Download a PDF copy of this article by clicking here.

![]()

A perfect storm is disrupting the legacy location-based entertainment business model

The rise of L&OTEs and foodies - The evolution of out-of-home entertainment

Preface:

Our company has been designing, producing and consulting for location-based entertainment and leisure venues of all types for over 30 years. In our earlier years in the industry there was no such thing as smartphones and the internet and social media didn’t exist.

Back then, especially for consumer leisure behaviors, change was slow. Over time, the rate of change rate of change has continued to accelerate, partially driven by technology. It took the television that was introduced in 1926, 26 years to become adopted by 25% of the American population. The PC, introduced in 1975, took 16 years. Social media that emerged in 2002 took six years. The smartphone in 2007 only took three years and voice assistance in 2016 only two years to be used by one-quarter of Americans. And the rate of change continues to accelerate today.

The presence of the internet, Google searches, apps, social media and other digital technologies has dramatically changed all types of consumer behaviors including their out-of-home leisure and entertainment preferences and behaviors. As technologies continue to evolve at breakneck speed so too does consumer behavior. We’ve already seen more change since the birth of the iPhone twelve years ago than previous generations saw in a lifetime.

Continually evolving digital technologies and the rapid rate of consumer adoption are ominous long-terms trends that present a new challenge for many legacy out-of-home leisure and entertainment business models. The rules of leisure and the leisure landscape have now fundamentally changed and will continue to in the future.

Location-based entertainment venues are brick-and-mortar facilities with physical attractions that cost millions of dollars to develop. To be economically sustainable, they need to have long lives. They aren’t software where you can just easily change the coding. With the rate that technology and consumer behaviors are changing, making substantial investment in fixed physical assets that will have a long life becomes very challenging.

Our company works with developers and owners of these brick-and-mortar facilities, mostly on the feasibility, design and production of new, expanded or renovated ones. We assist our clients to develop leisure and entertainment venues that won’t open for a year or more after work first starts and that then will need to be successful for a large number of years. In other words, they need to be future-proofed against all the changing consumer preferences and behaviors.

That is why we invest heavily in trends research – examining current and emerging trends to see where the future is headed so the facilities we design and produce for our clients will be relevant and successful in the future. We examine and use research data to discover and understand leisure trends. This is an evidence-based approach to development, not one just based on opinion or of replicating existing business-models that evolved yesterday that will surely be disrupted in the future, if not already.

This white paper presents:

- Some of our trends research, including the data supporting it,

- Makes a case for why the legacy, predominately attractions-based business model for location-based entertainment, is fast becoming obsolete due to the convergence of major trends creating a perfect storm, and

- Discusses what the new business model needs to incorporate

We hope you find this white paper enlightening and useful.

Randy White, CEO

A perfect storm is disrupting the legacy location-based entertainment business model

A number of trends have all come together at the same time to create a Perfect Storm that has transformed Americans’ leisure behavior, resulting in a major disruption to legacy location-based entertainment (LBE) business models, especially for the family entertainment centers (FEC) segment of community leisure venues (CLVs). First we’ll describe the three major trends of this Perfect Storm that have created a highly competitive and challenging entertainment landscape for legacy LBE business models. We’ll then examine their impacts and new business model opportunities.

Digitalization of entertainment

Over the past few decades, expanding screen-based digital entertainment options have offered consumers more and more reasons to just stay home. These include video games, streaming movies and shows, social media and others including YouTube and what is being called the Netflix effect – bingeing on shows. Social media and texting have allowed consumers to socialize with friends via digital connections such as on FaceTime rather than face-to-face in person. We are now seeing the incorporation of virtual and augmented reality into those at-home options, further increasing their attractiveness. Now you can enjoy at-home entertainment on your sofa while dining on a high-quality restaurant meal that was delivered by Grubhub, Uber Eats or other meal delivery services. All the digital and at-home options are crowding out time that was previously spent out-of-home (OOH), including at CLVs. Consumers are now cocooning in their homes, even to the extreme extent that Faith Popcorn calls ‘bunkering.’

Expanding out-of-home entertainment options

Meanwhile, the out-of-home (OOH) entertainment landscape is rapidly expanding with new options that didn’t exist in the recent past. There’s an endless ocean of possibilities for what we can do with our leisure time when we do decide to leave home. This includes everything from axe throwing, escape rooms to virtual reality, arcade bars, retail-tainment, even artainment at cultural venues and grocerant-tainment – dining and entertainment at grocery stores. The recent foodie movement has resulted in many restaurant dining occasions being considered a form of OOH entertainment. The number of legacy CLVs, such as FECs, is also expanding to the point of over-supply in many markets, attributable to shopping center and mall landlords enticing operators with sweet lease terms to fill vacant retail space in an effort to attract customers to their remaining retail stores, by private equity firms with plenty of funds to deploy, buying CLV chains and quickly encouraging their rapid roll-out, by existing private and public entertainment chains rapidly expanding and by startup entrepreneurs who don’t understand how crowded and competitive gaining a share of consumers’ OOH leisure time has become.

Conspicuous leisure & the pursuit of novelty

In the experience economy, our priorities have changed. Status, gaining social capital, has shifted from owning envious material goods and stuff to sharing envious experiences on social media. What you do now matters way more than what you own. Today, two-thirds of Americans would rather be known for their experiences than their possessions. Especially for younger adults, an impressive selfie capturing a memorable experience is as enviable as a new car or fancy watch was to their parents.

