This article first appeared in the August 2009 issue of the Leisure eNewsletter.

Download a PDF copy of this article by clicking here.

![]()

The future of leisure time; the new value equation

by Randy White, CEO

This recession is unique due to its suddenness, severity and longevity. It has already been nicknamed the Great Recession. Based on analyses by top economists, psychologists, sociologists and trend experts, when the recession ends, we will not be going back to the old normal. This recession ends consumerism as we once knew it. It has fundamentally changed the mentality of consumers.

Faith Popcorn of the BrainReserve summarized the overall impact of the recession this way, “The overwhelming reaction is to pare down, to simplify … Nearly everyone is considering opting for a simpler life, as we believe that there is a real relief in getting off the consumption treadmill. What may have started as an economic reality is rapidly becoming a bona fide lifestyle preference — even among those who can afford to spend…Today more and more people voluntarily choose to downsize, and this trend is growing both as a personal choice and because we have less money to spend… Even people who have the financial means to spend aren’t doing so anymore — and they find they are feeling really good about that choice. Downward Mobility is the new direction or Keeping Down with the Joneses; I did without more than you did, kind of thing.”

Thriftiness affects leisure time

No matter what you call it, voluntary simplicity, downsizing or whatever, the overall effect is the same. People are definitely saving more, paying down debt and spending less on stuff. Experts all agree: even after the economy recovers, thriftiness will rule the day.

This thriftiness has also affected how people spend their leisure time. People are recalibrating their values on how they spend their leisure dollars and available leisure time. People are finding less expensive things to do with their leisure time, and in many cases finding them to be more rewarding with an appealing price/value relationship. One way people have found to maintain -- and even improve their relationships and connections with friends and family -- is to stay home.

Stephanie Smith, a psychologist in Erie, Colorado, said a lot of her patients who cut their entertainment budgets have been pleasantly surprised by the joys of staying at home. Something as simple as meal planning, grocery shopping and cooking and eating together can bring families closer, she said. “If you go to a movie with your family, that’s family time and that can be very fun, but you’re not interacting with each other. If you are at home, playing Monopoly or checkers, you are face to face, talking, interacting,” she said.

In fact, while toy industry sales are down nearly 2% since April 2008, sales of board games increased nearly 5% during that period based on NPD Group research.

A July 2009 Technomic study found over one-third of consumers (36%) report they are entertaining at home more. Over the next year, 40% of consumers expect to entertain at home more, often in order to socialize with friends and family. “Consumers tell us they are enjoying reconnecting with friends in their homes,” says Melissa Wilson, a Technomic principal. “The appeal is tied to socializing in a very casual atmosphere where everyone brings a dish to share, often sourced from restaurants or food retailers.” Faith Popcorn’s BrainReserve Fall 2008 research found 72% of consumers reported “spending a good deal more time at home entertaining themselves and others.”

Basically, staying at home, day-cations and stay-cations are teaching people new leisure habits of how to spend time with family and friends. They’re getting significant value from these new habits not only in money saved but also in greater satisfaction and emotional reward.

In-home entertainment grows

The homeward bound cocooning trend has made technology more important to consumers. One way consumers have shifted their entertainment time and expenditures is away from spending on out-of-home entertainment to spending on in-home and on-the-go entertainment (use of the Internet, video gaming and electronics-on-the-go such as iPods and high-tech cell phones such as the iPhone.) The web especially is changing people’s leisure time value equation. Most of the web is free, and for many, the web is more fun than a trip to the mall or a visit to an entertainment destination. The Nielson Company reports the number of minutes played by the average video gamer has continued to grow during the recession. Although sales of new video games have declined, there has been a significant increase in the sale of more affordable used games (+40% in May 2009 compared to the year before.)

Entertainment spending shifting to technology

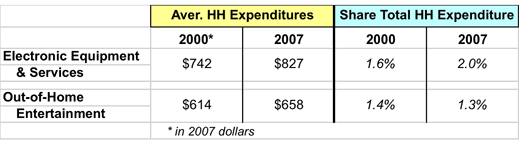

The trend of entertainment spending shifting to technology started before the recession, but the recession appears to be accelerating it. In 2000, the average American household spent $515 (1.6% of total expenditures) on electronic (audio and visual) equipment and services (basically purchases and rentals of music and video games). In pre-recession 2007, that grew to $987 (2% of total expenditures). After adjustment for inflation, that is a 33% increase in dollars spent and a 25% increase of the percentage of total expenditures. During the same time period, average household out-of-home entertainment (for entertainment fees and admissions) spending grew from $622 in 2000 to $658 in 2007, only a 7% increase after adjustment for inflation. Its percentage of all household expenditures fell from 1.4% in 2000 to 1.3% in 2007.

