Our company prides itself in using research to identify trends and guide our clients to future-proof their location-based entertainment centers (LBEs), which includes the categories of family entertainment centers (FECs), social eatertainment venues and agritainment/agritourism farms. As they say in hockey, you need to skate to where the puck is going to be, not to where it has been. We call this the “evidence-based” approach for consulting, design and production of LBEs.

The pandemic has suddenly and drastically changed the future, the direction of where the puck is now headed. Suddenly we are in a different world with a changed consumer. Our company is fortunate to have access to lots of timely survey data from some of the top consultancies and research companies who are examining peoples’ propensities to return to entertainment and cultural venues and restaurants. This gives us a good indication of what the future holds for LBEs during and after the pandemic. Unfortunately, it’s an inconvenient truth. But as bad as it may be, it is always better to know what is ahead so you can plan for it.

Every for-profit LBE business model that existed to offer consumers an entertainment experience before Covid-19, just a short two months ago, is now obsolete. With the stay-at-home orders, every business model, every LBE formula, is a 100% loser with zero customers. For at least the present time during lockdown, every type of LBE, whether a community-based LBE such as a FEC, a social eatertainment center, a regional amusement park or a tourist destination theme park, have all been replaced by at-home digital and virtual entertainment in the new “novel lockdown abnormal.”

LBEs are looking forward to getting back to normal after the lockdown ends. Getting back to the pre-corona normal will never happen! That ‘normal’ we knew in 2019 is history and will never exist again. In a sense, every LBE that reopens will be a start-up in a new world. There will be changing and evolving phases of corona normals that will evolve post-lockdown until we get to the final post-pandemic (post-pan) normal. And few of the current LBE business models will be a financially viable fit for any of those new normals. And getting to that final post-pan era is probably going to take a lot longer than anyone is anticipating.

The incompatibility of the pre-Covid-19 LBE business models with the evolving covid normals is multidimensional:

A changed consumer

- The pandemic has changed most peoples’ views of the outside world. People are being trained to view the outside world and contact with other people as dangerous, as a threat to their health and to their lives and the lives of their loved ones. They have become germaphobes, or more appropriately, virus-phobes. Social distancing, fear of touching communal surfaces, fear of close contact with other people, fear of crowded places and many other fears of the outside world have become behavioral norms. FOMO has morphed into FOGO (fear of going out). The mindset of self-preservation has now become dominant. These fears and the behaviors they create will last long after the crisis passes. For some people, they may never vanish.

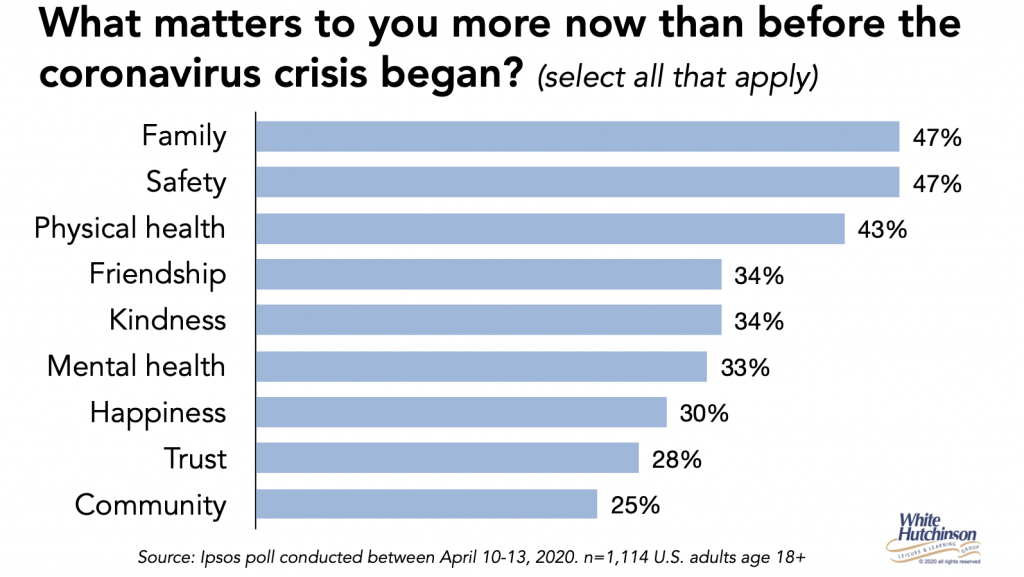

- Facing possible mortality for yourself or your loved ones changes your perspective of what is important. The pandemic has reset peoples’ values. It has given people time to learn and do things (at-home) they didn’t previously have time for. It has forced people to think about how they live and what activities are really important to them. The virus and our current ‘novel’ way of life will affect our every financial and lifestyle behavior even when the threat has passed.

