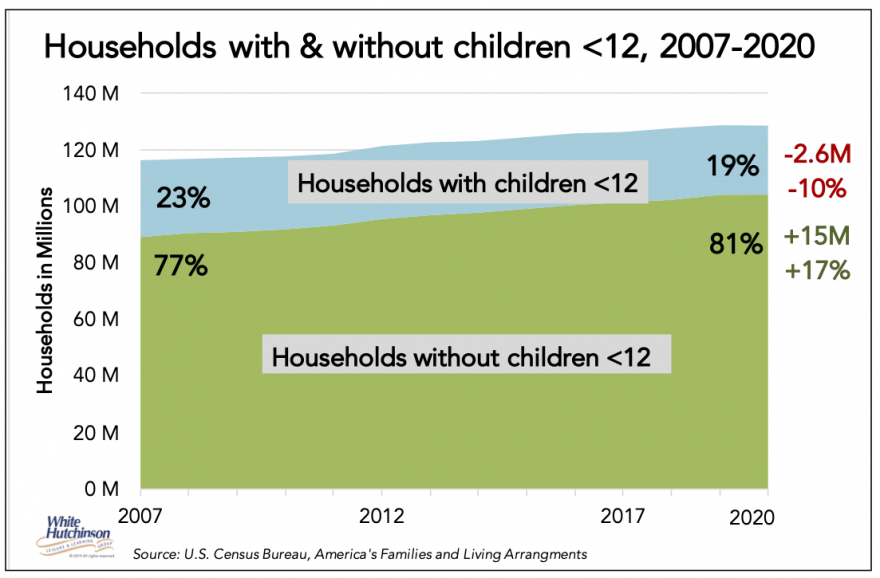

The declining birth rate does not bode well for many types of location-based leisure venues. This includes children's and family entertainment centers. Since the declining birth rate has been continuing for 14 years, it is resulting in a decline in the number of younger children and the number of households with younger children. We now have 2.6 million fewer households with children younger than 12 than we did in 2007. Meanwhile, the number of households with no children younger than 12 has grown by 15 million.

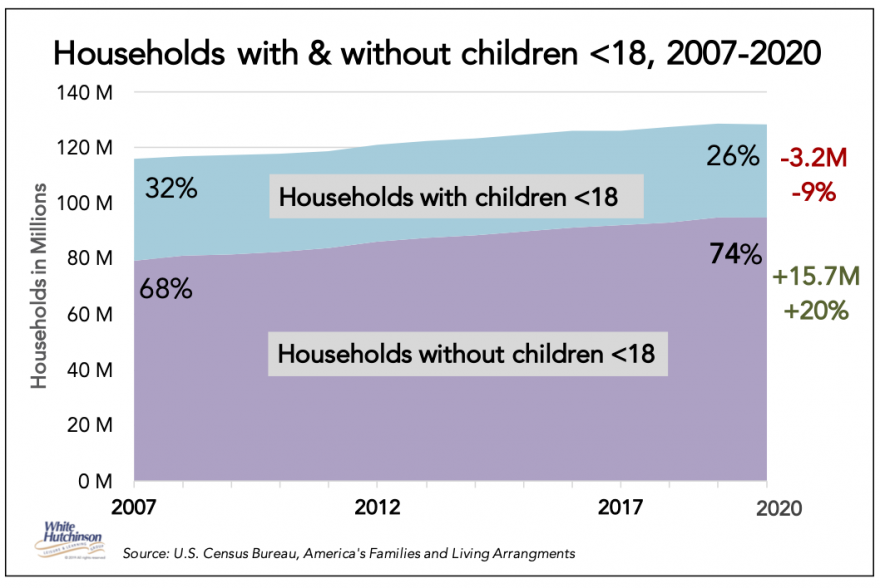

We see a corresponding trend in households with and without children of any age (younger than 18). We now have 3.2 million fewer households with any children. Households without children have grown by 15.7 million, from two-thirds to three-quarters of all households.

