Editor's corner

This month we're looking at what past and current trends indicate the "new normal" may be for out-of-home entertainment in the post-pandemic world. It's for sure we won't be going back to the pre-pandemic 2019 normal. The two-year pandemic has brought many once-in-a-lifetime changes to how we live, work, play, and stay healthy. These will all impact the frequency, spending, and type of out-of-home entertainment we will be participating in.

Competitive socializing

We credit Kevin Williams and his very popular weekly enewsletter, The Stinger Report, for introducing the term "competitive socializing" to describe a fast-growing category of eatertainment venues. In his enewsletter, he says that competitive socializing "is a blending of a hospitality atmosphere married to a re-imagining of conventional competitive entertainment." He says the term has been used in the U.K. since 2015 to define pubs incorporating a circus entertainment vibe or bowling with food and beverage.

So, what exactly is a competitive socializing venue? First, it incorporates a particular category of competitive group entertainment experience that is highly social. Having an entertainment experience solo is entirely different than having the same experience with a group of people. Group experiences are shared experiences and typically about socialization. The dynamic of group validation is an essential factor that differentiates a group experience. The competitive group games that have stood the test of time have done so because of their strong socialization component. This is one of the main reasons bowling, billiards, miniature golf, darts, and even bocce and shuffleboard have stood the test of time. In these type games, group members validate the play of each other. One person plays while the others watch, comment on, and review that person's performance.

Bonding is an essential component of group social dynamics. Sharing food and drink is the oldest form of group bonding. It started when ancient man sat around the campfire sharing food and drink, and now it's encoded in our genes. This is why food and beverage is an essential component of any competitive socialization experience. Yes, competitive entertainment alone can offer group validation, but it doesn't provide the primal campfire bonding experience that food and beverage bring to the table. The combination of bonding through repeatable quality, even craveable food and drink offerings, and competitive entertainment is what makes competitive socialization a bonding experience with far greater appeal (and higher per-capita sales) than other types of entertainment experiences or just the competitive entertainment without the simultaneous food and drink.

Not all forms of competitive entertainment can become competitive socialization. Activities like laser tag, competitive arcade games, go-karts, ping pong, and escape games lack the rhythm of play where one person plays while the other group members watch, talk among themselves and eat and drink.

We are seeing new forms of entertainment become competitive socializing. Ax-throwing venues like Lazertron has developed definitely qualify as competitive socialization. TopGolf and other imitators have taken the solo driving range model and turned it into competitive socialization. Puttshack and Swingers have taken miniature golf and added food and drink in a very hospitable atmosphere to make it competitive socialization. Flight Club has done the same with darts.

High-quality socialization experiences that can't take place in the virtual world or in the coming metaverse will be a driver for out-of-home experiences in the post-pandemic new normal. As a result, the competitive socialization model should be one of the formulas for success in that era.

How the pandemic has altered our eating habits

The latest Hartman Group report, "Shifting Food Habits & Routines: 2021 Eating Occasions," looks at how the pandemic has altered our eating habits. Even before the pandemic, the food and beverages venues have often become as important as the entertainment they offer. Three changes that they identified have implications for out-of-home entertainment venues going forward.

- Cooking fatigue has set in with a return to away-from-home eating occasions at restaurants and other venues offering food and beverages.

- More than before the pandemic, there will be an increase in social eating occasions, more with families or couples than with friends.

- Consumers are willing to pay for delicious flavor experiences. They are trading up and see the value for food and beverages that offer enhanced and new unique flavor profiles, especially true with Millennials, parents, and those with higher income levels. As prices continue to increase, consumers will become more discerning, paying more for the products they deem worth it for the enhanced experience they provide. Premium eating occasions will be in demand.

The post-pandemic out-of-home entertainment new normal

Hopefully, with the rapid drop in Omicron infections and the lifting of mask mandates in most parts of the country, we may be very close to the end of the pandemic. What will the "new normal" be for out-of-home entertainment when we are there? Inevitably, we won't be going back to the pre-pandemic 2019 normal. Two years into the crisis, the pandemic has permanently changed us. The pandemic has brought many once-in-a-lifetime changes to how we live, work, play, and stay healthy. Many will become part of the "new normal." Those changes are likely to include the entertainment we participated in during the pandemic, predominantly digital at-home entertainment.