Conspicuous consumption is out, and conspicuous leisure is in. Today, with the almost unlimited number and choices of different and expanding types of OOH leisure and entertainment, people want to enjoy, share and collect as many different experiences as possible in their limited leisure time, adding to their experiential CVs and increasing their social capital and bragging rights. For many people, especially the 20- and 30-somethings, if an OOH experience isn’t Instagrammable, it’s not worth going to. Today, it’s all about a culture of novelty-seeking and the pursuit of new, unique and sharable OOH experiences.

Our brains are hard-wired by evolution to crave novelty. The desire for novelty, to explore something new, is rooted in enabling us to learn something new about our environments and how to survive. Novelty triggers the production of dopamine, making us feel good, which, in turn, increases a person’s motivation to seek more novelty.

The vast majority of Americans now have the desire for adventure and discovery when it comes to experiences. So, when we do decide to leave home, rather than repeat same old, same old, we seek out one of the many available new and unique experiences to expand our sense of self, of who we are and what we can do, as well as add to our Experiential CVs. The desire to collect a variety of experiences is also driven by our desire to feel productive, as checking off items on our experiential check list creates the feeling that we have used our leisure time productively.

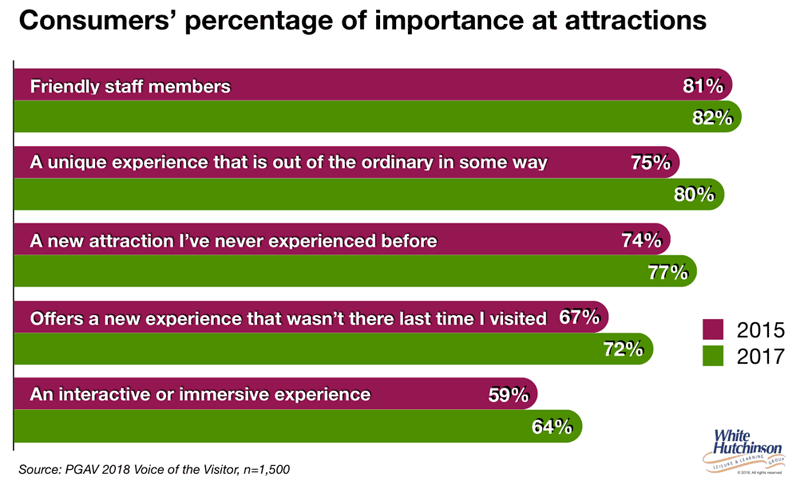

PGAV’s 2018 Voice of the Industry report said that 2017 marked the “Year of the New” for many attraction guests. The study found a marked uptick in the percentage of visitors looking for new experiences. They rated friendly staff members as the most important quality of visiting an attraction. In four other areas, they rated the uniqueness and quality of the experience as more important in 2017 than they did in 2015.

Death of the legacy business model

The foundation of the business model for CLVs, and especially FECs, has always depended on repeat business. CLVs are not regional attractions drawing from a large trade area, but rather community-based, so they depend on repeat visits from that smaller trade area to achieve their required attendance and revenues. Not all that long ago, that business model worked. However, today, repeat attendance has lost its appeal for a large segment of the population – they have a vast selection of OOH entertainment options and they want to enjoy and share as many as possible – been there, done that – what’s new and unique to enjoy and post?

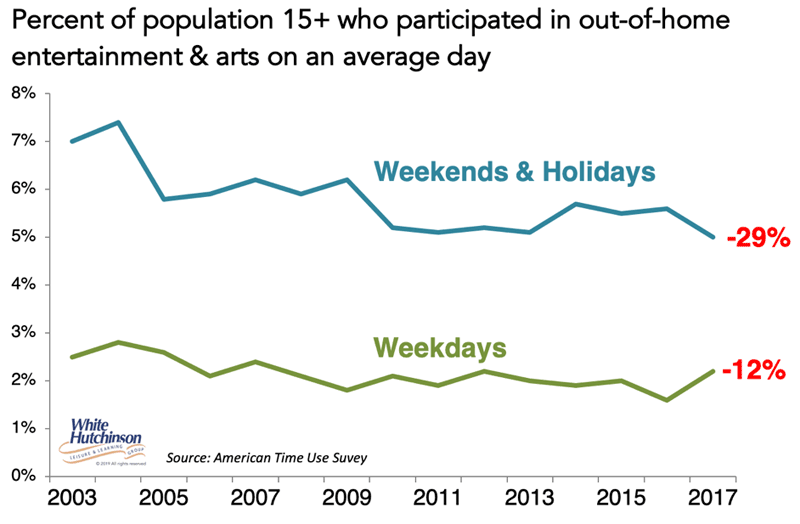

Also contributing to the death of repeat appeal are two other macro trends. The first is attributable to the at-home digital entertainment options. People are staying home and going out less often and spending less time at OOH entertainment and arts venues. So, the slice of the leisure time pie for OOH entertainment shrinks. Here’s three ways we’ve documented this decline in OOH entertainment.

Participation in OOH E&A

First is the trend of a decline in participation in some type of OOH entertainment or arts (E&A) activities. This not only includes brick-and-mortar venues such as legacy FECs, but CLVs and location-based entertainment and cultural venues of all types including movie theaters, museums, zoos, aquariums, botanical gardens, theme parks, aquariums, theaters, casinos and also a large diverse and selection of limited and one-time events (L&OTEs) such as different types of shows such as car and home & garden shows, festivals, fairs, and carnivals. On the average weekday, one-eighth less of the population (-12%), and on the average weekend and holiday, greater than one-quarter less of the population (-29%) visited an OOH E&A experience in 2017 compared to 2003.