- During lockdown, we’ve been using virtual and digital social and entertainment options and some of these have become new routines and habits that are likely to be sticky and permanently replace some of the visits we previously made for out-of-home social and entertainment experiences. Many LBE experiences may no longer be as relevant and compelling compared to the at-home ones we have gotten comfortable with and are enjoying. This will be especially true for mediocre LBE experiences, which will be among the first to fall out of favor post-lockdown.

- During the lockdown, people who didn’t previously cook are being forced to learn how. People are cooking more and enjoying it. Over half of people (52%) say they are cooking from scratch more. Just look at the explosion on social media about baking bread and the shortage of yeast in supermarkets. People are learning and enjoying new hobbies. Much of this activity will remain relevant post-lockdown and utilize some of their discretionary spending and leisure time that was previously spent out-of-home, including at restaurants and LBEs.

- Unemployment, a recession, added debt incurred during the crisis and the reminder that it is important to have cash saved for emergencies will create a new and long-term generation of risk-adverse supersavers. Discretionary spending will be greatly reduced for years to come. A just-released Harris Poll found that 41% of adults say they are very likely and 38% said somewhat likely (total 78%) to save more and spend less. And consistently across genders, ages and income, people say they anticipate spending one-third less on movies and shows.

LBE venue and operation requirements

- Social distancing changes the capacity of most LBEs. Their pre-corona financial models were based on accommodating a certain number of people at peak times, usually on Friday evenings, weekends and holidays. Reduced capacity means both their attendance and revenues will be dramatically reduced, possibly even below their breakeven point. For example, if we assume for one venue that peak time attendance was 70% of all attendance and if we assume it is reduced by only one third, the venue can only achieve 77% of pre-covid attendance and revenues (assuming adequate demand, the same pricing, per capita expenditures and distribution of attendance). If peak capacity reduces by 50%, as it will need to for most restaurant seating areas, then attendance and revenues can only reach 65% of pre-corona. Based on LBE industry economics, these are not financially sustainable revenues for most pre-covid LBE business models.

- The need to implement new safety standards in LBEs will increase labor costs. This includes daily deep cleaning, more frequent cleaning and disinfecting while open, and such things as a door person to check guests’ temperature or immunity passports and to get their contact information. There will also be increased cost for cleaning supplies, staff masks, one-time use menus and other items to make the facility not only safe, but even more importantly, perceived as safe by customers.

- Even if social distancing is no longer mandated by governmental authorities, many people will still require it to feel safe in order to attend. Large corporate and group events, which traditionally could generate as much as 30% of an LBE’s revenues, will fall out of favor. With social distancing, they are very difficult, if not impossible to run in any appealing fashion. Most private birthday party rooms are not large enough to allow for social distancing for the typical size party. Buffets for group events will no longer be perceived as safe.

- Some attractions make it impossible to maintain social distancing and are extremely difficult and expensive to clean and disinfect after every use multiple times a day. The close down time for cleaning will restrict their daily throughput. They will no longer be viable attractions to operate. This could include such things as soft play, trampolines, rock climbing walls and escape rooms.

- There will be a capital cost for needed changes to make facilities safe such as longer queues, creating safe distancing in restrooms for sinks and urinals and making as many things as contactless as possible.

These expenditures include technology for contactless transactions and contactless restrooms including changing paperless hand air dryers to contactless paper towel dispensers (see my blog, Will your entertainment or cultural venue be ready for the post-lockdown guests?)

Once LBEs are allowed to open, how many customers will return and how fast attendance and revenues will ramp up will have a major impact on which LBEs survive to the post-pan era. All the research is consistent. LBEs will have three basic phases of ramping up over time based on different segments of guests.