Accurately predicting the future is impossible. We know that the pandemic accelerated many trends that were already underway. Examining pre-pandemic trends and some changes during the pandemic should give us some indication of where out-of-home entertainment is headed in the post-pandemic world.

Pre-pandemic, several long-term trends were already underway for participation, including the amount of time and the amount of money consumers were spending on digital and IRL out-of-home entertainment.

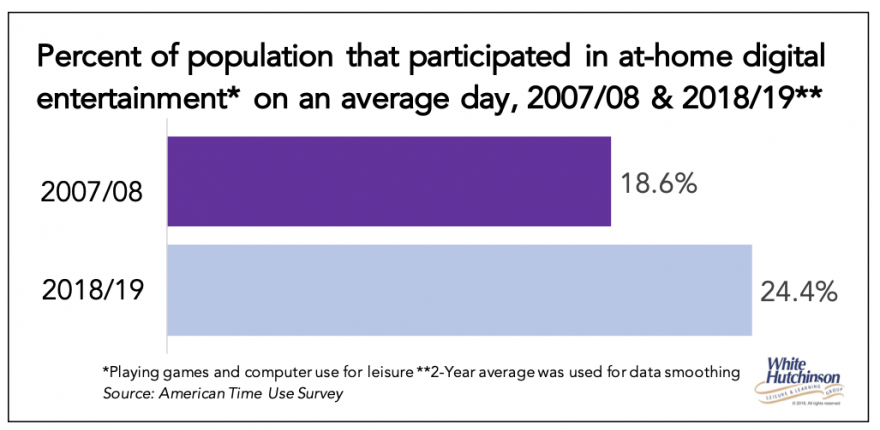

The percent of the population that participated in at-home digital entertainment on an average day increased by nearly one-third over the eleven years before the pandemic, from 18.6% to 24.4%.

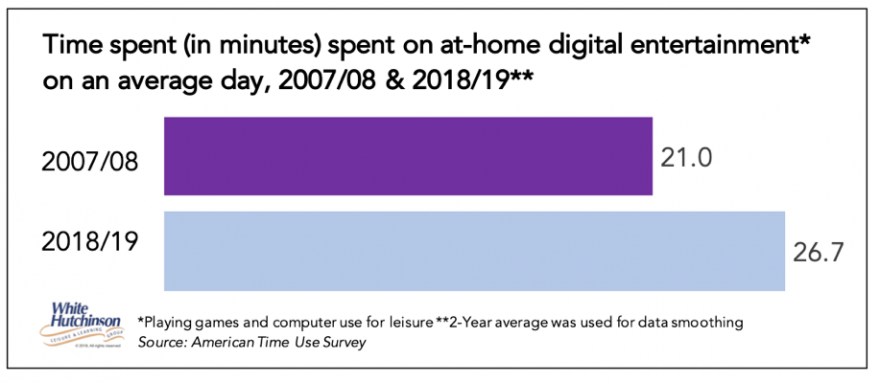

Not only was participation up, but the time spent on at-home digital entertainment increased as well.

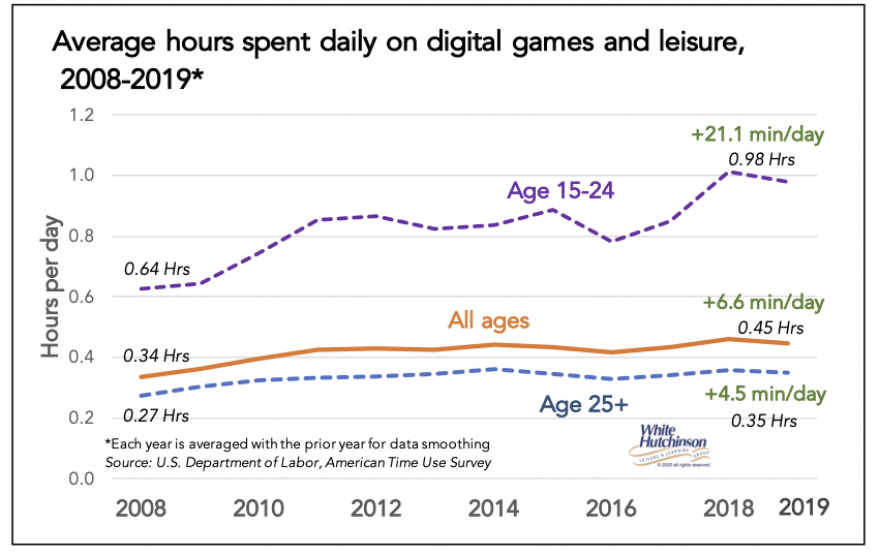

The most significant digital time increase was with ages 15-24. But ages 25+ also saw an increase.