Time attending OOH E&A

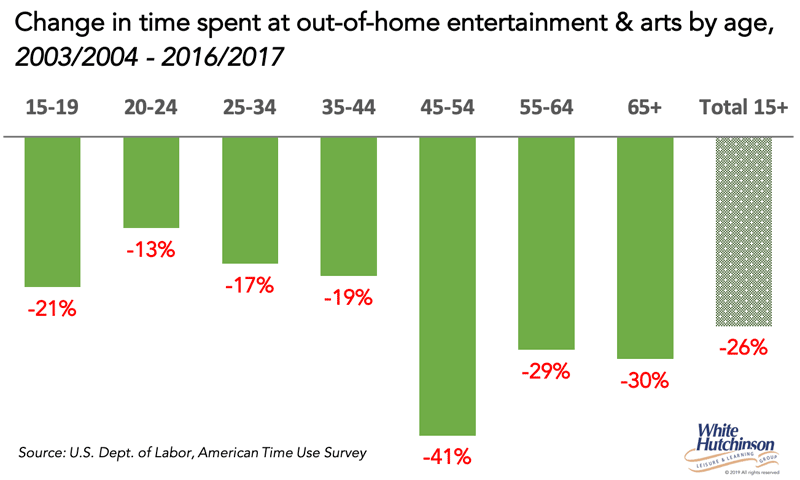

The second trend is a decline in the amount of time people spend each year attending an OOH E&A activity. People are going out less. People age 15 and older spent one-quarter less time at OOH E&A activities in 2016/2017 (-26%) than in 2003/2004. And the decline occurred for all age groups.

Frequency of visiting OOH E&A

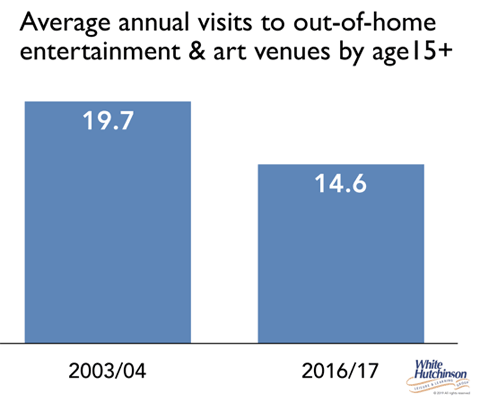

The third trend is the decline in the average number of times each year people attended OOH E&A. Based on our analysis, in 2003/04, age 15+ on average attended 19.7 times a year. In 2016/17, it had declined to only 14.6 times a year, a loss of five visits a year, one-quarter less visits. One less visit was attributable to a decline in movie attendance and four less to all other type OOH A&E venues and events.

Gentrification of OOH E&A

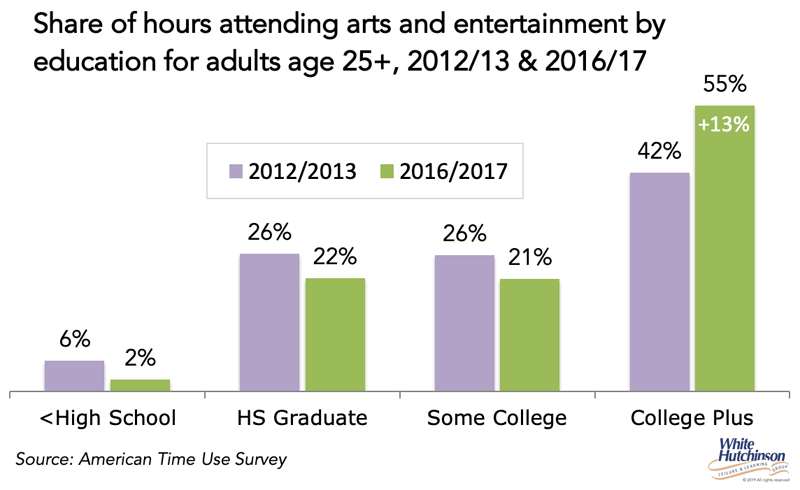

There has been a gentrification trend in attendance and time spent at OOH E&A. Over just a four-year period, 13% of the amount of time spend attending OOH E&A has shifted to adults with a bachelor’s degree or higher. They now account for over half of all time spent at those experiences (55%).

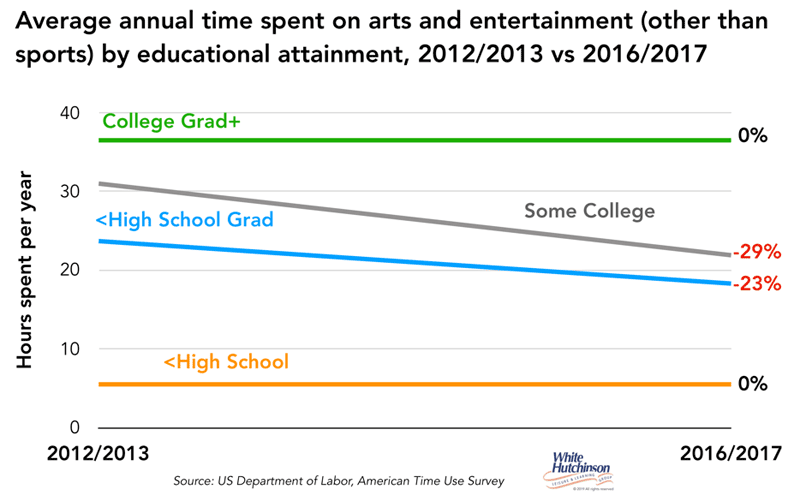

The decrease in average time spent at OOH E&A is totally attributable to adults without a bachelor’s or higher degree. The time for bachelor+ adults remained the same, that for high school and some college adults declined significantly. It stayed the same for adults without a high school degree, but their time is minuscule.

