Vol. XVI, No. 7, June/July 2016

- Editor's Corner

- Quite a change in a quarter century

- Go from 'stupid' to 'stupendous' in 3 days

- A business model built on quicksand; history continues to repeat itself

- Eight years and counting

- Bowling; a tale of two worlds update

- Who are the early adopters of new technology?

- An industry paralyzed by tunnel vision

- Pokémon Go a watershed moment

Bowling; a tale of two worlds update

Around this time every year, we analyze national surveys to examine bowling's changing landscape. This allows us to identify trends that will guide our company with the design of the community leisure venues (CLVs) that include bowling we are producing for our clients. We now have data for 2015, so here are some of the highlights of what we found.

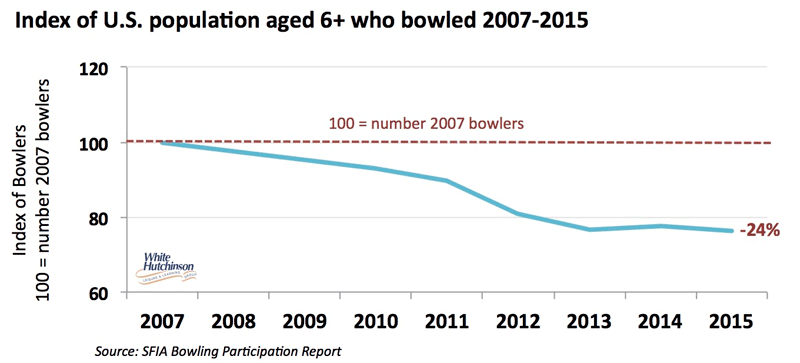

As we have reported in the past, participation in bowling is on the decline and that continued into 2015. The total number of people who bowled in 2015 was down another 2% from 2014. Since 2007, the number of bowlers has declined by almost one-quarter (-24%). For every four bowlers we had in 2007, we now have only three.

However, that doesn't portray a true picture of the decline, as during those same years the U.S. population grew by 6%, resulting in bowling participation declining by 28%.

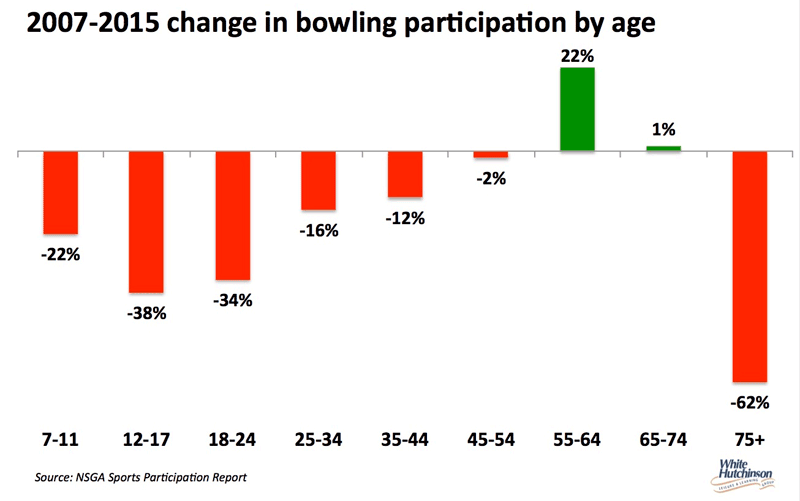

When we look at bowling participation by age, the greatest declines in participation have been among teenagers and the youngest adults.

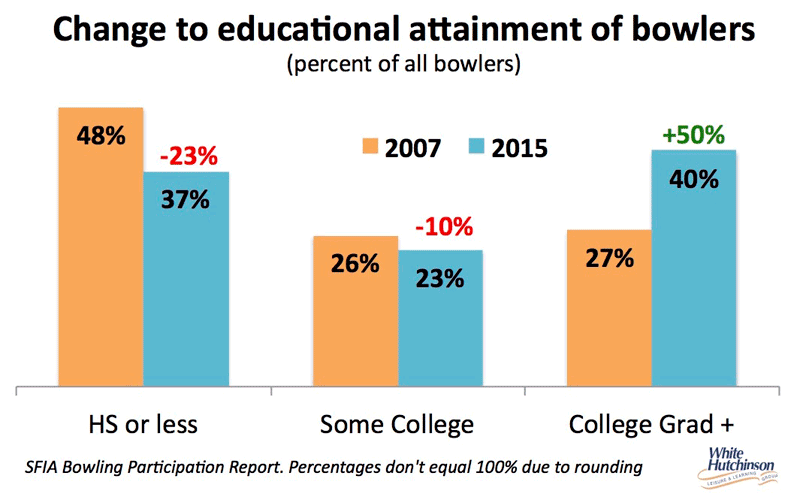

During those same nine years, we're seen a shift of bowlers to the higher socioeconomic households. Whereas back in 2007, only about one-quarter of bowlers (27%) were college graduates, there has been a 50% increase in 2015 to 40% of all bowlers.