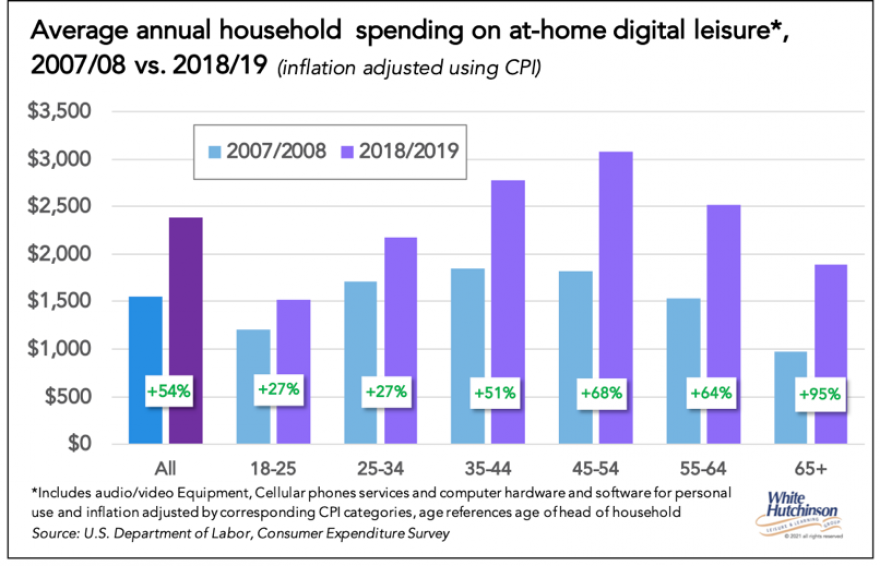

Spending on digital leisure and entertainment was up significantly for every age group.

The use of digital socialization and entertainment increased during the pandemic and is highly likely to continue into the post-pandemic era. A Deloitte study found that more than two-thirds of consumers who have tried a new digital activity or subscription during the pandemic say they are likely to continue their new activity or subscription. A ForgeRock survey of Americans found nearly half of consumers said they would use more online services and apps post-pandemic than they did pre-pandemic.

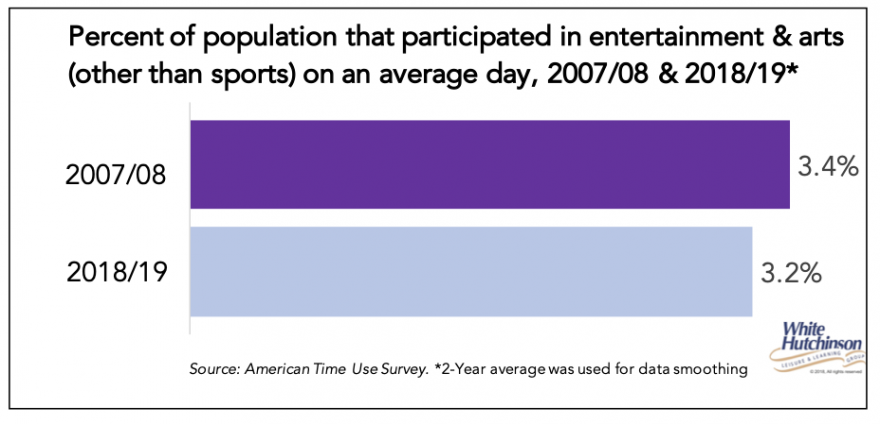

Over those same pre-pandemic eleven years, the participating rate in out-of-home entertainment and arts declined.