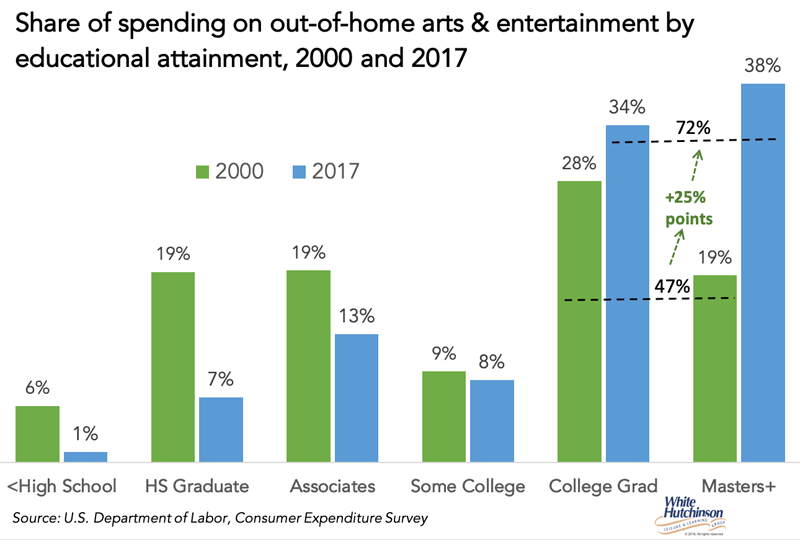

The gentrification trend is also confirmed when we look at spending changes for admissions and fees to OOH E&A. Bachelor’s and higher degree households have grown from 47% of all OOH E&A spending in 2003 to 72% in 2017. Yes, that socio-economic group now accounts for almost three-quarters of all OOH E&A spending.

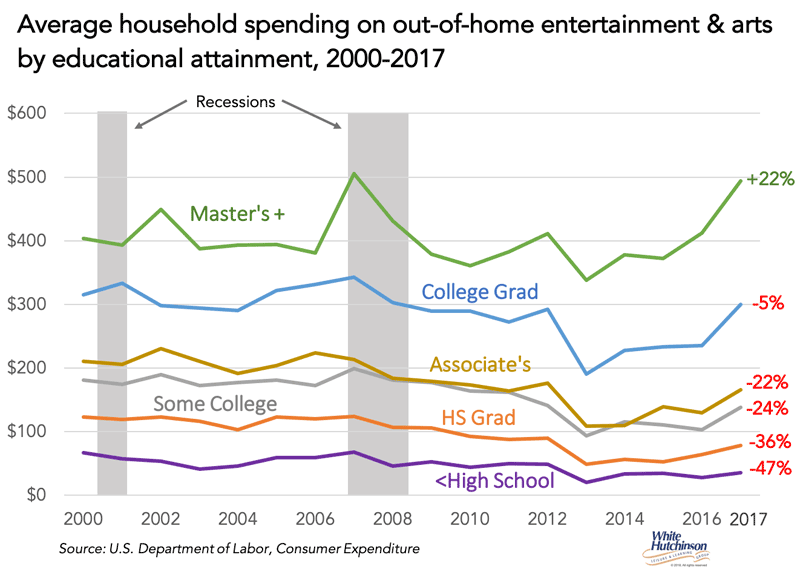

The graph below shows the annual spending changes since the turn of the century by educational attainment. Although average household spending on fees and admissions at OOH E&A venues is almost at the same level it was in the year 2000 (-3% inflation adjusted), only households with a master’s or higher degree have increased their spending. All other educational level households have decreased their spend. The graph clearly illustrates the gentrification trend – the lower the education level, the greater the decline in OOH E&A spending has been.

If we look at OOH E&A spending from a household income perspective, the top 20% of households by income in 2017, those households with $110,00+ incomes, accounted for nearly half (48%) of all spending for admissions and fees at OOH E&A.

At-home & screen-based entertainment is winning

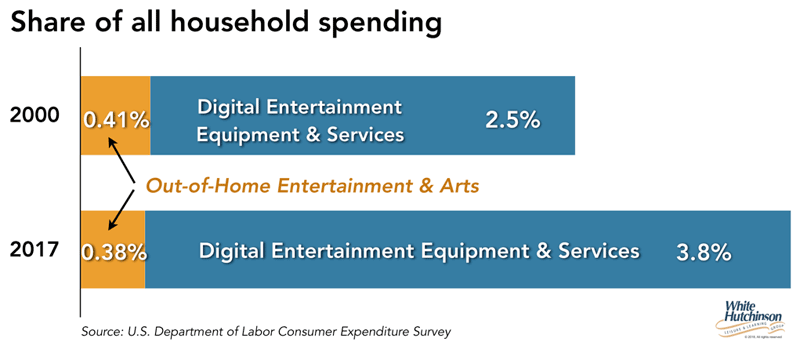

What is happening is digital entertainment options at-home and on mobile devices are winning out over OOH E&A. The share of all household spending for OOH E&A has actually decreased, whereas the share for digital entertainment has increased by more than half.