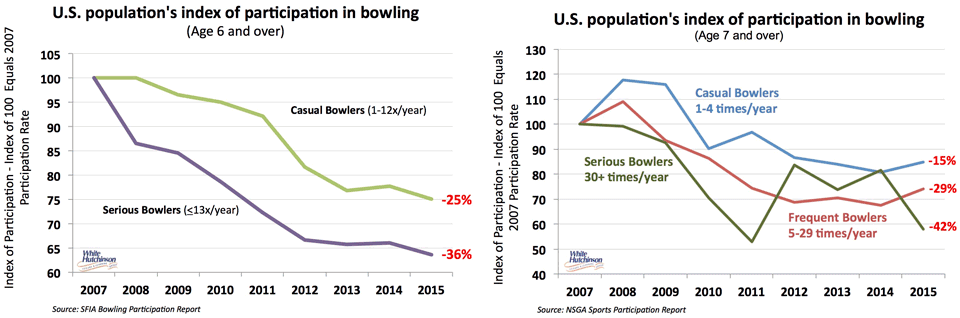

But as we've written in past articles, bowling occupies two different worlds, the casual bowlers and the serious and league bowlers, what we might call the sport bowlers. When we look at data that breaks bowlers down between those categories, we find the steepest declines are with the sport bowlers. Whereas around three decades ago, sport bowlers represented around three-quarters of all bowlers, sport bowlers have fallen of the cliff to only around 20% of all bowlers.

The greatest declines in bowling participation have been with the serious sport bowlers. Here's what the data from two different national surveys shows.

Since our company's work for clients involves casual social bowling, we will concentrate the balance of the analysis on those bowlers.

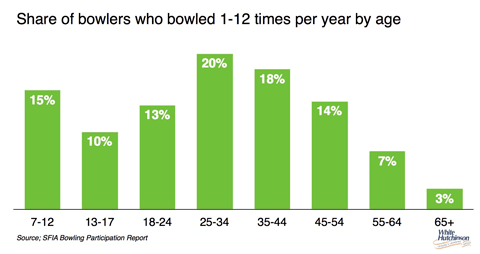

More then three-quarters (77%) of all bowlers bowled 12 or less times in 2015; more than 6 in 10 (62%) only bowled four or less times. The percentages of both have increased from 2007. Casual bowling now definitely dominates bowling.

Over half (55%) of casual bowlers now come from households where the head of the household is a college graduate. That compares to 40% of all bowlers.

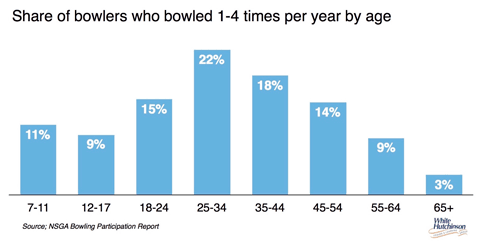

The two largest age groups of casual bowlers in number are ages 25-34 and ages 35-44, totaling between 38% and 40% of all bowlers based on two different national surveys. Both percentages have increased since 2007.

Over one-third (36%) of the 25-44 age group only bowled once during 2015, another one-quarter (24%) only bowled 2 to 4 times. So in total, six out of ten age 25-44 bowlers bowled 4 or fewer times in 2015.

The largest percentage decline in both number and participation rate has been with children bowlers with their numbers and penetration rates declining by 1/3 (33%) since 2007 compared to a decline of only half of that (-15%) in the number of age 25-44 casual bowlers. Children now represent only one-fifth to one-quarter of all casual bowlers.

Casual bowlers are basically evenly split between males and females.

Implications

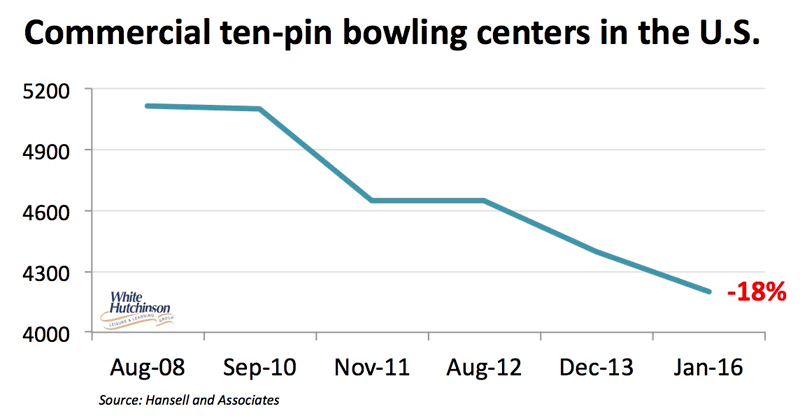

So what is all this data telling us? Before we get into that discussion, there's one more trend we need to examine, the number of commercial bowling centers in the U.S.