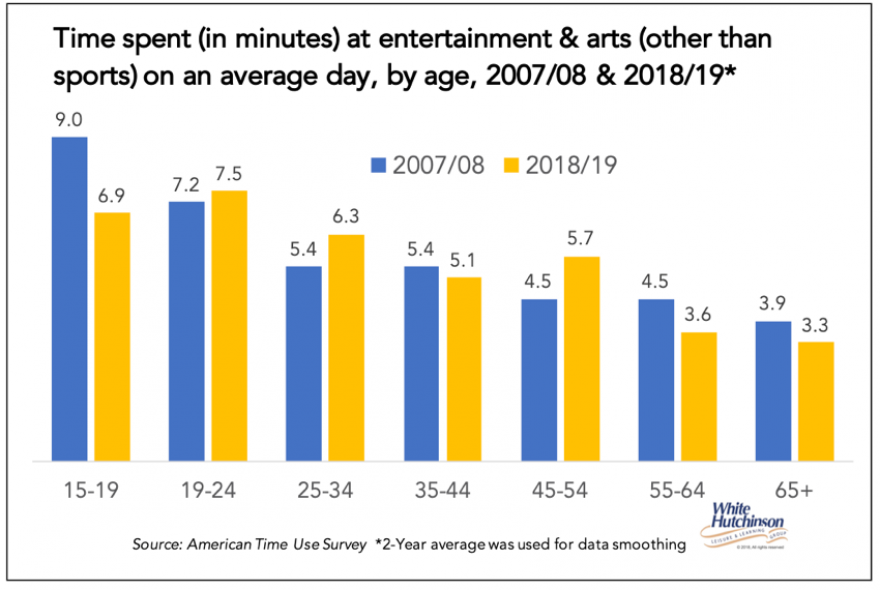

The time spent at out-of-home entertainment and arts increased for some age groups and declined for others. The most significant decline was for 15- to 19-year-olds.

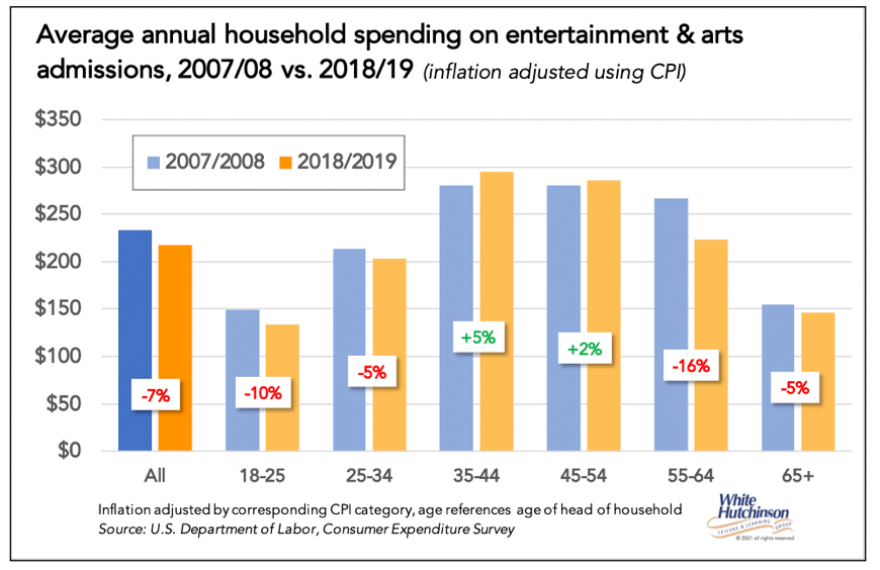

Over the eleven years, average annual household spending on entertainment and art fees and admission declined by seven percent, with declines in the 18-34 and 55+ age groups.