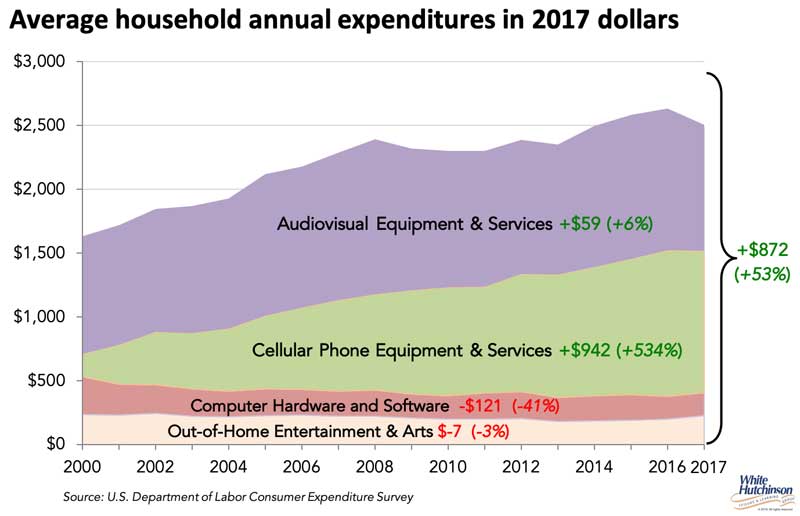

Total household spending for all types of entertainment has increased by 53% since 2000, an average increase of $872 per household, but all the increase has gone for at-home and mobile entertainment.

Basically, these OOH leisure time and spending trends indicate we have lost a large share of the lower and middle class for OOH E&A.

Hourly OOH E&A spending

Today people on average are visiting E&A experiences less often, but when they do visit, they are spending more (same average spending divided among fewer visits). But it is more nuanced than that. When we look at spending per hour at OOH A&E experiences, the spending rate for adults with a bachelor’s or higher decree has increased. Higher socio-economic people are spending more per hour when they do go out, spending on more premium, higher fidelity experiences, which they are willing to pay for. Time has become the new currency for the higher socioeconomic, so they don’t want to waste it their leisure on some mediocre experience.

For the population with a high school degree or some college, their time at OOH A&E has decreased, but their spending has decreased less, thus also resulting in also a higher spending rate per hour. This indicates that when they do visit OOH E&A, they are also looking for high quality experiences for the use of their leisure time.

Today, the higher socio-economic is now a greater share of time spent, attendance and spending than in the past. Today, the lion’s share of the OOH A&E market comes from higher socio-economic consumers seeking premium, high fidelity experiences.

Decline of repeat appeal & attendance at OOH E&A

The trend of declining repeat appeal and resulting declining overall attendance is confirmed by PGAV’s 2019 Voice of the Visitor annual outlook on the attraction industry. PGAV examined trends at 16 different types of major attractions and found that visitors only visited 3.3 different attractions in 2018, down from 3.9 in 2017. Their research also found that first time visitors to attractions reached its highest rate in history in 2018, 47%, reinforcing that consumers are more than ever seeking out fresh and new experiences. Their research also found that attraction visitors’ desire for fresh and new experiences extends into 2019 with a continuing decline to return to the same attraction as last year. PGAV’s 2018 Voice of the Visitor report found that attendance at all 16 different types of attractions, with the exception of sightseeing tours, declined between 2016 and 2017. They also found that repeat visitation was falling at 13 of the different attraction types. They found repeat visits at family entertainment centers had declined from 78% in 2015 to 63% in 2017.

The rise of one- and limited-time events

PGAV’s 2018 The Fight for Attendance report states the growing appeal of non-attractions (limited time, non-permanent brick-and-mortar venues) such as festivals, concerts and other live events and how they are winning a greater share of guests’ time and wallets. What is happening (due to the conspicuous leisure trend and desire to have new and unique experiences) is that people are choosing one- and limited-time experiences (O<Es) over brick-and-mortar venues with fixed attractions that don’t offer new unique experiences (been there, done that).

O<Es are eating CLVs’, and especially FECs’, lunch. The legacy business model that primarily relies on fixed entertainment attractions has lost its appeal. While the size of the pie of attendance at OOH E&A has shrunk, O<Es are getting a larger percentage share and CLVs are getting a smaller percentage slice of the remaining pie. The conspicuous leisure trend is resulting in O<Es gaining market share due to their uniqueness and social shareworthiness, plus the added urgency to visit them due to our anxiety between what others are doing, versus what we are doing, often called FOMO – fear of missing out.

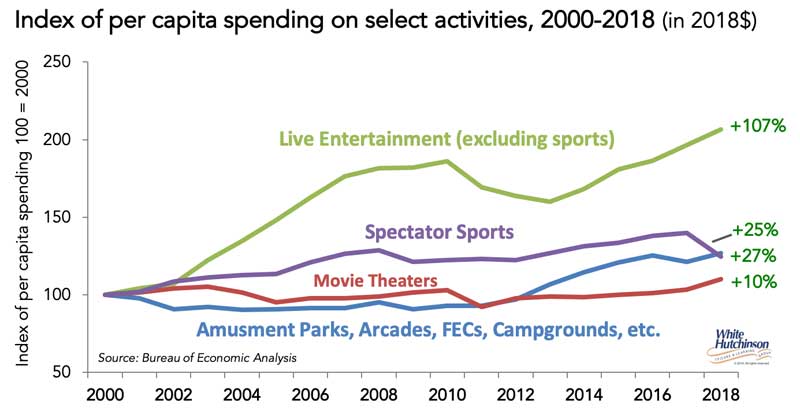

Per capita spending for live events (excluding sports), which are mostly all O<Es, has more than doubled since 2000 (+107%), whereas per capita for non-live entertainment including movie theaters, theme parks, arcades, FECs and related recreation has increased far less. For the 12 months ending June 30, 2018, 46% of all household spending for fees and admissions at CLV E&A was for live events.