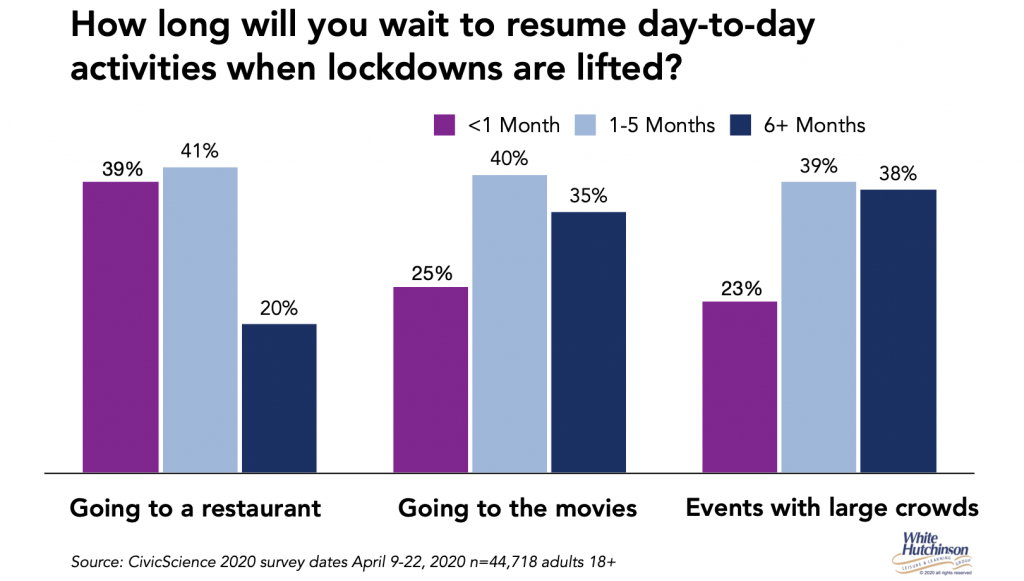

Phase 1 – A percentage of people will return to different LBEs as soon as they open. This will vary based on the type of LBE and partially on sociodemographics.

Phase 2 – Many people will wait longer and will return over time as they rebuilt comfort and trust that they will be safe attending as infection and death rates decrease and there is assurance from health authorities. Their level of comfort will vary based on the type of LBE and activity. The level of comfort with various activities will be almost directly correlated with the size of the crowd involved, the density of people and whether it is indoors are outdoors.

Phase 3 – there is another group of people who will wait to return until either they get vaccinated against coronavirus or there is herd-immunity (requires 60%-80% of the population to be immune through vaccination).

Still, there is a group of people who say they may never return or will wait until long after the post-pan normal when a vaccine is developed and fully deployed.

The multiple surveys our company has examined are totally consistent on this return behavior, although the percentages vary some. They all show the highest percentage of people who will return soon after businesses reopen will be to restaurants.

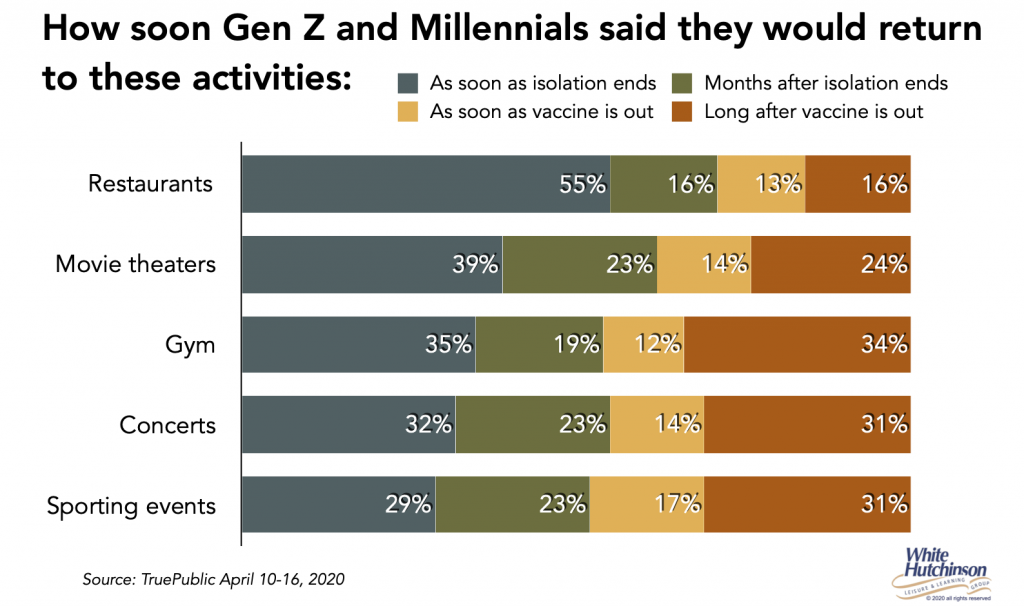

A TruePublic poll also examined what percent of Gen Z and Millennials would wait for a vaccine before returning to different activities. One-sixth of Gen Z and Millennials say they won’t return to restaurants until long after a vaccine is out. It’s one-quarter for movie theaters and almost one-third for concerts and sporting events.