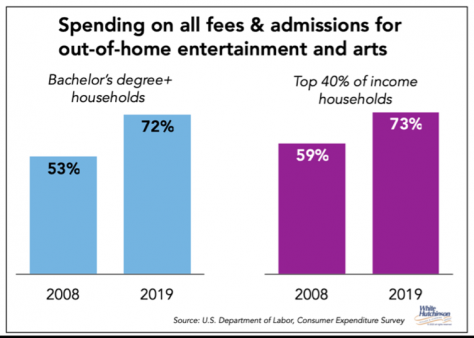

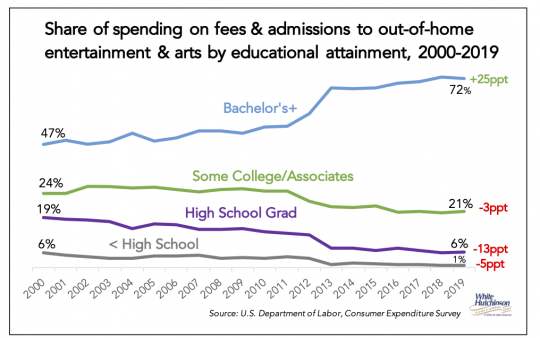

During the same time period, there was a significant gentrification shift, with an increasing share of spending for out-of-home entertainment and arts by bachelor's degree+ and higher-income households. They increased from slightly more than one-half of all spending to nearly three-quarters.

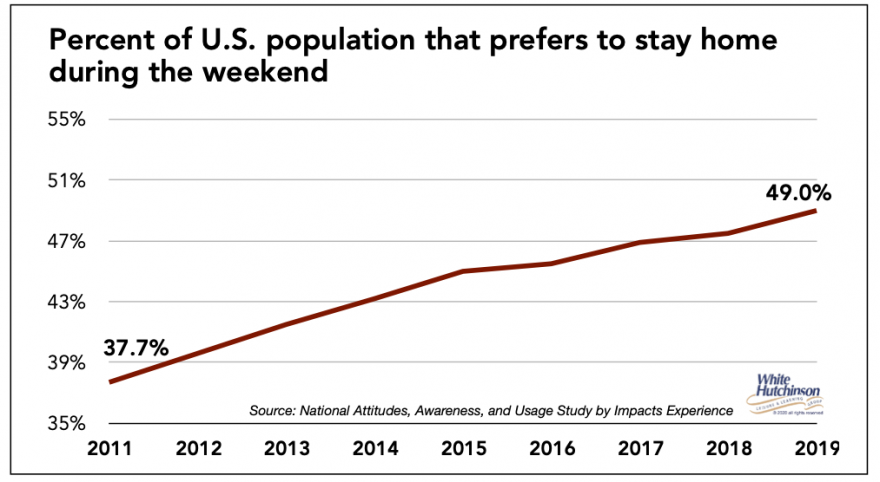

The decline in out-of-home entertainment and arts participation and spending is compounded by another pre-pandemic trend, an increasing percentage of people preferring to stay home on weekends. In 2011, 38% of people said they preferred to stay home on weekends. That increased to nearly one-half (49%) in 2019.

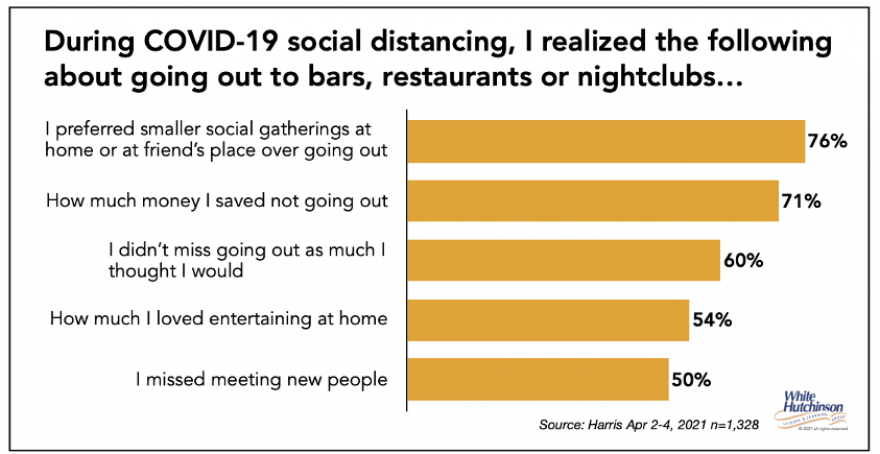

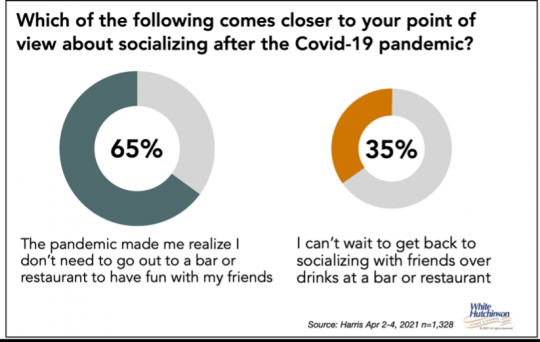

One survey during the pandemic indicates this trend will continue post-pandemic. People discovered a preference for not going out to venues for entertainment and socialization.