To understand how large the universe of O<Es is, we previously researched all the Kansas City metropolitan area festivals, fairs and fests that took place during a one year period (August 2017-July 2018). We were surprised to find 133 and we probably missed several dozen or more that weren't identified as festivals. When we’ve examined other markets, we’ve found a comparable ratio of festivals based on their populations. For example, for another city where the metropolitan statistical area is 55% the size of the Kansas City’s MSA, we found 39 festivals for 2019, and again know we didn’t find them all.

This year, between Memorial Day and Labor Day, we’ve identified 97, yes, NINETY-SEVEN different festivals scheduled in Kansas City (we know we’ve missed some that didn’t get listed in the published list). That’s one for every day between the two holidays.

Not only are there more live and O<Es, but consumers are also attending them more often. Nielson reports that 52% of the U.S. population attends some sort of live music event each year and the percent who attended a music festival in 2018 was 23%, up from 18% the previous year. They also found that attendees at live music events are 35% more likely to come from households earning more than $80,000 a year (the gentrification trend).

Research by EventBrite shows that Americans are attending more live events, including festivals, than ever before. They found that 4 out of 5 Americans (78%) attend live events, ranging from entertainment-focused experiences like music concerts and beer festivals to more cause-related events like marches and rallies. For millennials, the participation rate was 90%, an increase from 82% just three years earlier. And half said they attended a live event so they had something to share online (building their Experiential CVs and social capital). They also found that Boomers attended an average of 3.8 music events each year compared to 3.6 for millennials and visited almost as many food and drink events as millennials (average of 3.3 per year versus 3.6).

A September 2017 survey of UK millennials found that there is a move away from more traditional forms of entertainment (the U.K. OOH leisure culture is very similar to the U.S’s). Tickets to events and festivals now represent almost half of all the money they spend going out (47%). Almost two-thirds went to at least one live event or festival in the past year (62%), and of those that did, they went to an average of 2.3 festivals that year.

80% of UK millennials said they would sacrifice something in their lives to fund going to more festivals/events. One in three would be willing to sell their possessions on eBay to pay for a festival ticket. Even newer passions are not safe – one in eight would give up their Netflix or Spotify premium account and one in six Uber. One in ten would even stop buying birthday or Christmas presents to pay for a festival ticket.

Four in ten UK millennials say they want to go to more food festivals. They’re willing to make sacrifices in their day-to-day eating habits to pay to attend more food-based events; four in ten are willing to give up take-away food and one in three would take a packed lunch to work/college to save money.

Our company’s own nationwide consumer surveys found that in 2018, 43% of Americans age 18+ attended a beer and/or wine festival, 57% attended a food festival and 58% attended a paid music concert. And those who attended, attended approximately two times. For the festivals, participation skewed to higher incomes, whereas for the paid music concerts, the participation didn’t vary significantly by income. Those participation rates are much higher than for many type attractions including such things as bowling, the most popular type of indoor entertainment other than the cinema.

Foodies on the rise

53% of Americans consider themselves ‘foodies.’ American’s are seeking better and unique food at every event they attend. Eventbrite found that food is the second most important factor people consider when deciding to attend any type of event, outranking both the quality of the performers or speakers or whoever else is attending. 62% would go to an event just for the food and 66% would make sure to show up early if they thought the food might run out early.

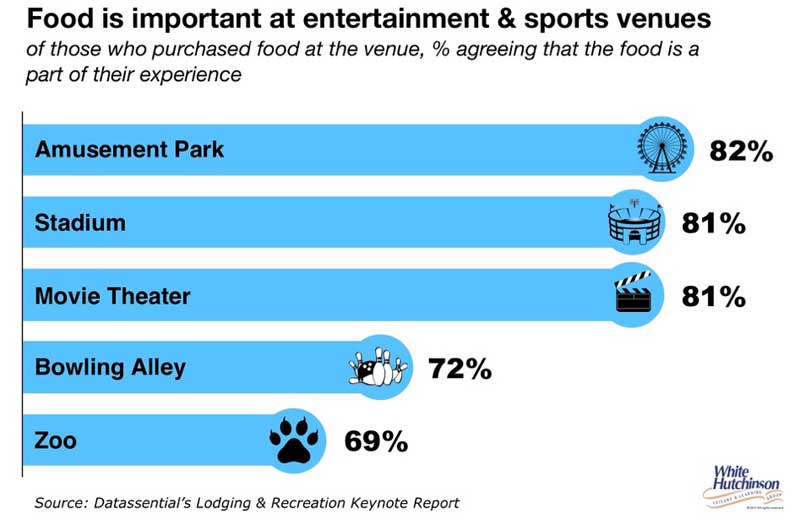

Food has become an important part of any OOH experience and an important factor in choosing other out-of-home destinations.

A study by commercial real estate services firm Jones Lang LaSalle found that 40% of customers will choose a shopping center to shop at based solely on the food the center offered. The International Council of Shopping Centers recently reported from their research that food at full-service and fast casual restaurants motivates 52% of consumers to visit shopping centers. The World Food Travel Association found that 75% of American leisure travelers consider a culinary activity to be motivation for visiting a destination. AAA’s latest travel survey found that 80% of Americans have participated in a unique culinary activity on vacation. 52% of millennials say having food experiences is the top reason motivating them to travel according to a survey by Contiki. Wakefield Research found that nearly 2/3rds of consumers (62%) said they would recommend a vacation destination based solely on its food and cuisine.

Having great food and drink is now very important to the attractiveness of events as it enables attendees to gain social capital. Eventbrite found that 84% of food festival-goers are likely to post pictures of the food while at the event.

