Vol. XXIII, No. 3, March 2023

- Editor's corner

- 2023 forecast for the attractions industry

- Esports isn't living up to its hype

- The weekday daytime leisure economy

- How the young adult market will shift

- Pistachio is a recent flavor trend

- For young adults, owning a VR headset is as rare today as it was in 2018

- Have we returned to pre-pandemic normalcy?

- Long waits reduce revenues and profits

- Store vacancies open opportunities

- Covid-related popularity of pickleball may be faltering

- Why LBE models need to be different today

- Competitive socializing with soccer

- It's all about perceived value, not just price

- Births down not totally bad news

- Announcing Agritourism Today

- Surge pricing comes to bowling

Why LBE models need to be different today

Our company is in its 34th consecutive year working in the out-of-home (OOH), location-based entertainment (LBE) industry, an industry that is so continuously changing, that even its name has had to evolve. Initially, and unfortunately still generally referred to as the 'family entertainment center' (FEC) industry, most successful venues today aren't designed for families. Even LBE is probably no longer an appropriate name for the industry, as most venues now need to offer so much more than just entertainment to be successful. Entertainment alone often is no longer attractive enough to get consumers out of their homes. Food and beverage and social experiences with family and friends have become significant components in many new models. It's now all about the whole experience, not just the entertainment attractions like in the early days.

But whatever you call it, the industry is entirely different today than in its early days as FECs. And the pandemic has accelerated the change to what a successful model needs to be. There are far more types of venues targeting different niche markets than the FEC concept of trying to be all things to all people, including families with children. There is now vastly more competition than just ten years ago, including not just all the LBEs, but also all the digital entertainment and social screen-based options we now have to enjoy in our homes sitting in our comfy lounge chairs.

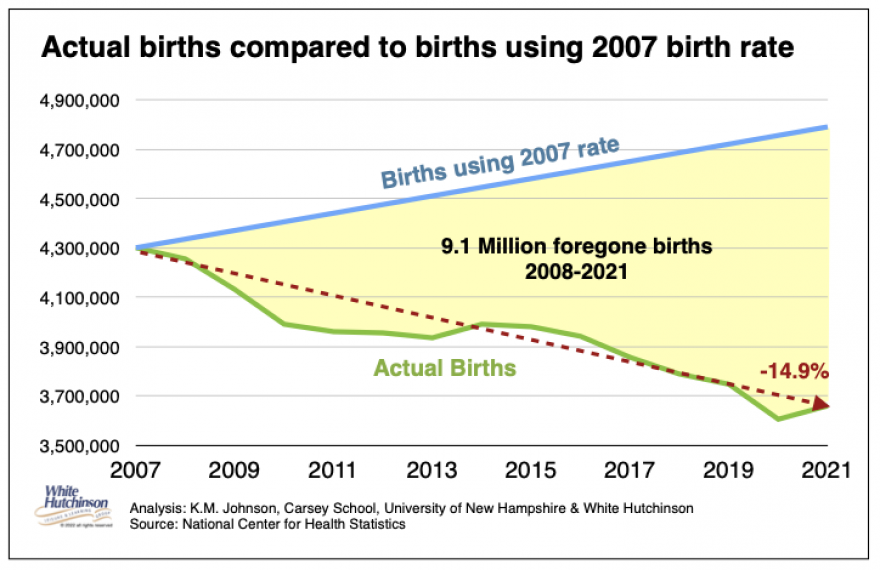

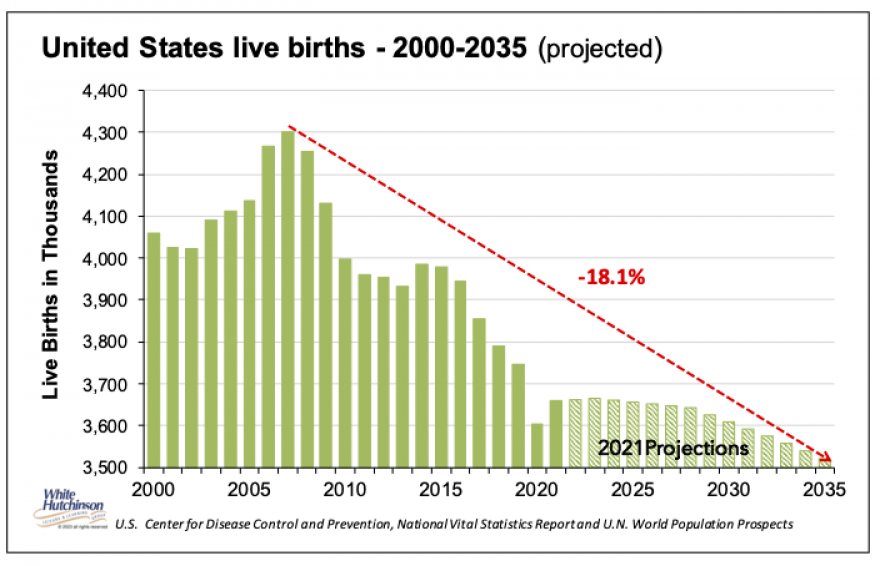

The market has also changed in terms of demographics. In the early days, the proportion of the population that was families with children was much greater. The pandemic has accelerated a baby bust, a long-term decline in births that started in 2008. There were 700,000 fewer births in 2020 than in the peak year of 2007. If the birthrate hadn't begun to decline in 2008, we would have had 9.1 million more children in 2021 than we did.

The number of births is projected to continue to decline into the future.

This means the percentage of households with children, the 'family' market, has declined and should continue to. The family market is typically parents with preteen children. So, we examined how large that market was in 2021, the most recent year detailed U.S. demographic data is available. Since the primary target market for most LBEs is younger adults, we examined households headed by age 25 to 39 with children under age 12.

What we found was only 40% of those households have children under 12. The larger market at 60% is adult-only households. And if you consider those households with children where the parents will hire a babysitter to go out, the adult-only market is the massive market to target, not the family market.

This explains why we are seeing such rapid growth of new LBE models that target adults, including the many competitive socializing models, including Top Golf and its imitators, and venues featuring bowling, darts and even axe throwing.

Subscribe to monthly Leisure eNewsletter

Vol. XXIII, No. 3, March 2023

- Editor's corner

- 2023 forecast for the attractions industry

- Esports isn't living up to its hype

- The weekday daytime leisure economy

- How the young adult market will shift

- Pistachio is a recent flavor trend

- For young adults, owning a VR headset is as rare today as it was in 2018

- Have we returned to pre-pandemic normalcy?

- Long waits reduce revenues and profits

- Store vacancies open opportunities

- Covid-related popularity of pickleball may be faltering

- Why LBE models need to be different today

- Competitive socializing with soccer

- It's all about perceived value, not just price

- Births down not totally bad news

- Announcing Agritourism Today

- Surge pricing comes to bowling