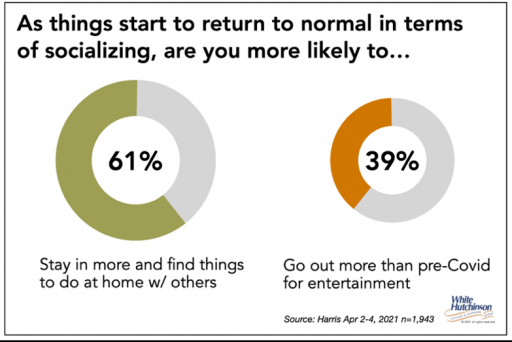

More than six in ten people said they expect to go out less and stay in more post-pandemic.

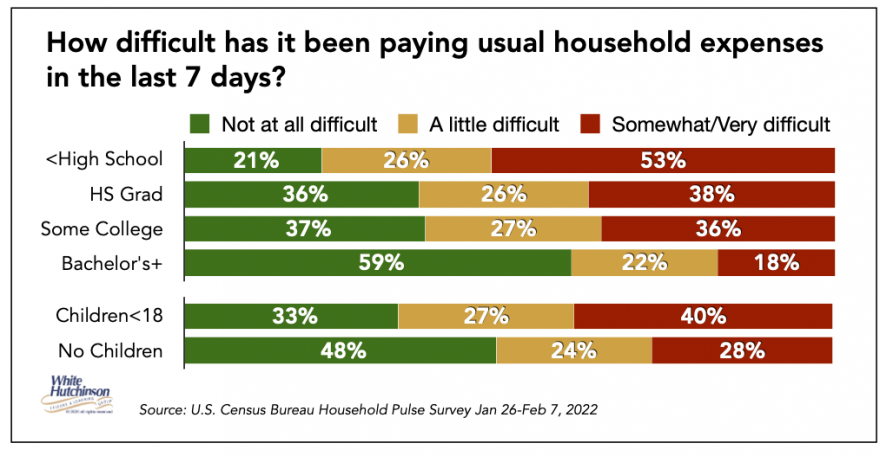

The pandemic's economics significantly increased income and financial inequality. The current inequality is evidenced by this January 26-February 2022 Census Bureau Household Pulse Survey. The lower socioeconomic were most impacted by a loss of income while the higher socioeconomic kept their jobs and increased their wealth in stocks and homeownership.

Implications

As a result of the increased income and financial inequality, for a large share of the middle and lower socioeconomic, their discretionary spending will likely be severely limited for many years, causing these financially challenged households to restrict their discretionary spending for out-of-home entertainment and further increase the bifurcation of out-of-home entertainment - the audience will become even more gentrified. The inflationary increase to the cost of out-of-home entertainment will also contribute to this. The middle-class will no longer be a viable market to target for most venues. The growing share of all attendance and spending for out-of-home entertainment will be coming from the higher socioeconomic in the post-pandemic era, requiring venues to cater to their higher standards, tastes, values, and preferences if they want to prosper.

We're likely to see a decline in total attendance at entertainment venues for the overall population due to a decrease by the middle and lower socioeconomic and the increasing use of at-home digital entertainment and socialization.

Another trend we predict is a shift in market share to competitive socializing venues that include premium and enhanced flavor profile food and beverage offerings (see competitive socializing and eating habits articles in this newsletter).