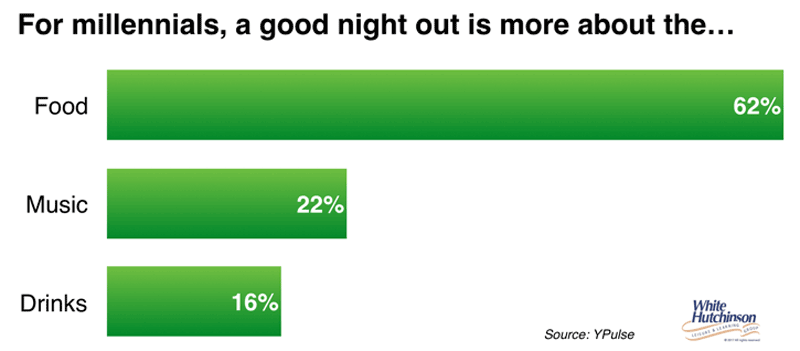

Food and drink at restaurants is now considered a form of OOH entertainment, especially to younger adults. Research by YPulse found that the vast majority of millennials (62%), the prime target market for many entertainment venues, consider a good night out as more about the food than the entertainment.

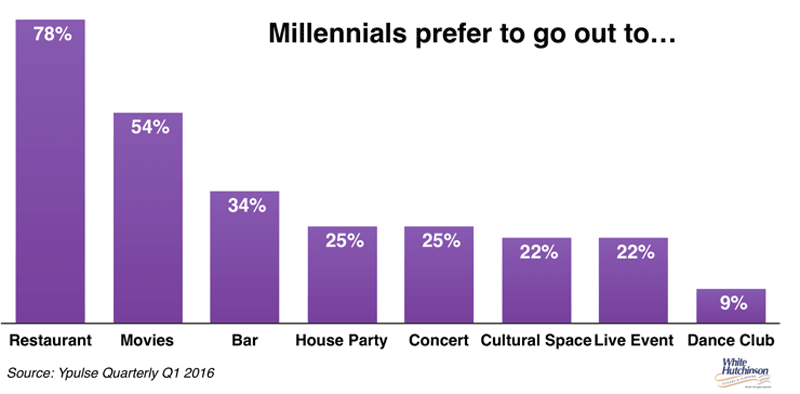

They found millennials prefer to go to restaurants over the movies, concerts and even live events (unless food and drink is a significant component).

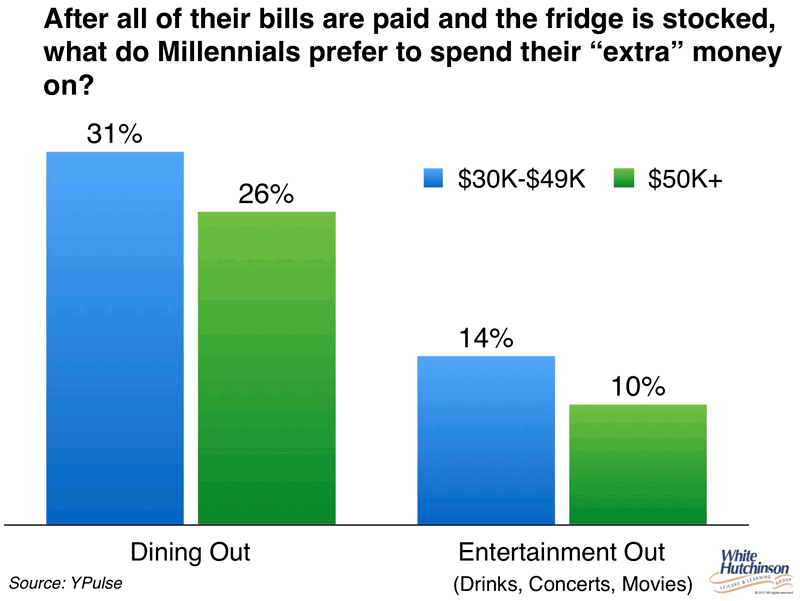

And when we look at those with the most discretionary spending, millennials with $50,000 and above incomes, one in four (26%) prefer to spend their extra money on dining out, while only 10% prefer to spend it on entertainment out (concerts, movies, etc.)

Death of the legacy business model

Yes, it used to be that in the not so distant past we had far fewer entertainment options at home, so boredom produced cabin fever and we sought out location-based entertainment. Those were also the days when there were far less O<E options such as live events and festivals, when restaurants weren’t considered as entertainment, and when social media didn’t reign to both feed FOMO and social capital. Those were the days when fixed attractions at brick-and-mortar entertainment venues had repeat appeal. That appeal has now dramatically declined, in some cases vanished. Why do the same old, same old, when there are so many new, different and unique OOH experiences to enjoy with your limited OOH leisure time (and less OOH leisure time for large segments of the population than in the past). Yes, the old business model for CLVs and FECs depending on repeat appeal is undergoing serious disruption due the overexpansion of CLV venues, the large number of OOH O<Es, the appeal of restaurants as entertainment and the appeal of just staying home with all its entertainment options.

In the legacy family entertainment center model, it was always understood that not all attractions lasted forever. Usually every three or so years, FECs looked for some new attraction to add, the next big thing. However, that life cycle has now reduced to sometimes one visit. We are seeing just about every legacy model CLV rapidly adding new attractions to stay relevant and as a result all the legacy model venues are becoming homogenized. FECs are installing ropes courses and Ninja courses, once the exclusive domain of adventure venues. Trampoline parks are installing arcades and bumper cars, once limited to FECs. Bowling centers are become FECs by installing laser tag and game rooms while FECs are now adding bowling lanes. Escape rooms, once a free-standing attraction, are being added to FECs. Indoor high-speed go-karting and FECs are adding axe throwing, originally a free-standing attraction. And many are now adding virtual reality, hoping it will be the next big thing to drive both new and repeat attendance. As a result, these venues are still following a legacy business model based on fixed attractions, becoming commodities competing on price rather than unique experience.