A just-released poll by Reuters/Ipsos found that only 27% of people would go to a movie theater, concert or live theater performance when venues reopen. Thirty-two percent said they would wait for a vaccine, even if the vaccine took a year to develop, before going back to the movies, theater or concerts. The rest said they either “don’t know” what to do or may never attend those events again.

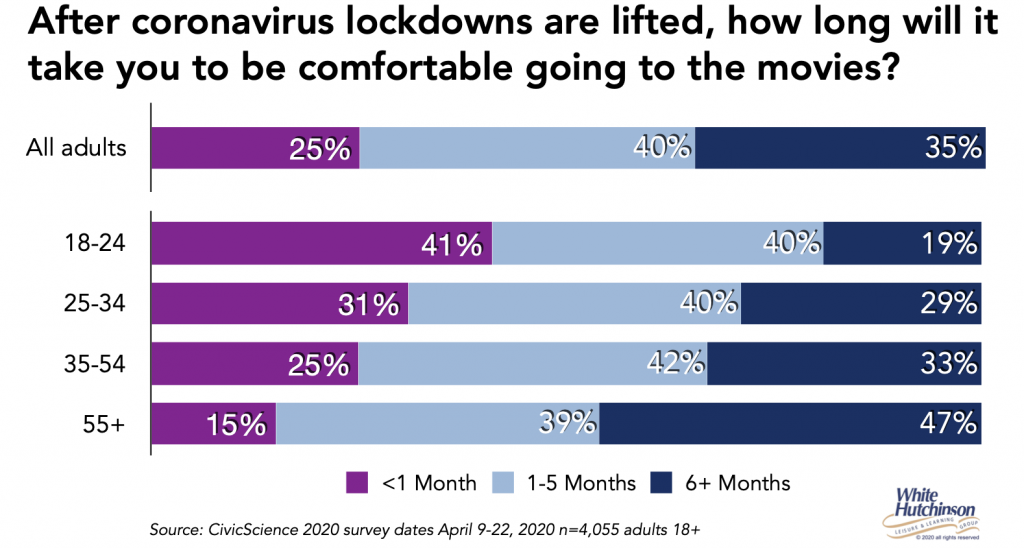

Surveys are also consistent that the speed of returning is inversely related to age – the younger, the sooner they will return. This is the data from a CivicScience poll for movies.

Surveys are also finding that there will be a net decrease (people attending less minus those attending more) in attendance. For example, Performance Research found there will be net decrease in attendance at theme parks by 14% of people. E-Poll Market Research found a net decrease in frequency of attendance of 13% for theme parks, 11% movies, 9% eating out and 12% attending music concerts/theater.

The timeline to get to post-pan with widespread vaccination is likely to be 2 to 3 years.

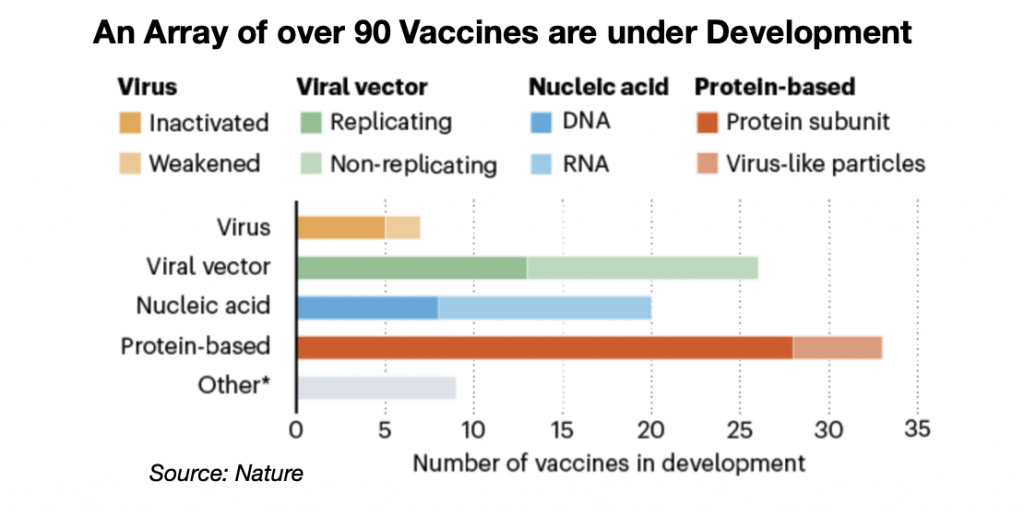

There are herculean efforts underway to develop and manufacture a vaccine. Over 80 potential vaccines are under development, but none are yet proven effective.