A decline in repeat visits and an increase in first-time visits

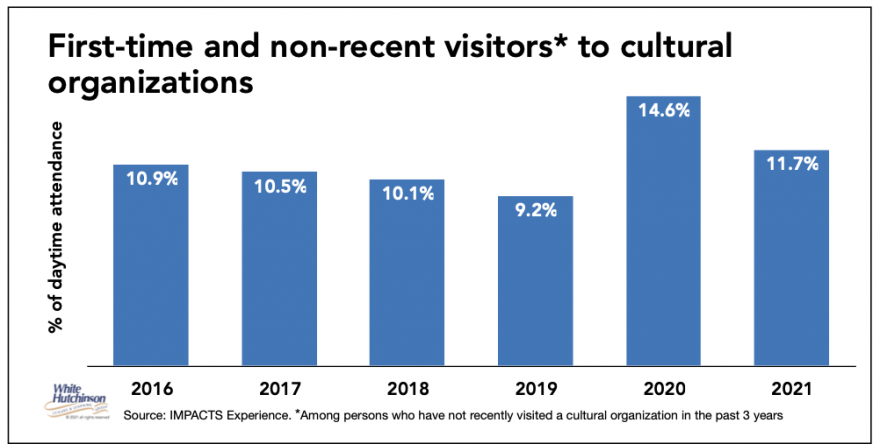

In last month's issue, we discussed how people seek new and unique out-of-home entertainment experiences, resulting in a decline in repeat appeal and an increase in people making first-time visits to new location-based leisure venues. We now have some data on this trend with cultural organizations courtesy of Colleen Dilenschneider's enewsletter from IMPACTS Experience, which monitors audience behaviors in exhibit and performance-based cultural venues in the U.S.

Their data shows a significant increase in first-time visitors, persons who visited for the first time or have not visited a particular cultural organization within the past three years. Pre-pandemic, 9.2% of attendance in 2019 was from first-time visitors. In 2020, it jumped to 14.6%. In 2021, it was 11.7%, one-fourth higher than it was in 2019.

When first time visits increase as a share of all visits, that means repeat visits decline.

Will the baby bust continue post-pandemic?

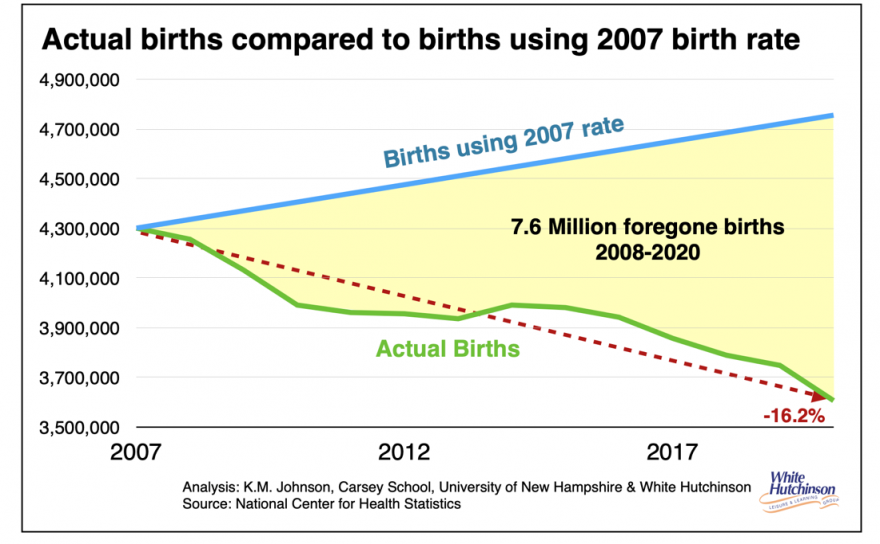

The pandemic has accelerated the long-term decline in births already underway that started in 2008. There were 700,000 fewer births in 2020 than in the peak year of 2007. If the birthrate hadn't begun to decline in 2008, we would have had 7.6 million more children in 2020 than we did.

The number of U.S. births continued its decline in 2021, according to a new report published by the Centers for Disease Control and Prevention.