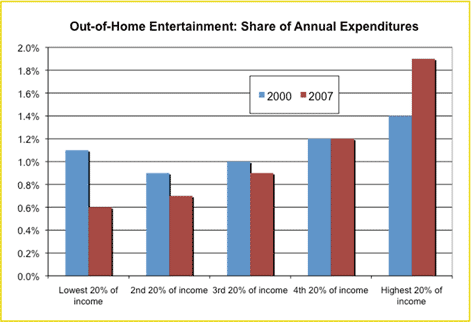

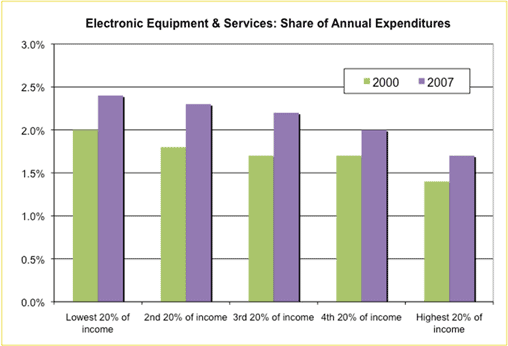

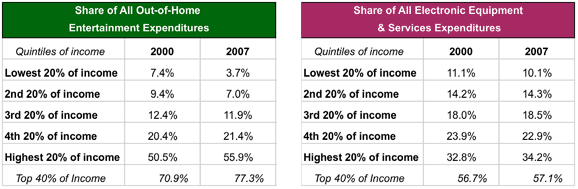

What is significant is the share of average household expenditures on electronic equipment and services grew across all household income categories over the seven years. In contrast, the share of income spent on away-from-home entertainment decreased for the lowest 60% of households by income, was flat for the fourth quintile by income and increased for the highest 20% of households by income. In terms of inflation-adjusted dollars spent, all income categories of households increased their spending on electronic equipment and services, whereas for out-of-home entertainment, spending decreased for the lowest 60% of income households and increased for the top 40%.

In 2007, households with the top 40% of incomes accounted for 57% of all electronic equipment and services expenditures and 77% of all out-of-home entertainment spending -- both increased market shares since 2000.

Changes to socialization

The web and electronics are also changing another aspect of leisure time —socialization. Social media (FaceBook, Twitter, etc.) and texting enable people to connect in non-physical space. This could be impacting the appeal of out-of-home social destinations, whether they are entertainment-, recreation- or dining- oriented. Socialization is a major component of visits to such destinations, yet they can be costly, whereas social media basically has no cost.

Research by the USC Annenberg Center for the Digital Future has found Internet-connected households are experiencing a decrease in face-to-face family time. Research showed between 2006 and 2008, hours devoted to family socialization and shared time at home dropped by more than 30% to 17.9 hours per month. The flip side of this phenomenon is families may be craving more shared time, which is easier to achieve without the distraction of the Internet in out-of-home leisure destinations, that is, if you turn off the Blackberries, iPhones and other wired devices. It is interesting to note the biggest names to engage kids in the recent past are brands like Wii and American Idol, which offer experiences that not only seek to meet both parents’ and kid’s needs, but also facilitate experiences the whole family can enjoy together. This underlying desire for social experiences, to reconnect with families and friends, appears consistently in the research on the recession’s impact.

Growth of experiences

The recession impacts leisure activities from another angle. Consumers’ dematerialization has a positive impact on leisure. As stuff takes on less importance, people are finding they have more room in their lives for experiences. They are valuing objects less and experiences and people more.