Since 2008, the number of ten-pin commercial bowling centers has declined by almost one-fifth, by over 900. That includes all the old bowling alleys that have closed minus a number of modern CLVs that have opened featuring bowling. The Bowling Proprietors Association of America (BPAA) reports that the median age of bowling centers is 52 years - yes, built in 1963. The vast majority of the bowling alleys that closed were predominately old league houses designed for league bowlers and/or were in areas where the neighborhood demographics had seriously declined. Most of the closed alleys were in bad repair and did not meet contemporary standards, especially for the higher socioeconomic that today makes up the majority of casual bowlers.

So is bowling on its deathbed? That depends which world of bowling you are referring to. Bowling centers that focus on the sport of bowling and cater to league bowlers are definitely on the road to their demise. League bowling is on a steep decline and most of the remaining league bowlers will soon be either too old to throw the ball or will die off. In the 2014-2015-league season, the United States Bowling Council's certified league bowlers numbered only one out of every 29 bowlers (3.4%). If non-certified league bowlers are included, league bowlers are only one of every 20 bowlers (5%). Leagues were something that you could sell to predominantly blue collar and 9-to-5 workers decades ago. Around three decades ago, league bowlers would agree to sign a contract to show up at a certain time every week for 30 weeks or more. Back then, bowling proprietors considered casual bowlers as a secondary market when the lanes couldn't be filled with leagues. It's a completely different world today. Consumers, and especially younger adults, demand their freedom and flexibility. And today, we have so many other options for out-of-home entertainment and leisure. Today it is next to impossible to get people to just sign up for an 8- or 10-week league. Heck, often they won't even commit for something in a week or two.

Some of the old alleys located in better socioeconomic areas have modernized and refocused. They are now trying to capture casual bowlers and consumers looking for other leisure options by adding other attractions such as laser tag and gamerooms, upping their game with better food and beverage, and putting new life into their centers. The BPAA labels them as bowling entertainment centers (BECs). However, many of these BECs try to have a split personality by continuing to offer league bowling. At the same time we are seeing New School leisure centers being built from the ground up that include bowling. In these, the focus is not on bowling, as it is only considered part of the mix. Food and drink takes a dominant role in most of these centers. Unlike the BEC owners who are still trapped in the paradigm of being in the bowling industry, the New School center developers who didn't come out of the bowling industry consider their venues to have a completely different focus - social gathering places built around great food, drink and social games. These New School centers are achieving far higher sales per square foot than most of the BECs.

So what explains the continued decline in casual bowlers? There are a number of factors. For one, the old bowling alleys that remain don't meet the standards for ambiance, service and food and drink of upper middle and higher socioeconomic customers who now account for 70% of all out-of-home entertainment spending in their local communities (remember, the median age of bowling centers is over half a century, meaning theoretically they could qualify for historic building designation.). Included are many of the BECs that in effect are trying to upscale by putting lipstick on a pig. This is just the opposite of the New School centers that are being designed and operated to attract the higher socioeconomic. Secondly we're now in the digital technology age. We now have many more appealing digital screen options competing for our entertainment and social time and attention and give us all the more reasons to not leave our homes. This has probably had the greatest impact on teens and young adults where we've seen the greatest decline in bowling participation. Third, we now have many more high quality out-of-home options competing for our disposable leisure time and spending when we do chose to leave our homes.

The decline in casual bowlers will not necessarily continue forever. It will eventually bottom out and probably see an upturn. The demand for quality out-of-home leisure options is partially elastic. As more of the New School centers appear and meet the standards for upper socioeconomic consumers, more consumers will choose bowling over their other options. Right now in many communities, there are no bowling options that meet those standards, so consumers just don't go bowling. Our company recently evaluated a market for a client where there were six existing bowling alleys. Four were marginal at best and one was so bad and scary on the outside that we didn't get out of our car to go inside. The sixth at best was a “C.” Once an upscale center with bowling is developed in that community, people who aren't now frequenting the many bowling alleys there will choose to go bowling.

No, bowling is not dead. Bowling is just in a transitional phase from a sport to casual-social in order to compete for the 21st Century consumer.

Vol. XVI, No. 7, June/July 2016

- Editor's Corner

- Quite a change in a quarter century

- Go from 'stupid' to 'stupendous' in 3 days

- A business model built on quicksand; history continues to repeat itself

- Eight years and counting

- Bowling; a tale of two worlds update

- Who are the early adopters of new technology?

- An industry paralyzed by tunnel vision

- Pokémon Go a watershed moment