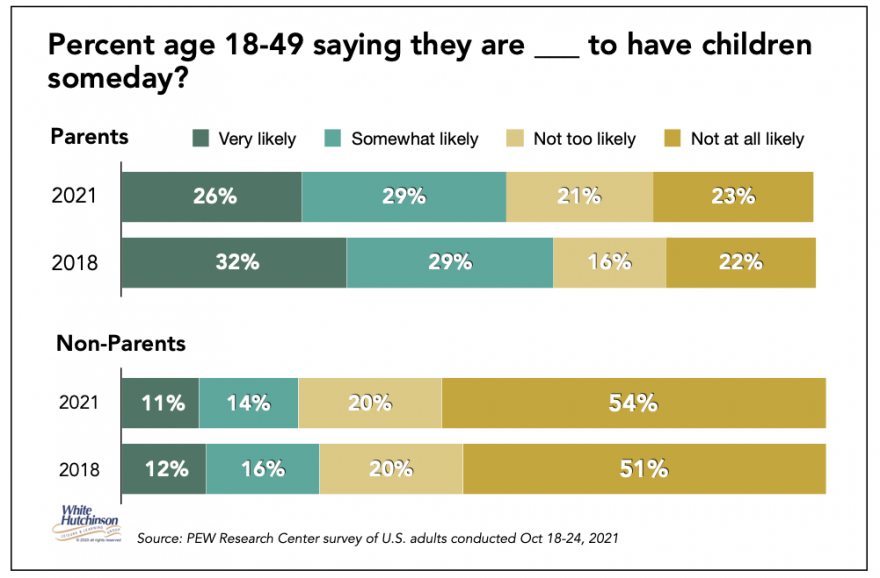

An October 2021 Pew Research Center survey finds that more than four in ten non-parents ages 18 to 49 (44%) say it is not too or not at all likely that they will have children someday, an increase of 7 percentage points from the 37% who said the same in a 2018 survey. Meanwhile, three-quarters of adults younger than 50 who are already parents (74%) say they are unlikely to have more kids, an increase of 3 percentage points from 2018.

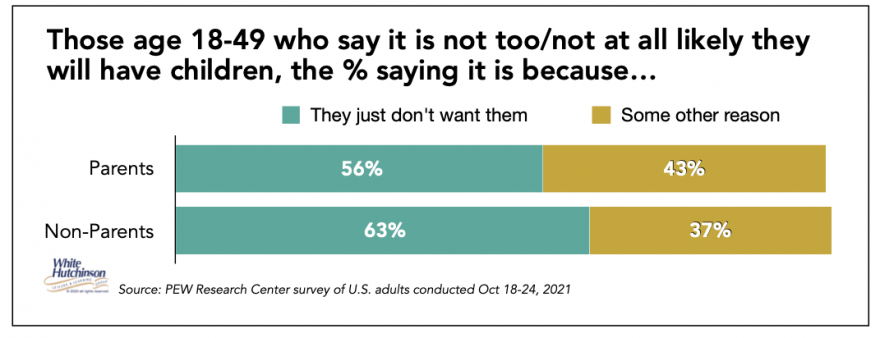

Most non-parents younger than 50 (56%) who say it's unlikely they will have children someday say they just don't want to have kids. Childless adults younger than 40 are more likely to say this than those ages 40 to 49 (60% vs. 46%, respectively). When it comes to 18- to 49-year-old parents who say they are unlikely to have more children in the future, again, a majority (63%) say it's because they just don't want to.

The PEW survey findings strongly suggest that birth rates will continue to decline in the post-pandemic era.

Thank you for reading our Leisure eNewsletter

Our eNewsletter is published on an occasional basis, usually monthly. Click here to access our index of previous eNewsletters.

Subscribe and tell a colleague

Subscribe at www.whitehutchinson.com/subscribe/lenews/. Also, tell your colleagues about our eNewsletter so they won't miss out.

To learn more about our projects and services

To learn more about our services and how we can help you with a new project or an existing one, don't hesitate to contact Randy White, our CEO, via e-mail or by phone at +1.816.931-1040. We are on Central Time (same as Chicago). Randy often works in the office on Saturdays, so feel free to contact him then if weekdays are not a convenient time for you to call.

Leisure eNewsletter is published on an occasional basis, about once every two months.

Copyright 2026, all rights reserved

White Hutchinson Leisure & Learning Group, Inc.

4036 Baltimore Avenue, Kansas City, Missouri 64111, USA

voice +1.816.931-1040

fax +1.816.756-5058

randy@whitehutchinson.com

The contents of this website and eNewsletters are protected by USA and international copyright law. Permission is granted to download and print single copites of any of the contents or articles for personal use. No other copies may be made. Educational institutions may obtain permission to make multiple copies for classroom use by e-mailing us with details. The contents of articles may be quoted provided credit is given to the "(author's name), White Hutchinson Leisure & Learning Group, Kansas City, MO, USA". All other rights for use or reproduction of the contents and articles are reserved.