Over $2 billion is being invested in the development of ten different potential vaccines, the construction of their manufacturing facilities and the actual manufacture of some of the vaccines in millions of doses, although none are yet proven and it is likely that the majority, and possibly all may prove unusable. Yes, there is the possibility that an effective vaccine might not be developed in the next year or two.

Current optimistic estimates are 12 to 18 months to develop a vaccine (Oxford University claims they may have one by September). Then, the vaccine needs to be manufactured in massive quantities, widely distributed and 60% or more of the population needs to be vaccinated to reach herd immunity (assuming recovered Covid people won’t have long-term immunity). That is optimistically estimated to take another 12 to 18 months. It’s also likely that the most vulnerable populations will be given vaccination priority. This includes the older population. That will mean the younger population, who are the prime target age group for most LBEs, may have to wait later in the vaccination period to receive theirs.

It is likely if a vaccine is developed on the current optimistic timelines, we won’t have herd immunity and the post-pan era won’t arrive until sometime in 2022, maybe not until 2023.

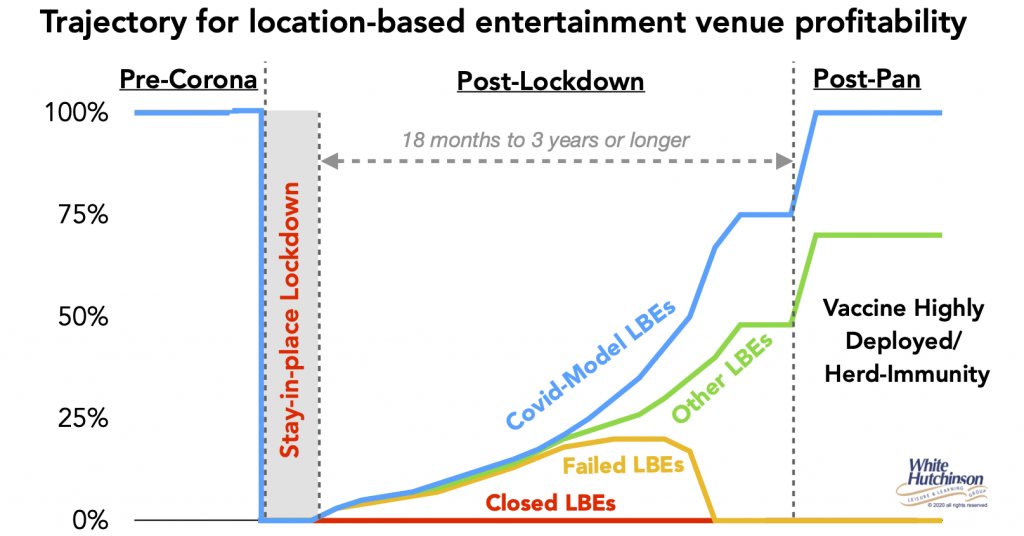

I see four different trajectories of business for four different categories of LBEs heading into the future:

- Many LBEs will not reopen. Many were financially struggling or marginal before coronavirus. Many won’t have adequate capital to survive until they can reopen, even with Payroll Protection Program loans. Others will choose to not reopen.

- Many LBEs will reopen but will either be incompatible with the post-lockdown world and/or the growth of business will be too slow, and they will keep losing money until they are insolvent and close.

- Other LBEs will make modifications to better adapt to the post-lockdown consumer, but attendance and revenues will still grow slowly over the year or more post-lockdown period until they get a final bump of business post-pan with the wide deployment of a covid vaccine and/or there is herd immunity. That will remove any social distancing constraints on design and operations and the return of the vast majority of customers. Their rates of growth will vary based on many factors, including their offerings and target markets. However, due to the pandemic-changed consumer and their changed values and changed and lasting at-home entertainment behaviors, as well as some people still staying away, those LBEs will never return to their pre-covid level of profitability.

- There will be innovation and new covid business model LBEs will evolve. These could be pre-covid models that make all the adaptions and changes necessary to be a perfect fit, completely new model LBEs or a few of the pre-covid models that end up still being a good fit. Their attendance and revenues will ramp up faster and when post-pan arrives, they will be as profitable, if not more profitable, than pre-covid business model LBEs.