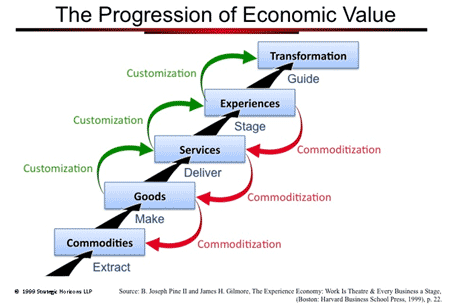

People’s growing desire for experiences brings with it not only a desire to strengthen their bonds and enjoy good times with family and friends, but also a desire for knowledge and self-improvement. We want to do things that make us better people rather than just enjoying ourselves. The Great Recession has accelerated the trend identified back in 1999 by Joe Pine and Jim Gilmore in their book, The Experience Economy, in which they identified the progression of economic value. Economic activity and the progression of economic value start with raw commodities that are transformed into goods, which are then wrapped in services and finally transformed into experiences. Experiences then move to the top level of value as transformational experiences, experiences that permanently improve the consumer, such as education or yoga classes. Each level increases the total value to the customer, and accordingly, the total price the customer is willing to pay. Generally, price sensitivity decreases, profit margins increase and competition decreases as you move up the progression of economic value.

One example of the progression of economic value is birthday parties. Half a century ago, mothers made birthday cakes from scratch with butter, sugar, eggs, flour, milk, etc. Those commodities cost maybe a quarter. Then in the 1960s and 1970s, along came cake mixes and canned frostings. These goods cost several dollars. Then in the 1980s, many parents stopped baking cakes and ordered custom cakes from the supermarket or local bakery, specifying the type of cake and frosting, designs or themes and the specific words for the top (a service). At $10 to $20, these cakes cost about 10 times what they cost to make at home and still involved only several dollars’ worth of ingredients (commodities). Up until this time, birthday parties were held at home. Then along came Chuck E. Cheese's, Discovery Zone and other facilities that offered out-of-home birthday party experiences. These facilities stage birthday party experiences that cost $200 and more per party. Some businesses have raised the level of birthday parties to transformational by including an educational or enriching activity as part of the party experience, such as the entire party building robotics or creating artwork.

Transformational experiences create value

The recession has also made people more conscious of and care more about value, meaning they want to derive greater value from the dollars they spend. People care about value more than they used to because they can’t afford or no longer want to overpay; they don’t want to make a mistake with their money. Value equals the benefit divided by the price.

Value = Benefit/Price

Value can be created two ways. Either you lower the price with discounts or coupons, or you increase the value of what you give. The desire for greater value from leisure experiences is accelerating the desire for transformational experiences, as transformational experiences have greater perceived value than ordinary experiences.

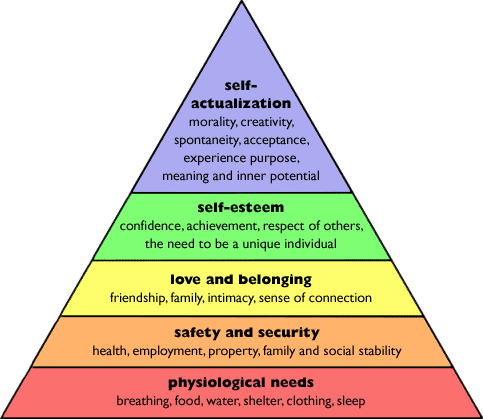

Pam Danziger, president of Unity Marketing, identified this trend toward transformational leisure experiences back in 2005 when she said, “Powered by a feeling of entitlement, Americans bring a unique achievement orientation to how we ‘recreate.’ We want to accomplish something meaningful and measurable through our leisure pursuits. For more Americans ... the goal of leisure and entertainment is to reach a greater self-actualization. Psychologist Abraham Maslow placed self-actualization at the pinnacle of hierarchy of human needs, to be satisfied only after the basic needs for food, clothing and shelter, safety, belonging and self-esteem. According to Maslow, self-actualization refers to man’s desire for fulfillment … to become everything that one is capable of becoming.”

Maslow’s hierarchy of needs

Basically, the progression of economic value and Maslow’s hierarchy of needs place the greatest value on the same needs — experiences that make you a better person rather than just buying things or enjoying non-enriching experiences. Of course, this is true only for people in the more developed world who don’t have to worry about shelter and food.

The increasing desire for transformation or self-actualization experiences is also growing due to the increasing education levels of people in America and other societies. In 2008, 34% of Americans 30-34 years old had a bachelor’s degree or higher. That compares with only 21% for the generation of those who are 70-74. More educated people tend to seek more knowledge and self-improvement than less educated people.

The increasing desire for enriching or transformational experiences shows up in research about contemporary parents’ choices for their children. Fisher Price, the well-known children’s toy company, found Generation X parents want their children to learn as they play, compared to Boomer moms who saw children’s play and learning as separate activities. The Generational Imperative, Inc. found Gen X parents put a premium on toys that are both educational and fun, whereas. This research echoed that of Fisher Price, which found Boomer parents tended to separate playtime and learning time.