What’s the answer?

So, what’s the answer, what is the future-proof new business model for brick-and-mortar entertainment type venues? How can they stop the disruption from this perfect storm? The answer lies in four pillars for success in the future.

Pillar #1 – Limited - and one-time events

Although having some attractions such bowling and other social games are still an important part of the mix as they help facilitate socialization, the primary reason that people do go out. But they alone no longer work. They need to be mixed with changing limited- and one-time events (L&OTEs) to offer continuous uniqueness , harness the power of FOMO and offer guest the opportunity to build their social capital and add to their experiential CVS. Different unique events fit the model that has become a contemporary primary decision criterion for where people go when they do go out. In fact, it is their high appeal that motivates people decide to leave the convenience and comfort of just staying home.

This is something that museum, science centers and botanical gardens learned long ago. They have continually changing exhibits to drive repeat visitation.

Success with CLVs now requires heavy programming of L&OTEs. Operators of CLVs now need to become producers of continually changing experiences to be successful

Pillar #2 – Food and drink

The legacy business model of having a concession stand or snack bar with mediocre food no longer cuts it. Good quality, contemporary and foodie-worthy food and drink, including beer, wine and hopefully cocktails, is now an essential component for any successful CLV. The selections need to offer the essential foodie qualities of adventure and discovery. The food and drink needs to be so good that it is destination-worthy on its own. It combined with interactive social games, the venue mix known as social eatertainment, can give a CLV a highly competitive advantage over restaurants.

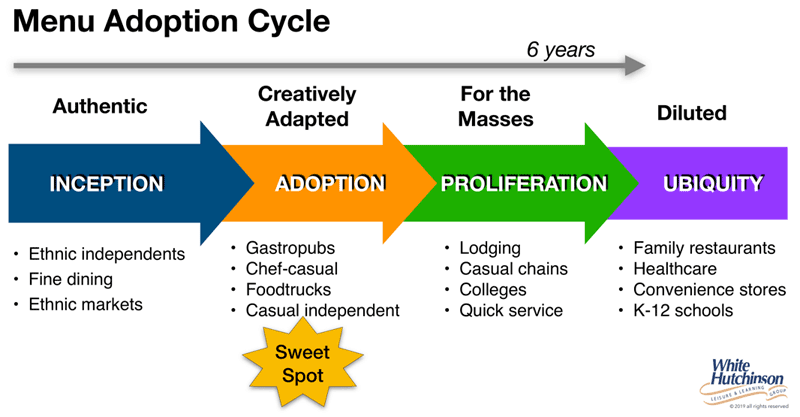

Historically, food trends generally took 12 years to move through the entire Menu Adoption Cycle from inception to ubiquity. The rapid evolution of consumer food cravings and preferences today has roughly cut the cycle time in half to six years. The sweet spot of the American consumer’s appetite used to be at the Proliferation stage – safe, mainstream foods that are at most slightly progressive. Now the sweet spot where food and drink needs to be has changed to one stage earlier to Adoption – adventurous dining, discovering new foods and flavors, including ethnic foods, even street foods. That stage now evolves from the beginning of the Inception Stage in just a few years. Some true foodies are now even searching out new and unique foods and drink at the Inception Stage.

Food and drink also offers the opportunity to develop limited-time offerings (LTOs) and events around food, wine, beer and liquor, no different than what many festivals offer. LTOs are a frequent and common marketing tool that many chain restaurants now use to drive repeat visits.

Today, for the successful new model CLVs, such as Top Golf, Punch Bowl Social and many of the boutique bowling concepts, food and drink makes up the majority of revenues.

Pillar #3 – Socio-economic appeal

For economic and other reasons, we have lost the middle class as significant visitors to CLVs. The majority of visits and revenue at CLVs comes from higher-socioeconomic guests. They account for the majority of all time spent at E&A venues and very nearly three-quarters of all revenues.

CLVs need to be designed and operated at the caliber that higher socio-economic guests expect. The quality of the experience they get for their limited leisure time is more important than cost. They are looking for premium experiences and will pay a fair price for it.

Catering to the high-socioeconomic does not exclude the middle-class. When they go out, they too are looking for a premium experience. The data indicates although they go out less often than in the past but that they are spending more when they do.

Pillar #4 – Make it social

Research has consistently found that the primary reason people do go out, whether to a festival, a restaurant, a concert, a museum, an entertainment venue or any other OOH leisure destinations, is to socialize. 69% of consumers say they are more likely to visit a restaurant that creates a space that encourages them to hang out and socialize. Games, food and drink act as facilitators of socialization. Combined, they can offer a persuasive reason to leave home. In today’s world, socialize, especially to the younger generations, not only means socializing face-to-face, but also sharing on social media. The OOH E&A experience needs to be shareworthy.

The new business model

With the rapidly expanding possibilities of what we can do with our leisure time, both digitally and in the real world, and with our desire to seek out unique, quality and sharable OOH experiences, success today, but also in the future, requires new business model CLVs to offer a highly social experience that combines social interactive games and attractions with limited and one-time events and foodie-worthy food and drink in a setting and with guest services that meets the expectations and appeals to the higher-socioeconomic.