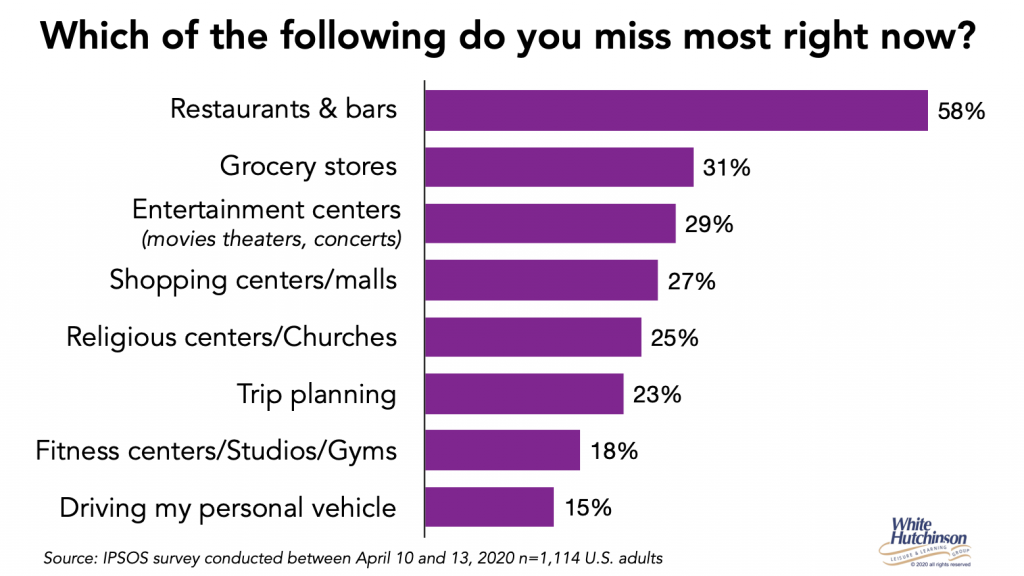

So which LBEs have the highest probability of survival and success? There were a number of LBE business model trends already under way pre-corona that will probably accelerate. This includes the growth of venues targeting adults (rather than families) that were focused on offering high quality interactive social experiences that included destination-quality food and drink that accounted for more than half of revenues. The research shows that consumers are missing restaurants and bars the most and rank them as the number one business they want to return to with the highest percentage of people saying they will.

Indoor and outdoor interactive social eatertainment venues should have an advantage as they combine both dining and drinking, entertainment and a social experience, although social distancing will still be a challenge for the indoor ones such as Punch Bowl Social. Top Golf doesn’t have that disadvantage as its bays are socially-distanced by design, each bay’s group is small and disinfecting the handles of golf clubs, tables and chairs will not be complicated nor take much time between the changeover of groups at each bay. Additionally, they are an outdoor activity, which people consider as safer than indoor. However, their corporate group business will be more limited.

Other outdoor entertainment experiences, especially if not too densely crowded, should fare well. Pre-covid there was a significant growth in agritainment/agritourism offerings, especially fall pumpkin patches/corn mazes/ festivals. If farmers can innovate the design of corn mazes so people won’t have to pass each other in the narrow aisles so the mazes will be perceived as safe, the fall farm events could perform well, especially since they are outdoors.

At least one type of outdoor attraction ends up being a good fit for the post-lockdown era – miniature golf, as it has built-in social distancing between each group at a different hole and is as much a social experience as it is a play activity.

One type of LBE that faces a high pandemic-era challenge is movie theaters. An industry colleague, Bob Cooney, just wrote a very informative article about the future of movie theaters, “Why COVID-19 might cause movie theaters to disappear.” One good point he made is unlike many LBE experiences, “movies are a shared, not social, experience.” Our research shows that people will crave physical social experiences post-lockdown. You can access Bob’s article here.

Bob’s point about shared experiences now having less appeal may apply to other attractions, including game rooms, a mainstay and significant revenue generator for traditional FECs. In fact, most games, with a few exceptions, aren’t even shared, much less social. They are solo experiences.

Covid-19 will have an everlasting impact on out-of-home leisure and entertainment, including the LBE industry. We are currently in uncharted waters. Once the lockdown has ended and LBEs open, we should be getting some good data on peoples’ actual behaviors and will be able to more accurately predict the course of different LBEs into the future. My guess is that it may be sometime in June and I’ll be able to report some of that new data to you.