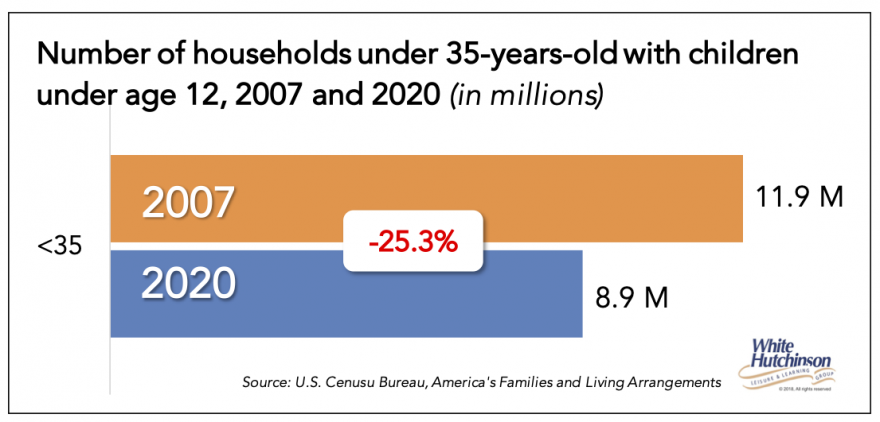

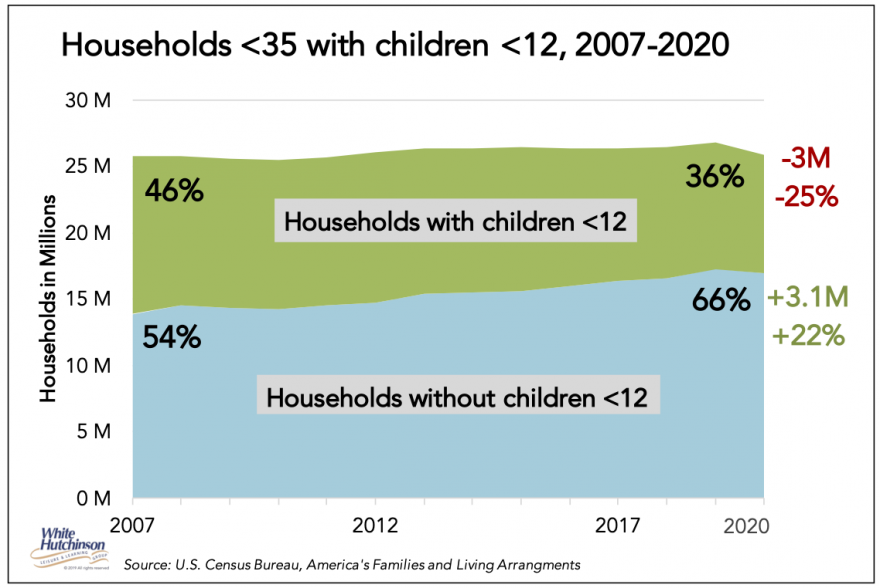

Since 2007, the number of households under age 35 (a prime target for many adult-oriented venues) with children younger than 12 has declined by one-quarter. We now have 3.0 million fewer households under age 35 with children under age 12. Conversely, the number of households under age 35 without children under age 12 has grown by 3.1 million.

Location-based leisure venues highly dependent on young children or families with young children, such as children's entertainment centers and family entertainment centers (FEC), need to reevaluate their long-term strategic direction in light of the ongoing reduction in the size of their target markets.

Vol. XXII, No. 7, July 2022

- Editor's corner

- The baby boom that isn't

- Pleasure revenge arrives

- How video game socialization is competition to location-based entertainment

- The immutable laws of marketing: Violate at your peril!

- Disney again dipping its toe into the non-theme park LBE market

- Does indoor mini-golf and cocktails have legs?

- Pickleball grows in popularity and launches a new LBE chain

- Founder of Punch Bowl Social to launch a new concept