Psychology of happiness

According to psychologists and researchers, money helps people lead more comfortable lives, but it doesn’t always contribute to the moments in life that bring happiness. Those tend to come from social interactions and activities, not from accumulating material goods.

“Simplicity is the silver lining to the downturn,” says psychology professor Robert Wicks, author of the forthcoming book, Bounce: Living the Resilient Life. “They weren’t spending time really enjoying themselves and weren’t spending time with family and friends. The simplicity that’s possible during difficult times would not have come to the fore if the crisis had not occurred.”

New research from the San Francisco State University presented earlier this year found consumers said dining out or buying theater tickets was money better spent than buying more things. What’s more, they said the experiential purchase provided greater happiness for themselves and others, regardless of the amount they paid or their income.

Future of location-based entertainment and leisure

So what do all these recession-driven changes mean for the future of location-based entertainment and leisure venues? One thing is for sure: the Great Recession marks the end of the world as we have known it. Business as usual simply isn’t anymore. Location-based entertainment and leisure (LBL) destinations are not dead. But to prosper in the new world order, these businesses will have to be open to change to appeal to what is being called the new grounded consumer.

Several things are apparent. LBLs need to offer greater value for two major reasons. First, because consumers are demanding greater bang for their bucks. Second, LBLs must attract people away from the appeal of in-home electronics and the Internet. Adding more transformation experiences versus just pure entertainment is one way to accomplish this. Creating environments that facilitate social experiences between family members and friends is another. Offering experiences that cannot be duplicated at home is still another. The good news is that experiences can now trump material purchases in terms of value and happiness.

Prosper with high fidelity

In his forthcoming book Trade-Off, Kevin Maney says businesses like LBLs will need to have high fidelity to prosper. He explains there is an ever-present tension between fidelity (the quality of a consumer’s experience) and convenience (the ease of getting and paying for something). Conflicting forces determine the success or failure of products and services in the marketplace. Maney says almost every decision we make as consumers involve a trade-off between fidelity and convenience – between the products we love and the products we need. Offerings that are at one extreme or the other – either high in fidelity or high in convenience –- tend to be successful. To really win, the offering needs to be ten times better than what you’re aiming to replace, which means ten times higher fidelity or ten time cheaper and easier. Some everyday examples are a refrigerator is ten times more convenient than an icebox and a cell phone is ten times more convenient than a pay phone. Rock stars sell out concerts at high ticket prices because the experience is high in fidelity – it can’t be replicated in any other way, and because of that, we are willing to suffer inconvenience for the experience. In contrast, a downloaded MP3 of a song is low in fidelity, but consumers buy music online because it’s super-convenient and low priced. The things that fall into the middle – products or services that have moderate fidelity and convenience – fail to win an enthusiastic audience.

Think about it. Movie theaters are ramping up the fidelity of movies by offering 3-D and IMAX movies (that command a premium price) and even in-theatre dining to compete with the convenience of in-home movies. T-Rex Caféoffers a high fidelity dining experience for families by offering more than food and beverage: an immersive prehistoric dinosaur world experience. Attendance at zoos, aquariums and museums has been increasing over the past decade as they offer a higher-fidelity experience than watching the Discovery Channel or History Channel on TV.

One example in the LBL industry of high fidelity versus convenience is bowling. Wii game consoles now let consumers “bowl” in their homes. That’s convenient. Hybrid bowling centers (also know as bowling-based FECs) and bowling lounges have ratcheted up the fidelity with large-screen video masking units, upscale décor and quality food. They are getting premium prices and high attendance due to their high fidelity.

One example in the LBL industry of high fidelity versus convenience is bowling. Wii game consoles now let consumers “bowl” in their homes. That’s convenient. Hybrid bowling centers (also know as bowling-based FECs) and bowling lounges have ratcheted up the fidelity with large-screen video masking units, upscale décor and quality food. They are getting premium prices and high attendance due to their high fidelity.

The answer for LBLs’ success now and in the future is they must raise their fidelity to overcome the convenience of electronics, at-home leisure and consumers’ search for value. LBLs need to offer experiences that can’t be found at home, and the experiences need to be high in quality and fidelity with high perceived value.

Additional reading: